Americans woke up on Labor Day weekend to unsettling news about their health insurance. Leading newspapers and CNN reported that between spring 2000 and spring 2001, monthly premiums for employer-sponsored health plans rose 11 percent. The jump in premium costs represented the largest increase since 1992.

The source of the information was the 2001 Annual Survey of Employer Health Benefits, which was conducted by the Henry J. Kaiser Family Foundation and the Health Research and Educational Trust (HRET). This third annual national survey of randomly selected public and private firms was conducted between January and May 2001.

The number of firms surveyed was 2,734; 1,907 responded to the full survey, while 827 indicated only whether they provide health coverage to their employees. The firms ranged in size from small enterprises with as few as three workers to corporations with more than 300,000 employees. The survey team stratified the sample by industry and the number of workers in each firm. Through statistical weighting procedures, the survey was designed to produce nationally representative estimates for firms, workers, and covered workers in companies with three or more employees.

Virtually ignored by popular media accounts was the timely information the report contained about what’s happening with mental health benefits. Most significant was the fact that of workers who have mental health benefits, the percentage of workers whose mental health benefits are carved out has remained stable, at 22 percent in 2001. This finding is consistent with observations reported in connection with a survey of health care purchasing at Fortune 500 companies (Psychiatric News, September 21).

Benefits Under Carveouts

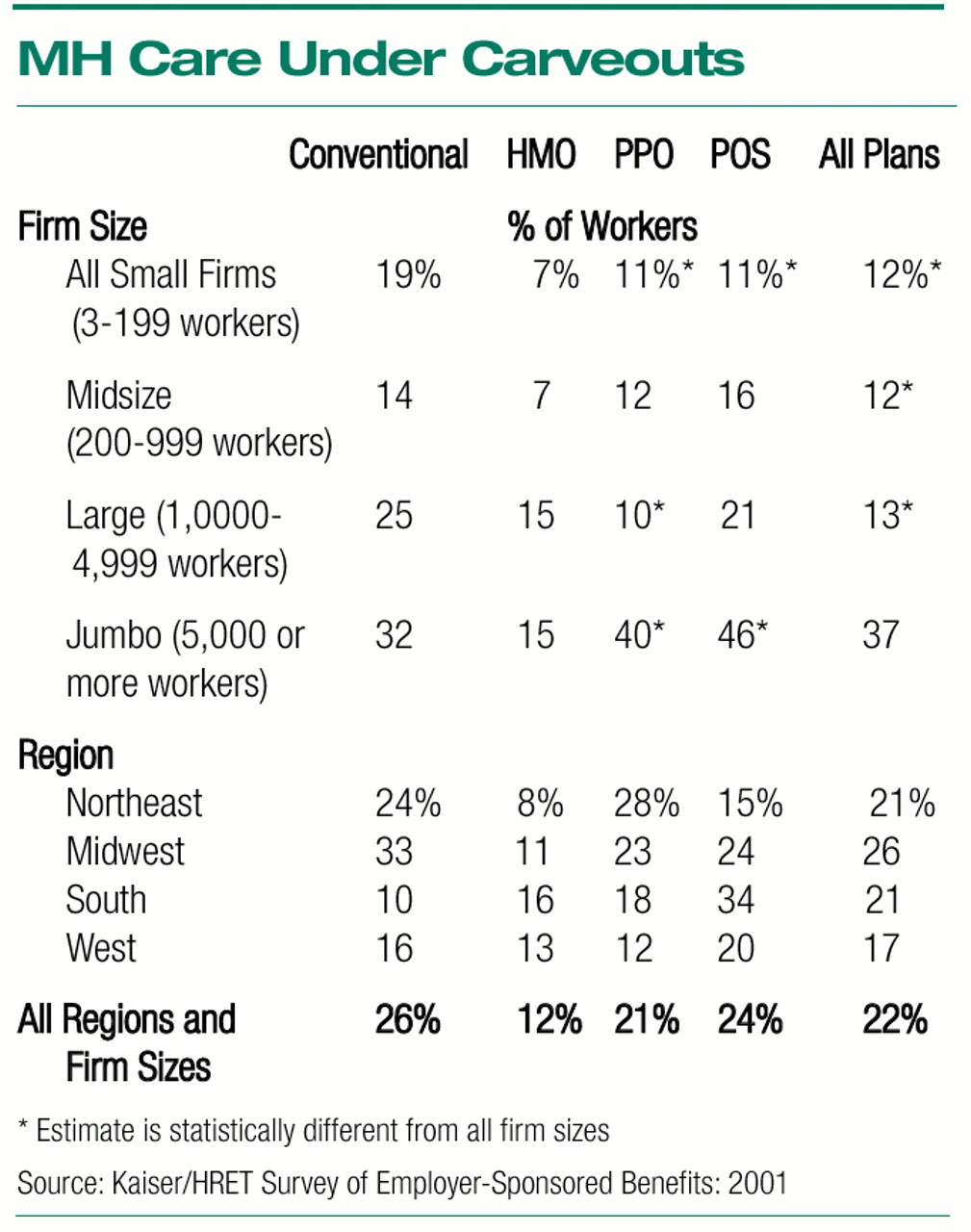

Mental health carveouts are the most common among workers covered by point-of-service (POS) and conventional plans and the least common among health maintenance organization (HMO) plans. Covered workers in small firms are less likely to have mental health benefits carved out from their plan than those in all firms (

see chart below).

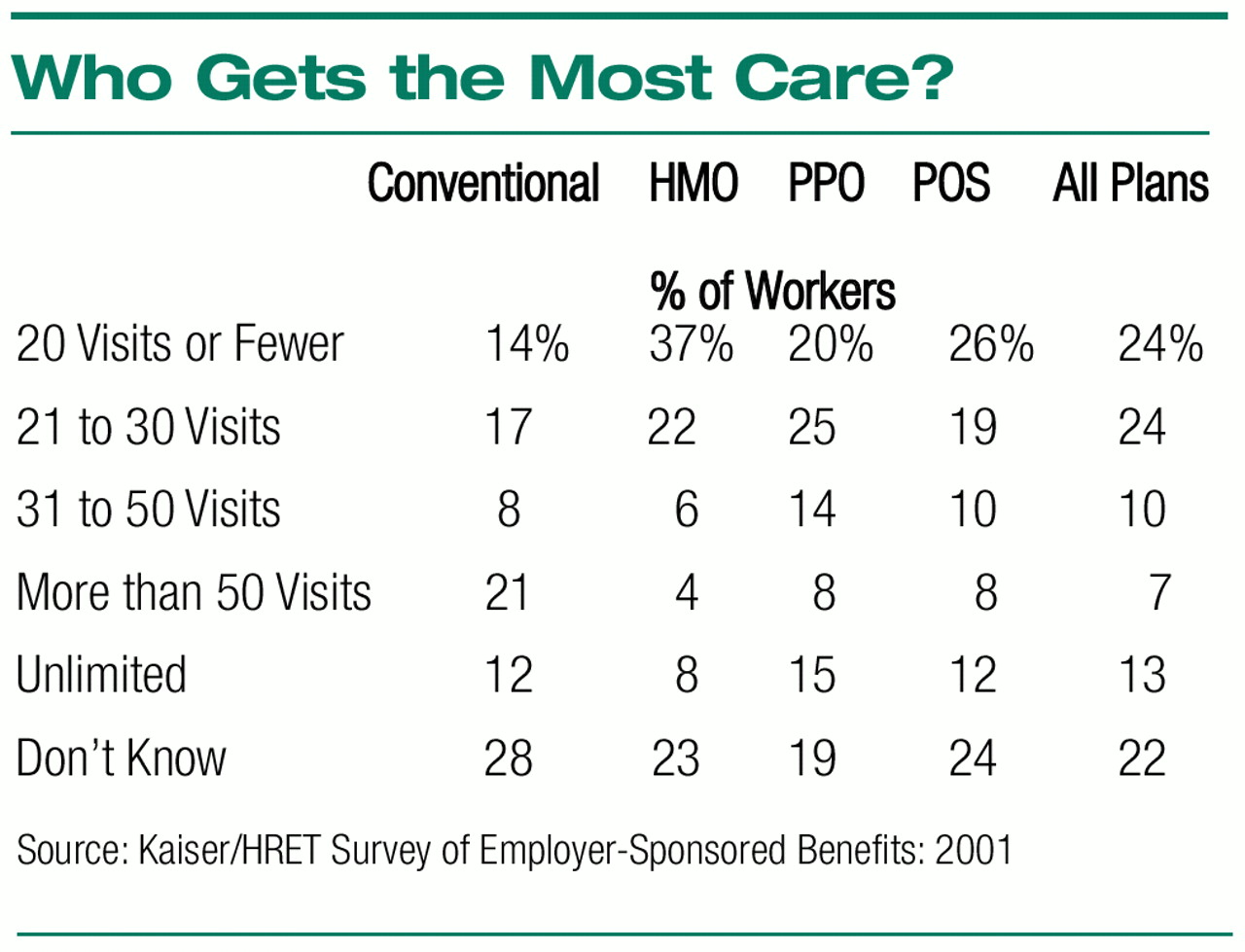

Health plans continue to impose limits on the use of mental health benefits, although restrictions have decreased slightly since the previous survey. Overall, just 13 percent of covered workers have unlimited outpatient mental health visits, and nearly one quarter (24 percent) of workers are restricted to 20 or fewer visits a year (

see table at right). The corresponding figures from the previous annual survey are 11 percent and 26 percent. By contrast, in 1991 approximately 36 percent of covered workers in all large firms (200 or more workers) were in plans with unlimited outpatient mental health benefits.

Workers in preferred provider organizations (PPOs) are the most likely to have unlimited outpatient mental health visits, at 15 percent. Workers covered by HMOs are most likely to be restricted to 20 visits or fewer a year (37 percent).

Unlimited inpatient mental health days are not frequently offered, with only 16 percent of covered workers having unlimited inpatient days in 2001, compared with 18 percent in 2000. Thirty-three percent of covered workers are limited to 21 to 30 inpatient mental health days a year.

Norman Clemens, M.D., chair of the Committee on APA/Business Relationships, said, “Such restrictions are poorly informed and counterproductive to business policy. It is now well established that ending such discrimination against the mentally ill and those caught in substance abuse does not significantly increase the cost of health insurance. The cost to employers of full coverage is compensated by greater worker productivity, less absenteeism and turnover, reduced general medical and disability costs, and improved morale. Employers tell us that the common illnesses of depression, anxiety disorders, and substance abuse have a very large impact on the workplace. Their reports are borne out in the literature.”

Enrollment is shifting from HMOs to less-restrictive forms of managed care like PPOs. Forty-eight percent of employees are enrolled in a PPO plan, up from 28 percent in 1996 and 41 percent last year. Enrollment in HMOs has fallen, from 31 percent of workers in 1996 and 29 percent last year to 23 percent in 2001. Indemnity insurance has almost disappeared, enrolling only 7 percent of employees, down from 27 percent in 1996.

What’s Next?

James Maxwell, Ph.D., principal author of the Fortune 500 survey, identified increases in prescription drug cost and use as one of three challenges facing employers. The Kaiser survey offers support for his view. The authors pointed out, “Employers [who use prescription drug carveouts] reported that prescription costs for family coverage increased 15.5 percent, a rate higher than overall premium coverage. Employers have responded to increased costs by instituting cost-sharing arrangements under which the employee is given an incentive to select less-expensive drugs and also by increasing drug copays.”

The future offers no financial relief. In fact, said Jon R. Gabel, vice president for Health System Studies at HRET, “With managed care in retreat and premiums and claims expenses accelerating, the situation today is the polar opposite of five years ago. For employers and employees, this means that more bad news is just around the corner.”

Premium equivalents for self-insured plans (the estimated costs of health care claims for an employee whose employer self-insures) rose 9.5 percent, compared with 3.8 percent in 1999. This increase is significant because it reflects actual growth in health care costs and “suggests higher premium increases in the coming years.”

The report is posted on the Web at www.kff.org/content/2001/20010906a/. A print version can be obtained by calling (800) 656-4533 and requesting #3138. ▪