Behavioral health conditions contribute significantly to morbidity (

1,

2), mortality (

3), and medical care costs (

4). Access to and quality of behavioral health services present challenges, even if individuals are privately insured. Efforts to improve population health and health care services must incorporate behavioral health (

5). The delivery of behavioral health services is undergoing significant changes. The current U.S. health care environment is trending toward mainstreaming behavioral health services and addressing behavioral health disorders as chronic conditions (

6–

13). For instance, disease management programs, previously focused on chronic general medical conditions, are now commonly used for depression (

14–

16). Primary care practitioners (PCPs) are expected to more fully address behavioral health through patient-centered and integrated care, and specialty providers may more frequently interact with PCPs (

17–

21). To be successful, providers need the support of the delivery system as a whole, including payers (for example, health plans) (

19).

Health plans play a key role in facilitating improvements in population health and health care services because they engage in activities that have an impact on access, cost, and quality of care. Furthermore, a large proportion of the U.S. population is covered through private insurance—about 64% in 2014 (

22). This proportion is increasing, with 6.7 million people newly enrolled in 2014 via the insurance marketplace established under the Affordable Care Act (ACA) (

23).

Although behavioral health care is becoming more integrated with general medical care, its delivery system still has unique aspects. For example, health plans often choose to contract out the delivery and management of specialty behavioral health services to managed behavioral health organizations (MBHOs) for a variety of reasons, including their specialized expertise (

24–

27). Contracting approaches used by health plans can affect access, costs, and coordination between behavioral health and general medical care (

28).

The ACA includes legislative requirements that present opportunities to continue the momentum for improved behavioral health service delivery, most recently generated by the Mental Health Parity and Addiction Equity Act of 2008 (MHPAEA), and the trend toward more integrated care (

29–

31). During these changes, examining how private health plans organize and manage behavioral health services is critical. To understand access to behavioral health services for the large proportion of U.S. adults who have private health insurance, it is essential to investigate the role of contracting for behavioral health services, specific services available under the plans, and cost-sharing. This study examined the organization and management of behavioral health services for a nationally representative sample of private health plans in 2010 and assessed changes over the preceding decade. The survey took place during the first year that MHPAEA was law but prior to final MHPAEA regulations and before the ACA took effect, offering a unique opportunity to gather baseline evidence pre-ACA. This information will be crucial to understand the impact of MHPAEA and the ACA moving forward.

Methods

Data Source and Population

Data were collected in 2011 for the 2010 benefit year through the third round of a nationally representative survey of private health plans regarding alcohol, drug, and mental health services. Previous survey rounds were conducted in the same 60 market areas in 1999 and 2003 (

26,

32–

34). The study compared the 2010 results with 2003 results, and this article reports 2010 results in detail. In 2003, a total of 368 plans were surveyed (83% response rate); in 2010, 389 plans were surveyed (89% response rate).

The survey was administered by phone to senior health plan executives. Typically, one respondent answered all administrative questions (for example, plan characteristics and benefit design) and referred us to the medical director or behavioral health medical director for all clinical questions (for example, integration and disease management). In some cases, we were referred to the plan’s MBHO for information. For some national or regional plans, respondents at the corporate headquarters reported for multiple sites. Each plan was asked about its top three commercial products, defined by enrollment. Questions were asked at the product level within each market area–specific plan.

The primary sampling units were the 60 market areas that the Community Tracking Study had selected to be nationally representative (

35). The second stage sampled plans within market areas. Plans serving multiple market areas were defined separately, and data were collected with respect to a specific market area.

The sample of 463 health plans from 2003 plus the health plans newly identified and selected during 2010 resulted in a fielded sample of 545 plans. After eliminating 107 plans ineligible because they had closed (N=44), had low enrollment (N=52), or were not offering comprehensive commercial insurance (N=11), we had 438 eligible plans of which 389 responded (89%), reporting on 939 products. For the clinical portion of the survey, 385 plans (88%) responded, reporting on 925 products. Nonrespondents tended to be in larger metropolitan areas in the South and West.

Variables

Health plans were categorized by the type of arrangement used to manage behavioral health services. Four arrangements were identified: external (contracts with an MBHO for delivery and management of behavioral health services), hybrid-internal (behavioral health services are managed by a specialty behavioral health organization that is part of the same parent organization as the health plan and that also contracts with other health plans), internal (all behavioral health services are provided by plan employees or through a network of providers directly administered by the plan), and comprehensive (contracts with a single vendor for both general medical and behavioral health provider networks). The hybrid-internal category is a new construct for 2010 and was developed because previously, in 2003, some respondents described the contracting arrangement as either internal or external, depending on relationships within the corporation; however, in 2010 respondents described this arrangement as internal. Comprehensive contracts were reported by only four products in 2010 (unweighted), and thus they are not shown by contracting arrangement and are included in the total column only.

We examined whether health plans offered several services, either internally or through a vendor, including wellness programs, disease management programs, and pharmacy benefits. We collected information on a range of covered behavioral health services, from inpatient hospital treatment through outpatient counseling. We also ascertained patient cost-sharing for in-network outpatient behavioral health services, including type (copayment, coinsurance, or both) and level. Plans were considered to have high cost-sharing when copayments were greater than $20 or coinsurance was greater than 20%. We did not adjust for inflation, and thus any given copayment (for example, $20) was effectively less expensive in 2010 than 2003. However, this was somewhat counteracted by moderate medical price inflation that took place during this time. We asked health plans about innovative policies to support providers in their delivery of behavioral health services.

Statistical Analysis

Findings reported are national estimates. The data were weighted to be representative of health plans’ commercial insurance products in the continental United States. The response rates differed slightly between the administrative and clinical portions of the survey resulting in two weighted samples: 8,431 products for the administrative portion of the survey and 8,427 products for the clinical portion. Statistical analyses were implemented by using SUDAAN software for accurate estimation of the sampling variance. Significant differences were based on pairwise t tests with a .05 significance level, adjusted for multiple tests with the Bonferroni correction.

Results

Product Types and Contracting Arrangements

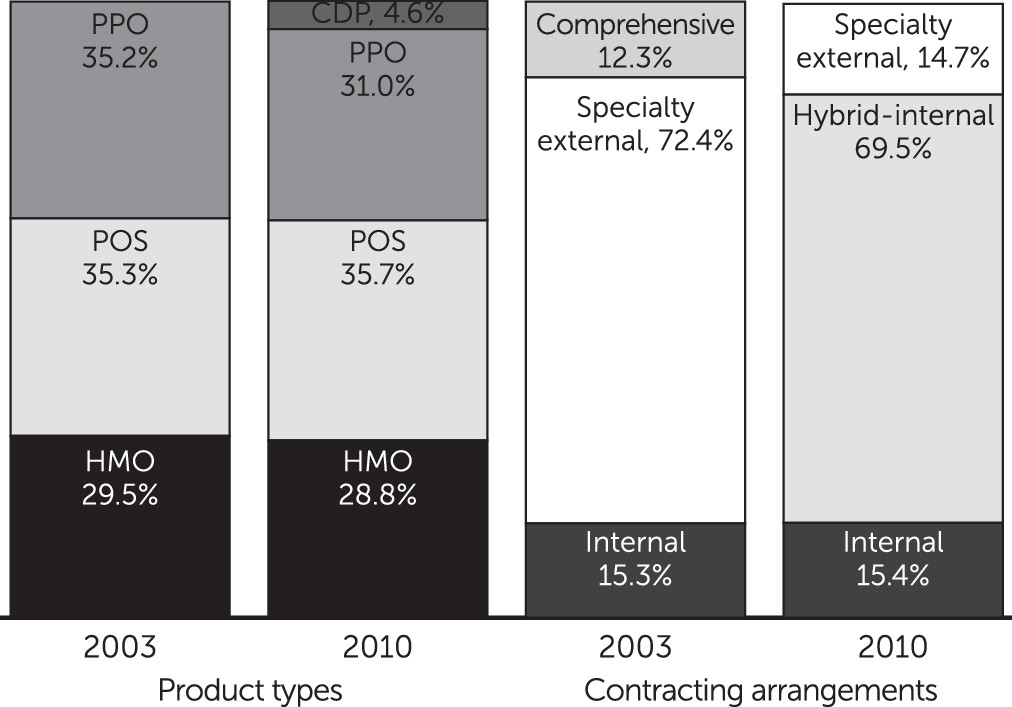

The distribution of product types most commonly offered by health plans was relatively stable between 2003 and 2010 (

Figure 1). In 2010, 28.8% of products were health maintenance organizations, 35.7% were point-of-service products, and almost one-third (31.0%) were preferred provider organization products. However, in 2010, for the first time, consumer-directed products were represented (4.6%) among the most commonly purchased products.

In 2010, respondents reported that behavioral health services were managed by a specialty behavioral health organization that was part of the same parent organization (hybrid-internal arrangement) for 69.5% of all products (

Figure 1). Health plans contracted with external MBHOs to manage services (specialty external) for 14.7% of all products, and behavioral health services were managed internally for 15.4% of products. In 2003, most plans had specialty external contracts (72.4%), but in 2010 many of these shifted to hybrid-internal arrangements. Comprehensive arrangements in which general medical and behavioral health services are managed by the same external vendor virtually disappeared between 2003 and 2010, whereas the prevalence of internal arrangements remained unchanged.

Health plans may also contract for other services related to the provision of behavioral health care, such as the delivery of wellness programs, disease management services, and pharmacy benefits (

Table 1). In 2010, almost all health plan products included a wellness program (98.0%); the proportion was slightly smaller among products with internal contracts (88.1%). In 2010, the vast majority (90.8%) included disease management programs for depression, but only 20.8% included a disease management program for substance use disorders. In 2003, almost no products reported offering disease management programs for substance use disorders. Depression disease management programs also increased substantially since 2003. Products with specialty external and internal behavioral health contracting were less likely to have either type of disease management program. All products reported having general medical disease management programs (data not shown), and all offered pharmacy benefits.

Many products used an external vendor for wellness programs (54.4%), behavioral health disease management (37.6%), and pharmacy benefits (73.1%). Use of an external vendor for these programs varied with the behavioral health contracting arrangement but did not exactly follow the same pattern. Products with a specialty external behavioral health contract nearly always contracted out behavioral health disease management (89.2%) and pharmacy benefits (98.7%), but they were less likely to do so for wellness programs (57.5%). Hybrid-internal products were less likely than specialty external products to contract out for behavioral health disease management programs or pharmacy benefits but as likely to do so for wellness programs. Internal products were the least likely to use an external vendor for these other programs, but many still did so (30.7% for wellness programs and 42.3% for pharmacy benefits). Internal products rarely contracted out behavioral health disease management programs (16.5%).

Coverage of Behavioral Health Services

Inpatient hospital, detoxification, partial hospital, intensive outpatient, and outpatient counseling services for both mental health and substance use conditions were covered by nearly all products in 2010, but other behavioral health–specific services were covered by fewer products (

Table 2). Residential treatment for mental health was covered by 93.3% of all products, but residential treatment for substance use was covered by only 84.0% of products. Compared with specialty external or hybrid-internal products, smaller proportions of internal products covered residential services (63.3% for mental health and 72.4% for substance use disorders); hybrid-internal products were also less likely than specialty external products to cover residential services for substance use disorders (84.2% versus 95.5%). Opioid replacement therapy was covered by 69.2% of products in 2010, but significant variation was noted by contracting arrangement. It was covered less frequently by external products (36.4%), more often by hybrid-internal products (69.1%), and by almost all internal products (99.7%).

Coverage of mental health and substance use services was stable for most services between 2003 and 2010. However, coverage for nonhospital residential mental health treatment increased from 80.4% to 93.3%.

Behavioral Health Cost-Sharing

Most products required copayments (73.7%) in 2010, and the rest required coinsurance (24.5%) (

Table 3). This represents a shift since 2003, away from copayments and toward coinsurance.

Higher cost-sharing may be an access barrier. Overall, 48.7% of products in 2010 required high patient cost-sharing (more than a $20 copayment or 20% coinsurance), an increase since 2003, when 42.1% of products required high cost-sharing. Much of this change was driven by growth in copayment levels.

Cost-sharing in 2010 varied by contracting arrangement. Specialty external and hybrid-internal products were more likely than internal products to use copayments in 2010. About half of internal products used copayments (49.5%), and the rest used coinsurance (28.8%) or both (21.2%). High cost-sharing was more common in specialty external products (74.1%) than in hybrid-internal (48.1%) or internal (30.7%) products.

Innovations to Improve Care Delivery

Some health plans facilitated providers’ use of technology to improve delivery of behavioral health care (

Table 4). In 2010, 30.3% of products allowed PCPs to bill for phone or e-mail contact with patients. Online appointment scheduling was rare, but online referral systems were offered in 71.8% of products. Online personalized response to questions or problems was available in 70.0% of products.

Financial incentives for meeting preannounced quality or outcome standards for either behavioral health or general medical care were not widespread (31.6%). Financial incentives or recognition programs for PCPs for any condition were offered in 59.9% of all products. Very few incentive or recognition programs specifically included measures of behavioral health care (4.4%).

Health plans may encourage delivery of high-quality care through medical home initiatives and targeted incentive programs. Four-fifths of health plans (79.3%) had programs to encourage practices to become medical homes; nearly all of those (98.5%) included behavioral health in the medical home.

Discussion

As the health care system evolves, encouraging the delivery of patient-centered, integrated, and value-based care, additional demands are placed on primary care and specialty behavioral health providers. It is desirable that both groups of providers communicate and collaborate to serve their patients. Providers cannot meet these challenges without support and structure from payers, including private health plans. There is some evidence that health plans are beginning to offer these supports, but increasing patient cost-sharing may be a barrier to accessing services.

For the first time in our surveys, consumer-directed products were represented in the top three commercial products. For consumers, these products offer flexibility to choose how to spend their health care dollars, but these products also rely on higher consumer cost-sharing. Use of health care services is sensitive to price. Sensitivity to price of mental health service use varies with individual characteristics (for example, income, need, and provider supply), and increases in cost-sharing result in decreases in use of both needed and unneeded services (

36–

38). We anticipate that the use of consumer-directed products will continue to increase. Given these plans’ reliance on high cost-sharing, their growth may pose challenges for individuals with behavioral health conditions and for providers.

Historically, health plans have either managed behavioral health services internally or contracted them out. This decision was determined by the costs associated with each option and the value of each option to customers (for example, employers and state governments) (

28). In 2003, products with the hybrid-internal arrangement described themselves as either external or internal, but in 2010 respondents universally described this arrangement as internal. Although this appears to be a significant change in approach, it more likely represents a shift in perceptions of the value of integration among health plans and their customers. These plans now prefer to be identified as internal, or integrated, rather than as having a separate specialized behavioral health organization. The hybrid-internal category reflects respondents’ reports that health plans want to make behavioral health more integrated with general medical care, even if the care is managed by a separate entity within the corporation. Internal and hybrid-internal arrangements may become even more common with increasing consolidation in the health insurance industry.

Similar to contracting with MBHOs, contracting for other types of services has advantages, such as specialized expertise and economies of scale in infrastructure and staff. However, there are similar concerns about integration and implications for patient-centered care when information straddles different service providers. For example, prescription monitoring programs, used in many states to limit prescription drug misuse, are most effective when clinical and prescription data are collectively available, which is less likely when pharmacy benefits are contracted out. Furthermore, use of any external vendors by a plan may complicate the development of incentive designs associated with value-based purchasing.

Disease management programs for chronic general medical conditions and depression have been available for a long time. Substance use disease management programs are newer and were offered less frequently. Their emerging use may indicate that health plans are focusing more on substance use disorders. Of interest, disease management for substance use was most often offered by hybrid-internal plans, which will also benefit from any reduction in general medical spending associated with treating substance use disorders.

Coverage of services remained largely unchanged from 2003 to 2010, with behavioral health services continuing to be covered by nearly all health plans for most levels of care. MHPAEA includes many requirements if behavioral health is covered, but it does not require coverage. It was encouraging that employers did not eliminate behavioral health coverage in response to MHPAEA. This is not the full picture of access, however, because access is also determined by medical necessity criteria and prior authorization, continuing review, and other benefit limits (

39). Many of these restrictions have lessened, in part as a result of MHPAEA but also because of a general trend toward less management, at least in the initial phase of treatment (

40). Detailed analyses from this study related to parity have been published elsewhere (

40).

As health plans become more concerned with behavioral health, they are investing in innovative ways to improve access to and quality of services. Access to services can be improved with investments and support of technology to improve the reach of behavioral health services. Although provider incentive payments are another tool that could be used to drive quality and a focus on behavioral health, health plans reported rarely using them in the context of behavioral health. Global or bundled payments are one tool health plans are increasingly considering to incentivize providers. Similarly, providers are forming accountable care organizations (ACOs) to set up these supportive structures. As payment systems shift to put more risk on providers, we anticipate increases in innovations at the provider level. Health plans that contract out for behavioral health services may face additional hurdles to develop these structures and therefore may be more likely to rely on specific financial incentives to improve the quality of behavioral health care. The shift toward ACOs and global or bundled payments may encourage more focus on the quality of behavioral health care.

Our findings are limited in that they reflect health plan policies but do not provide in-depth information about how the policies are implemented or affect patient access, quality of care, or outcomes. Data quality prevented more detailed analysis of cost-sharing (for example, deductibles across types of outpatient services). In designing a national, organizational survey, the goal was to capture the broad overview of the delivery and management of behavioral health services, with resulting tradeoffs between in-depth probing and interview length to ensure adequate completion rates and data quality. Finally, data were self-reported by health plan executives and not otherwise verified; however, we targeted executives with broad knowledge of plan policies.