The benefits of health insurance have been demonstrated through several high-quality studies (

1). In a randomized controlled trial, Medicaid recipients experienced significant gains in financial security, improved health-related quality of life, and lower rates of depression, compared with those in a waitlist control group (

2). There is also strong evidence that health care coverage improves the likelihood of having a usual source of care (

3), accessing preventive services (

4), and receiving routine primary care (

5) and reduces the risks of premature mortality (

4). Because adults with substance use disorders often lack health insurance (

6,

7), increasing their health coverage is an important public health goal, even apart from any potential effects on access to substance use services (

8,

9).

The Medicaid expansion and health insurance marketplace exchange provisions of the Affordable Care Act (ACA) have the potential to increase insurance coverage for low- and middle-income adults with substance use disorders. Medicaid expansion, which extends Medicaid eligibility to residents of participating states with household incomes up to 138% of the federal poverty level (FPL), contributed to early coverage gains (2012–2013 to 2014–2015) for low-income adults with substance use disorders (

10). The health insurance marketplaces offer subsidized health insurance to individuals with incomes between one and four times the FPL. These tax credit subsidies could help low- and middle-income adults with substance use disorders afford coverage. Yet individuals with substance use disorders may have difficulties accessing and navigating marketplace exchanges (

11). Although marketplaces accounted for approximately 40% of ACA-related general population coverage gains in 2014 and 2015 (

12), it is not known to what extent people with substance use disorders received insurance through marketplaces. Despite a requirement that insurance plans sold through marketplaces offer substance use disorder benefits at parity with medical and surgical benefits, coverage differentials may make these plans less attractive to people with substance use disorders (

13).

Following the transition to the Trump administration in January 2017, the new administration issued an executive order seeking to reduce the “economic burden” of the ACA. Shortly after the order, advertising for federally supported marketplaces was reduced, and outreach and consumer assistance for the 2017 marketplace enrollment period declined (

14). This was followed by reductions in federal funding for enrollment advertising for the 2018 enrollment period, a decrease in navigator support, and cancelation of $10 billion in payments to insurers for cost-sharing reductions to reimburse low-income marketplace consumers (

15). Overall, approximately 12.7 million people were enrolled in health insurance coverage through marketplaces in 2016, 12.2 million in 2017, and 11.8 million in 2018 (

16).

Little is known about the effects of this change in policy direction on coverage of low- and middle-income adults with and without substance use disorders. To address this knowledge gap, we compared trends in coverage among adults with and without substance use disorders who reported family income levels that would make them eligible for marketplace premium tax credits. We examined changes in coverage from before the 2014 marketplace launch and Medicaid expansion (2012–2013) to the last 2 years of the Obama administration (2015–2016) and first 2 years of the Trump administration (2017–2018).

Methods

Data Source

The National Survey on Drug Use and Health (NSDUH) is a cross-sectional annual U.S. population survey sponsored by Substance Abuse and Mental Health Services Administration. NSDUH yields national- and state-level representative estimates of substance use disorders for the civilian noninstitutionalized population. Individuals without a household address, active duty military personnel, and institutional residents are excluded from the sampling frame. The NSDUH data collection protocol was approved by the institutional review board at RTI International. The annual mean weighted overall response rate of the 2012–2018 NSDUH surveys was 62.9% (range, 48.8% to 66.8%; total N=407,985) (

17).

Background Characteristics

Using DSM-IV criteria, NSDUH yields estimates of past-year dependence on or abuse of alcohol, marijuana, cocaine, and heroin. The survey also collects information on respondent age, sex, race-ethnicity, family income, state of residence, and education level.

Health Insurance

Health insurance status at the time of the survey interview was the outcome. We partitioned insurance status into hierarchical groups of private insurance, Medicaid, other public insurance (Medicare, CHAMPUS, Department of Veterans Affairs, Tricare, or military health), and no insurance. Respondents with private insurance were partitioned into employer-based coverage, defined as coverage “provided through work, such as through an employer, union, or professional association,” and individually purchased private coverage, defined as private coverage not provided through work. We considered individually purchased private coverage as a proxy for marketplace-purchased plans.

Medicaid Expansion State Residence

States were partitioned by Medicaid expansion implementation status (

18). By the end of 2014, 26 states and the District of Columbia had expanded Medicaid and are referred to as expansion states. The remaining 24 states are referred to as nonexpansion states. (A table in an

online supplement to this article lists the expansion and nonexpansion states.)

Statistical Analysis

We examined whether health insurance coverage trends differed among adults with and without substance use disorders. Because we focused on potential effects of marketplace tax credits on individually purchased plans, we limited the analysis to adults ages 18–64 years with family incomes of 100%−400% of FPL that enabled them to receive tax credits. Baseline sociodemographic characteristics were first compared among adults with and without past-year substance use disorders.

To distinguish coverage trends under policies of the Obama and Trump administrations, we considered coverage from before ACA implementation (2012–2013) to the last 2 years of the Obama administration (2015–2016) and the first 2 years of the Trump administration (2017–2018), leaving out the year of policy implementation (2014). We used a difference-in-differences design (

19) to assess differences in secular trends in insurance coverage between populations with and without past-year substance use disorders. Multivariable logistic regression analyses estimated changes in coverage prevalence and included the effects of categorical survey years, a substance use disorder dummy variable, an interaction term for year × substance use disorder, and covariates age, sex, race-ethnicity, region, and education. Some models compared 2012–2013 with 2015–2016, and others compared 2015–2016 with 2017–2018, providing flexibility for the covariate distribution to be controlled separately in the two periods. Because covariate distributions varied between models, estimated insurance percentages for 2015–2016 may vary between models. Adjusted difference estimates in coverage prevalence (back-transformed from marginal log-odds) (

20) tested change in coverage over time among adults with and without substance use disorders. The interaction contrast on the predicted prevalence scale from the model provided the difference-in-differences test of whether changes over time differed between adults with and without substance use disorders. Percentages, differences, and difference-in-differences estimates were adjusted for age, sex, race-ethnicity, region, and education level.

Because the value of marketplace premium subsidies declines with increasing income from 100% to 400% of FPL, lower-income individuals have stronger financial incentives to purchase marketplace plans (

21). To assess this effect, analyses were stratified by poverty level (100%−200% versus 201%−400%). Because lower-income adults in Medicaid nonexpansion states, compared with expansion states, have fewer affordable coverage options, we compared coverage trends among expansion and nonexpansion state residents with and without substance use disorders. SAS, version 9, callable SUDAAN using PROC MULTILOG was used to account for NSDUH’s complex sample design and sample weights.

Discussion

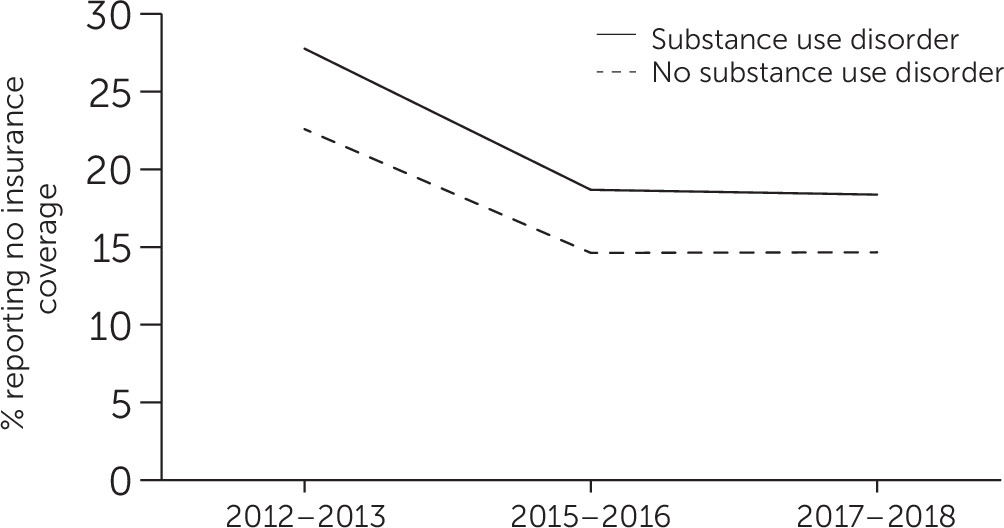

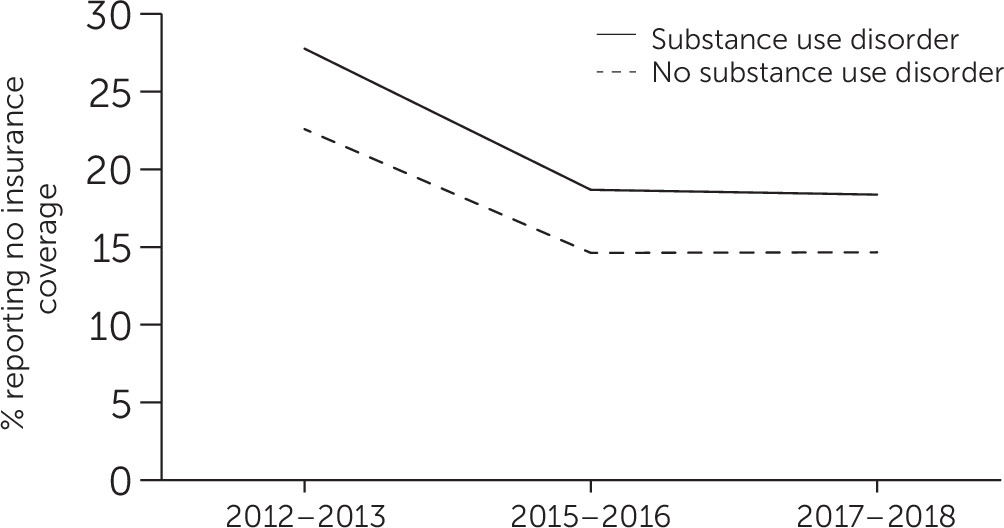

Consistent with prior research (

10), a decline was noted in the percentage of low- and middle-income adults who were uninsured during the first 2 years following implementation of Medicaid expansion and marketplace exchanges. Following the change in administrations between 2015–2016 and 2017–2018, however, the proportion that was uninsured remained unchanged. This new finding was also observed among low- and middle-income adults without substance use disorders. Opposition to the ACA under the Trump administration may have contributed to ending the decline in the percentages of these two groups of low- and middle-income adults without health insurance. During 2017–2018, there was a shift in federal health care policy away from the ACA reflected in public statements (

22) and actions, including a reduction in advertising marketplace enrollment, shortening of the enrollment period (

14), and cancelation of reimbursement payments to insurers for low-income marketplace withholding that may have slowed enrollment of lower-income people (

23).

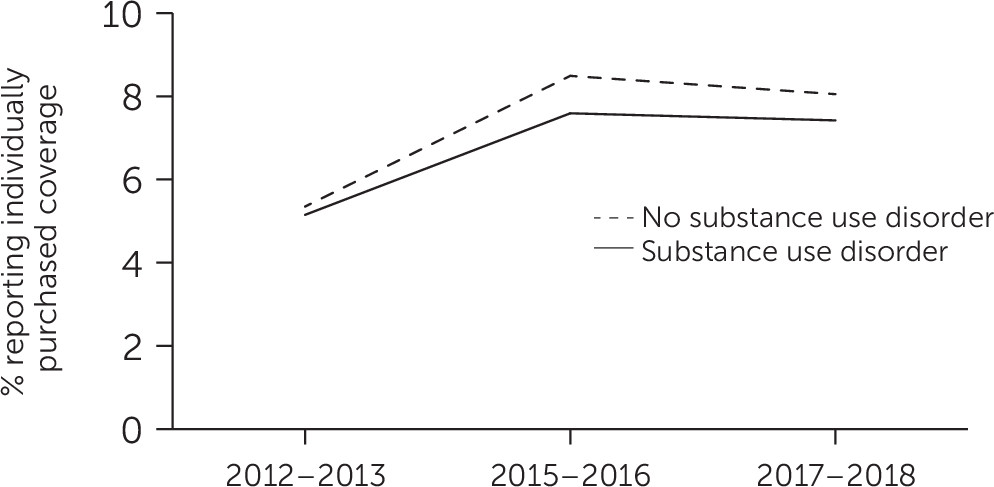

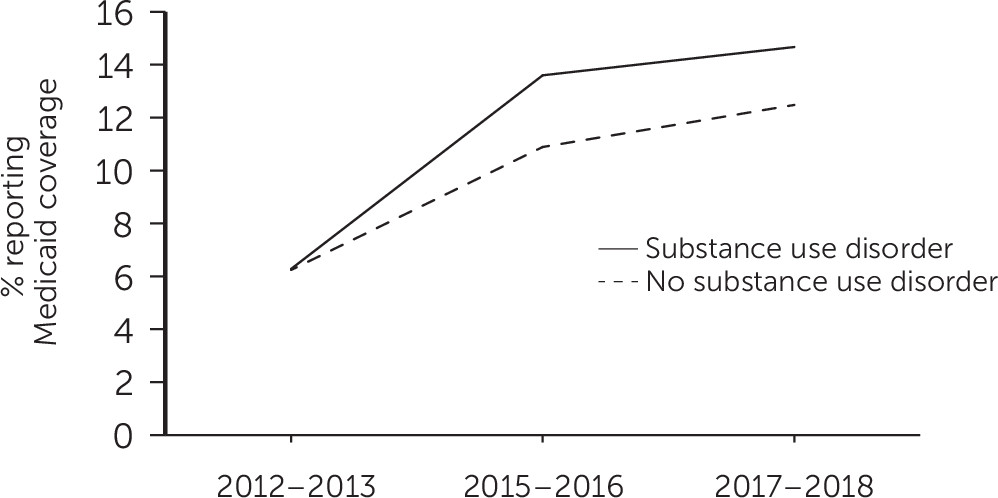

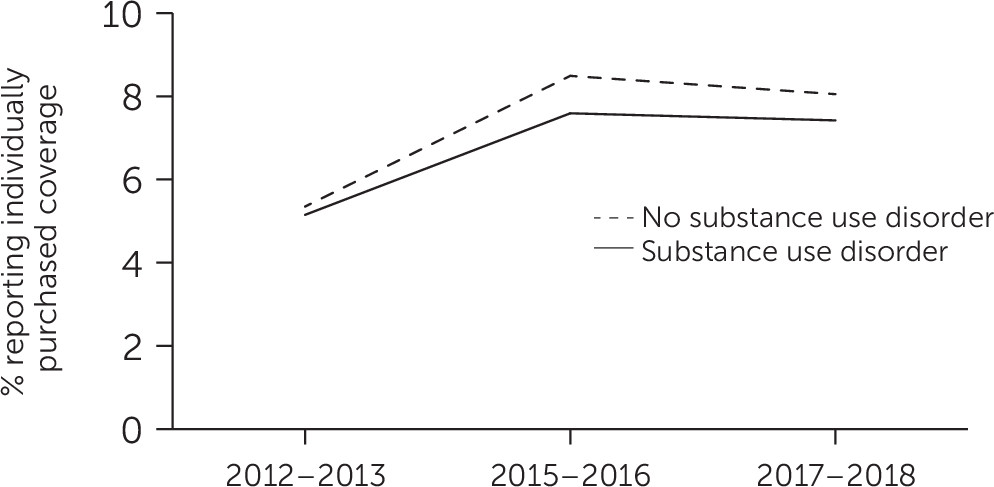

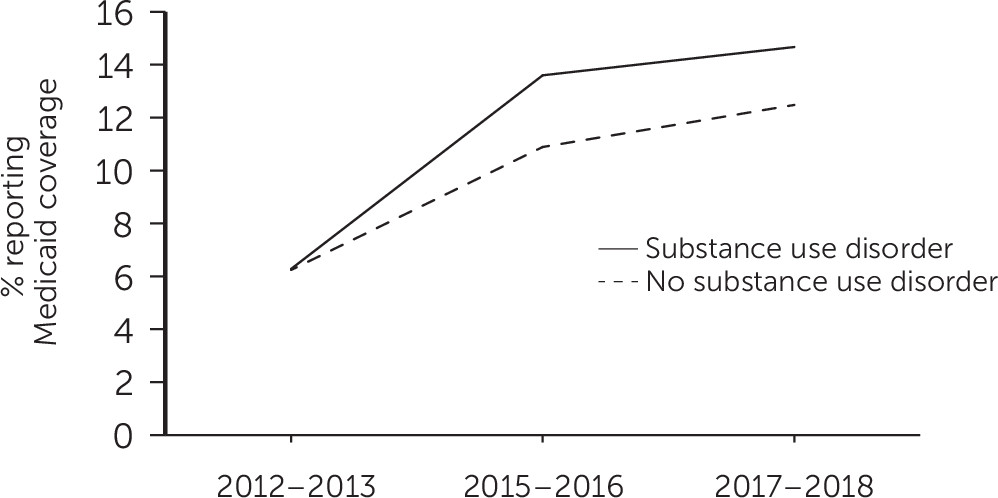

Between 2012–2013 and 2015–2016, trends in insurance coverage were consistent with Medicaid expansion and health insurance marketplace policies. Growth occurred in Medicaid coverage and individually purchased private coverage among low- and middle-income adults with and without substance use disorders. Meanwhile, coverage changed less in other public insurance programs and in employee-sponsored private insurance plans that were not a focus of these two ACA provisions.

Under the marketplace provision, individuals with family incomes of 100%−400% of the FPL are eligible for premium tax credits to reduce premium payments. Because the subsidies are progressive (

24), the increase in individually purchased private plans was expected to be greater among adults in the lower group, compared with the upper group, of this income range. Although evidence of such an effect was noted among adults without substance use disorders, gains in individually purchased private coverage were similar for the two income groups with substance use disorders (see figure in

online supplement). Lower-income adults with substance use disorders may have had greater difficulties in accessing benefits available to them through the marketplace exchanges, compared with their counterparts without substance use disorders. Detailed prospective research could help identify which outreach strategies are most helpful for which populations in achieving marketplace enrollment (

25).

It is not known why adults with substance use disorders were relatively less likely than those without substance use disorders to take advantage of marketplace subsidies. Some possibilities include more challenging life circumstances, competing priorities for basic daily needs (

26), or more extensive reliance on navigators for enrollment assistance. During the Trump administration, federal funding for ACA navigators was reduced by 43% between 2016 and 2017 and by 72% between 2017 and 2018 (

27).

The increase in Medicaid coverage following expansion, by contrast, was proportionately greater for adults with substance use disorders, compared with those without substance use disorders. Lower average incomes of adults with substance use disorders may have resulted in a larger proportion being eligible for Medicaid under ACA expansion (

28). Medicaid coverage plays an important role in the availability of substance use services (

29) and general medical services (

30) for individuals with substance use disorders. Expansion by states of Medicaid eligibility has been associated with slower growth in drug overdose (

31) and in deaths related to substance use disorders (

32). Although Medicaid coverage gains were concentrated in expansion states, a larger share of adults with substance use disorders, compared with those without these disorders, remained uninsured throughout the study period.

Compared with the gains seen under Medicaid expansion, marketplace exchanges have been associated with smaller gains in coverage for adults with incomes of 100%−138% of the poverty level (

33). A similar pattern was observed even among a broader income group with substance use disorders, many of whom were not income eligible for Medicaid. Higher premiums for marketplace plans, compared with Medicaid coverage, or greater difficulties navigating marketplace enrollment, compared with Medicaid enrollment, may have contributed to their having a relatively smaller increase in individually purchased private plans, compared with Medicaid.

The findings suggest that adults with substance use disorders increased enrollment in Medicaid and individually purchased private insurance plans in the years immediately following ACA policy implementation (implemented in 2014). However, because the findings capture coverage at the time of the survey, the results likely understate percentages of adults who were uninsured at some point during each year. In a recent study, nearly one-quarter of marketplace beneficiaries disenrolled before the end of the year (

34). From the insurers’ perspective, adults with substance use disorders are among the least desirable to insure because their health care expenditures often exceed their premiums (

35), making them a group vulnerable to disenrollment. In an analysis of Medicaid enrollees, disenrollment was greater among adults with substance use problems, compared with those without these problems (

36). Despite coverage gains, expanding coverage for lower-income adults with substance use disorders, such as through incentivizing insurers to participate in marketplaces and adjusting risk through more generous premium tax credits (

37), remains a key public health care policy challenge. In evaluating these findings, it is important to bear in mind that most of the adults with substance use disorders had alcohol use disorder. Compared with adults with drug use disorders, those with alcohol use disorders may have faced fewer barriers to health insurance following ACA implementation.

This analysis had some limitations. First, a change in NSDUH survey design prevented an examination of trends in coverage of adults with prescription stimulant, sedative, or opioid use disorders other than heroin use disorder. Second, NSDUH did not sample homeless individuals not living in shelters, active duty military personnel, or persons residing in institutions. Third, NSDUH did not directly assess whether insurance coverage was purchased from marketplaces. Instead, it was assumed that private insurance not purchased through an employer, union, or professional association was individually purchased on a marketplace. In addition, no effort was made to distinguish federally facilitated from state-based marketplaces. Fourth, the difference-in-differences models assume that without Medicaid expansion, insurance trends in expansion and nonexpansion states would have been constant over time. However, ACA provisions other than Medicaid expansion and marketplaces, such as the employer mandate (

38) and dependent coverage provision (

39), or other factors that were not controlled for in the models may have contributed to differential changes in coverage in expansion and nonexpansion states. Finally, the analysis did not assess the effects of coverage on substance use treatment or other health care use. Some prior research suggests that increases in coverage alone may not be sufficient to increase substance use treatment (

10,

40). Beyond health insurance, several other factors, such as transportation, service availability, stigma, and perceived effectiveness of treatment, may influence access to needed behavioral health services (

41). A lack of local providers may help explain why gains in coverage may not be sufficient to increase treatment (

42).