In 2015, nearly 2.6 million Americans had an opioid use disorder (

1). The prevalence of the disorder has more than doubled over the past ten years, contributing to a dramatic rise in opioid overdose deaths during this time (

2,

3). Opioid use disorder is a relapsing chronic condition that can be treated with medication, most commonly methadone or buprenorphine (

4). Although both drugs are effective at managing the core symptoms of opioid use disorder, one advantage of buprenorphine is that it is delivered through office-based prescribers and community pharmacies, whereas methadone for treatment of opioid use disorder must be obtained through an opioid treatment program certified by the Substance Abuse and Mental Health Services Administration.

Expanding access to buprenorphine is a major policy priority. Only one in five people with an opioid use disorder receives treatment (

1). The Comprehensive Addiction and Recovery Act and additional federal regulations in 2016 implemented measures to ameliorate a long-standing shortage of physicians credentialed to prescribe buprenorphine to patients with opioid use disorder (

5–

7). As the supply of buprenorphine prescribers increases, buprenorphine prescription costs may play a greater role in determining access to treatment of opioid use disorder, adherence, and outcomes. The objective of this retrospective study was to examine historical buprenorphine utilization and spending trends among commercially insured adults to inform continued efforts to further expand treatment of opioid use disorder. It is important to study these trends in the privately insured population because patients with commercial prescription drug coverage may be more likely to experience higher out-of-pocket prescriptions costs and cost-related nonadherence, compared with patients with Medicaid or Medicare Part D coverage that provides more generous cost sharing.

Methods

We used Truven Health MarketScan outpatient prescription claims data to describe buprenorphine use and expenditure trends in repeated annual cross-sections from 2003 to 2015. MarketScan captures health insurance transactions for roughly 20 million individuals annually who are enrolled in an employer-sponsored commercial health insurance plan provided by one of over 100 large- or medium-sized U.S. employers.

We included prescription claims for buprenorphine products approved by the Food and Drug Administration to treat opioid use disorder. Since 2003, buprenorphine has been available in several formulations, including monotherapy and a buprenorphine-naloxone combination. Buprenorphine-naloxone is most commonly used for maintenance treatment of opioid use disorder and is favored for its abuse-deterrent properties. Buprenorphine products are formulated as dissolvable tablets or sublingual films and require daily or near-daily use. Generic buprenorphine monotherapy and generic buprenorphine-naloxone products became available in 2009 and 2013, respectively.

For each calendar year cross-section, we described the number of new and total buprenorphine users per 100,000 enrolled adults (ages 18–64). Individuals were considered new buprenorphine users only during the year in which their first buprenorphine prescription claim was recorded. We also reported trends in buprenorphine treatment use and market share by product type: brand buprenorphine-naloxone tablets, brand buprenorphine-naloxone film, generic buprenorphine-naloxone tablets, brand buprenorphine tablets, and generic buprenorphine tablets.

To understand changes in spending for buprenorphine products over time, we reported median out-of-pocket, health plan, and total spending (combining patient and plan spending) for a 30-day supply of buprenorphine treatment (that is, combining all five products). We calculated spending across all buprenorphine products and separately by buprenorphine product category. All spending estimates were inflated to 2015 dollars by using the medical care component of the Consumer Price Index (

8,

9). In sensitivity analyses, we examined mean spending, and results were similar (not shown).

This study was exempted by the University of North Carolina at Chapel Hill Institutional Review Board.

Results

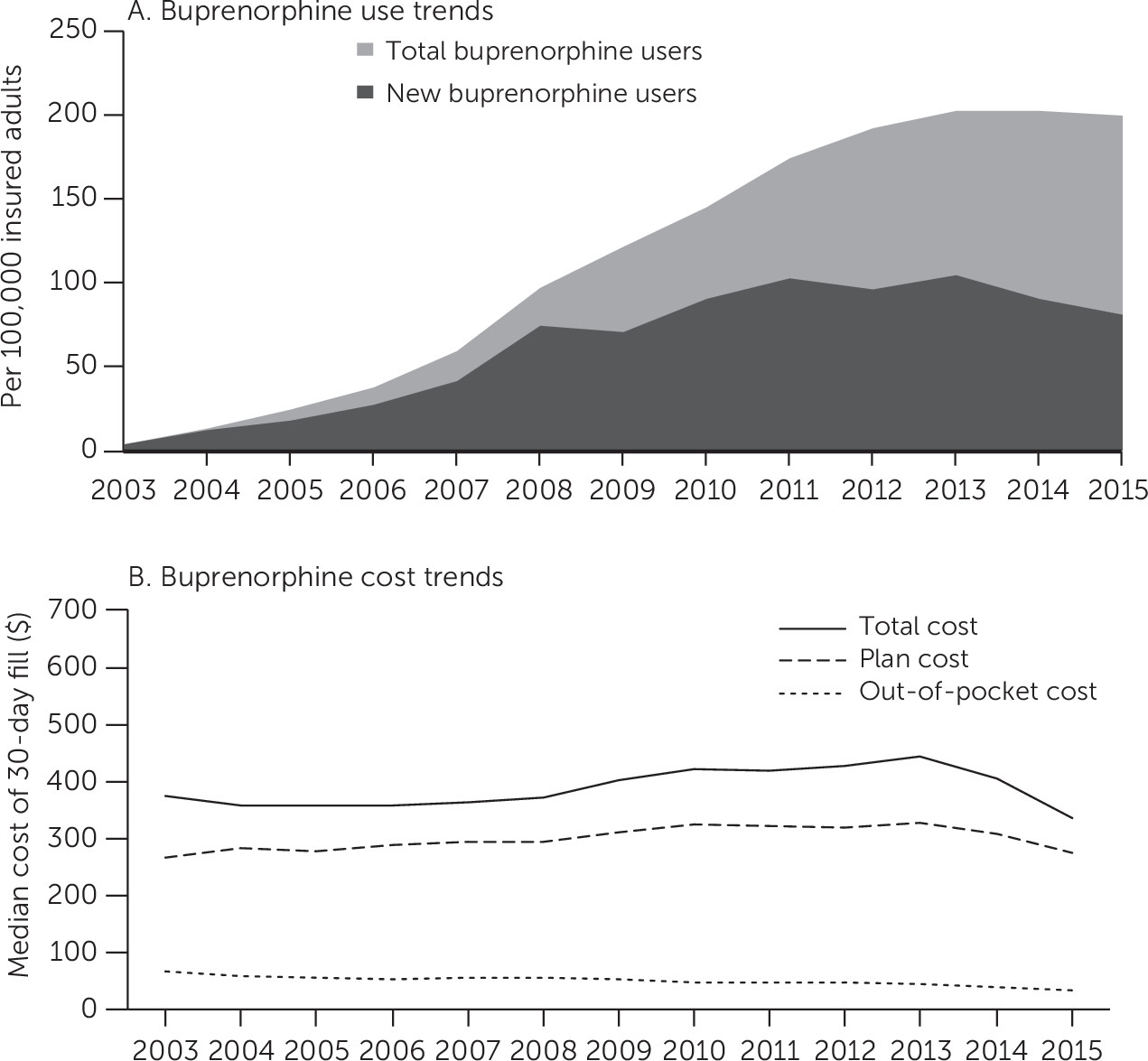

A total of 326,432 commercially insured adults recorded at least one prescription claim for a buprenorphine product approved to treat opioid use disorder across all study years. Buprenorphine use rates rose sharply following the approval of buprenorphine for the treatment of opioid use disorder in 2003 (

Figure 1, panel A). Since 2013, the number of total buprenorphine users has remained at 200 per 100,000 insured adults. The number of new buprenorphine users increased steadily during this time, peaking at 105 new buprenorphine users per 100,000 insured adults in 2013. Buprenorphine initiations dropped to 81 new buprenorphine users per 100,000 insured adults in 2015.

Nearly all the growth in buprenorphine use through 2010 was attributed to brand buprenorphine-naloxone tablet use. [A figure in an online supplement to this report shows buprenorphine prescription days supplied by product type from 2003 to 2015.] In 2010, the manufacturer of the brand buprenorphine-naloxone tablet introduced a film formulation, which has garnered the bulk of the buprenorphine market share since 2012, even after the introduction of generic buprenorphine-naloxone products in 2013. In 2015, generic buprenorphine-naloxone tablets held only 22% of the market share of buprenorphine products with an indication for opioid use disorder, compared with a 63% combined market share for all branded buprenorphine-naloxone products.

Combining all product categories, the median total and plan spending for a 30-day buprenorphine prescription fill increased an average of 2% annually from 2003 to 2013, and patient out-of-pocket expenditures dropped by 1% annually over the period (

Figure 1, panel B). Median total spending for a 30-day buprenorphine prescription was $376 (interquartile range [IQR]=$218–$553) in 2003 and increased to $444 (IQR=$234–$536) in 2013. This mirrored expenditure trends for brand buprenorphine-naloxone products [see figure in

online supplement showing median spending by product type from 2003 to 2015], which comprised the largest market share during this period. After 2013, total and plan buprenorphine prescription spending decreased by 24% and 17%, respectively (

Figure 1, panel B) because of small decreases in buprenorphine-naloxone total and plan expenditures, continued decreases in generic buprenorphine monotherapy product expenditures, and broader use of increasingly lower-cost generic buprenorphine-naloxone alternatives [see figure in

online supplement]. By 2015, total spending had decreased to $335 for a 30-day buprenorphine prescription (IQR=$210–$437).

From 2003 to 2015, median patient out-of-pocket spending decreased from $67 (IQR=$32–$134) to $32 (IQR=$11–$70) (

Figure 1, panel B). Out-of-pocket spending for all buprenorphine product types remained low and slowly decreased across the study period [see figure in

online supplement]; notably, median out-of-pocket spending for a 30-day fill of generic buprenorphine-naloxone and generic buprenorphine tablets in 2015 was $10 for each.

Discussion

The median amount paid by private payers for a 30-day supply of buprenorphine therapy has remained relatively stable since 2003, and out-of-pocket expenditures for privately insured adults in our sample have steadily decreased over time from $67 to $32. Our findings demonstrate that branded and generic buprenorphine products have been insulated from substantial spending increases seen among other life-saving drug classes, including certain formulations of the opioid overdose rescue drug naloxone (

10). Despite slow uptake of generic buprenorphine-naloxone combination products, their entry into the market in 2013 may have contributed to observed decreases in out-of-pocket spending for buprenorphine treatment.

This finding signals meaningful benefits for commercially insured patients with opioid use disorder who receive buprenorphine treatment. Existing research on medications for other chronic conditions, such as asthma and diabetes, indicates that as out-of-pocket costs of chronic medications decrease, patients are more likely to initiate therapy, maintain adherence, and achieve desired clinical outcomes (

11). Also, buprenorphine treatment for opioid use disorder is often accompanied by other services, such as behavioral therapy and urine drug screens, which increase total costs of opioid use disorder care. Maintaining or improving buprenorphine affordability will increase patients’ ability to adhere to a comprehensive regimen of medication-assisted treatment.

Despite declining out-of-pocket spending on buprenorphine and an 8% nationwide increase in the number of individuals with an opioid use disorder from 2013 to 2015 (

1,

12), the rate of privately insured adults in our sample initiating buprenorphine treatment decreased 23% from 2013 to 2015. This finding is concerning given buprenorphine’s increasingly prominent role in addressing the stark gap in outpatient treatment of opioid use disorder. Further work is needed to determine the underlying reasons behind this decline in buprenorphine treatment uptake so that it can be reversed. This includes examining the effects of 2016 federal policies that aimed to increase buprenorphine access by both expanding the types of prescribers allowed to treat opioid use disorder with buprenorphine and increasing the number of patients whom prescribers are allowed to treat with buprenorphine (

6).

In addition, research is needed to investigate whether the proliferation of high-deductible health plans (HDHPs) in the commercial insurance market may be adversely affecting buprenorphine uptake among privately insured adults. HDHPs require patients to pay full price for medical care and prescription drugs until they have spent a high, prespecified dollar amount, at which point cost sharing for services begins. Early evidence has shown that patients who switch to an HDHP have lower adherence to medications used for chronic conditions compared with patients in plans with lower deductibles (

13). With median spending for a 30-day buprenorphine prescription totaling $335 in 2015, it is possible that patients with HDHP coverage may forego buprenorphine therapy out of an inability or unwillingness to pay.

It will be necessary to carefully monitor changes in buprenorphine use and outcomes since our study ended in 2015. It is important to examine the rate of diffusion of generic buprenorphine-naloxone formulations since 2015 and the potential effects that slow uptake of lower-cost generics may have on initiation of and adherence to treatment for opioid use disorder. In addition, there has been much activity at federal, state, and local levels to expand treatment of opioid use disorder with buprenorphine. The 21st Century Cures Act included a two-year $1 billion investment in enhancing treatment access. Programs that train physicians in how to prescribe buprenorphine or link private physicians to opioid treatment programs, such as the “hub-and-spoke” model, have demonstrated effectiveness in increasing access to buprenorphine (

14). Also, more private payers are removing prior authorizations and other formulary restrictions on treatments for opioid use disorder (

15).

This study had some limitations, including lack of generalizability to persons with public insurance or individual marketplace coverage or persons who are uninsured. Trends in these populations may be different than in the large-group private market, because different insurers pay different prices for the same drugs. Furthermore, we were limited to evaluating spending only among patients who filled a buprenorphine prescription, and thus patients who were prescribed buprenorphine but did not fill the prescription for cost-related reasons would not have been included. This may have led to an underestimation of out-of-pocket spending for patients. Third, individuals receiving buprenorphine outside the prescription drug benefit captured in MarketScan (for example, by paying cash) would also not be observed. Therefore, our estimates of uptake may not capture all buprenorphine use. Fourth, we could not observe any buprenorphine manufacturers’ rebates paid to insurers, and thus our expenditure estimates may not reflect the real cost of certain buprenorphine products. Fifth, our study did not examine trends in use of and spending on other treatments for opioid use disorder, including methadone and naltrexone. Although we did not assess longitudinal trends for all treatment modalities for opioid use disorder, focusing on buprenorphine is important because of the foundational role policy makers and clinicians expect buprenorphine to play in closing the opioid use disorder treatment gap. Finally, although we excluded formulations of buprenorphine approved only for pain management, our analyses may also have included some individuals who were prescribed buprenorphine products approved to treat opioid use disorder for the off-label purpose of treating pain.

Conclusions

Declining out-of-pocket spending on buprenorphine in private insurance plans is a promising development that could reduce financial burden and increase access to treatment of opioid use disorder. Encouraging more individuals with opioid use disorder to initiate buprenorphine treatment should be a priority. Further steps to increase affordability and to reduce barriers to buprenorphine use could advance this goal and may be most effective when combined with investments in improving the addiction treatment delivery system.