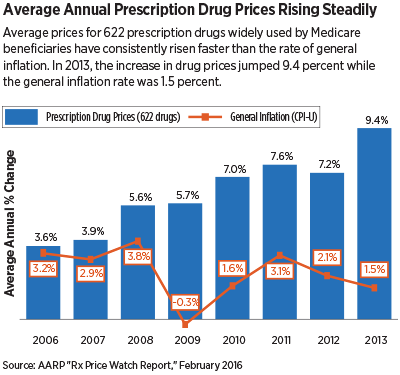

Retail prices for brand name, generic, and specialty prescription drugs widely used by Medicare beneficiaries increased by an average of 9.4 percent in 2013, according to an “Rx Price Watch” report published by the AARP.

In contrast, the general inflation rate was 1.5 percent that year. The average annual increase in retail prices for the combined set of drug products examined in the AARP report exceeded the corresponding rate of general inflation every year from 2006 through 2013 (see graph).

According to the report, the average annual retail cost of drug therapy for prescription drugs on the market since the end of 2005 and used to treat chronic conditions was $11,870. (That reflects the total price for a specific prescription that a pharmacy benefit manager bills to a health plan, not the out-of-pocket cost that a consumer would pay.) This amount represents an increase of $7,534 over the 2006 annual cost of $4,336.

The report “Trends in Retail Prices of Prescription Drugs Widely Used by Older Americans: 2006 to 2013,” released in February, does not specifically reference drugs for psychiatric conditions. But a November 2015 report, “Trends in Retail Prices of Specialty Prescription Drugs Widely Used by Older Americans, 2006 to 2013,” showed that retail prices for all but four categories of specialty prescription drugs rose faster than the rate of inflation in 2013. Among those, antidementia drugs rose by 39.5 percent; antipsychotic prices rose by 3.7 percent.

APA President Renȳe Binder, M.D., said the data in the AARP report are alarming. “Many of our patients with psychiatric illness have multiple comorbid medical conditions requiring the use of more than one prescription drug and may be especially affected by the rise in prices. APA is working with the AMA and other interested parties to help craft workable solutions to keep prescription medications affordable.”

AARP President John Rother said the findings are attributable entirely to drug-price growth among brand name and specialty drugs, which more than offset often substantial price decreases among generic drugs. More importantly, the recent acceleration in overall prescription drug price growth could be an indication that lower-priced generics can no longer be relied upon to counterbalance the price trends seen in the brand name and specialty prescription drug markets.

“The AARP report provides new evidence that drug companies are raising prescription drug prices on patients indiscriminately,” Rother said in a statement. “[The prices of] specialty and branded drugs alike are going up six times faster than inflation. The exorbitant increases make health care more expensive for families, taxpayers, and job creators and put a major strain on federal and state governments. It’s going to take market-based policy solutions to deal with this unsustainable trend.”

He added that during an election season, the skyrocketing price of prescription drugs was bound to become a focus of attention. “One of the most important issues for voters is reducing these prescription price hikes and protecting hardworking Americans from price gouging,” he said.

Since 2004 the AARP Public Policy Institute and the University of Minnesota’s PRIME Institute have collaborated to report an index of manufacturers’ drug price changes for three “market baskets”—brand, generic, and specialty drugs; recently, a combined market basket (that is, brand, generic, and specialty) has been added to the series to view the price change trend across all types of prescription drugs in the U.S. market. This year’s report is based on 2011 data from the Truven Health MarketScan Research Databases and a Medicare Part D plan provider.

At the November Interim Meeting of the AMA House of Delegates, physicians approved new AMA policy calling for an end to direct-to-consumer advertising, citing its effect on drug prices. Delegates who voted for the policy said that although some patients may be prompted to visit a physician because of increased awareness of an illness or treatment stemming from advertising, the DCTA’s ultimate is to drive demand for a product, resulting in increased pharmaceutical prices.

Psychiatrist and AMA Board Chair-elect Patrice Harris, M.D., M.A., said that the vote in support of an advertising ban reflects concerns among physicians about the negative impact of commercially driven promotions and the role that marketing costs play in fueling escalating drug prices.

“Direct-to-consumer advertising also inflates demand for new and more expensive drugs, even when these drugs may not be appropriate,” she said. “Patient care can be compromised and delayed when prescription drugs are unaffordable and subject to coverage limitations by the patient’s health plan. In a worst-case scenario, patients forego necessary treatments when drugs are too expensive” (

Psychiatric News, December 10, 2015). ■