“When employers say they are going to do something, you can usually count on it,” Drew Altman, president of the Kaiser Family Foundation (KFF), told attendees at a Washington, D.C., press conference last month to announce the results of the annual KFF-Health Research and Educational Trust (HRET) survey of job-based health benefits.

Unfortunately, that observation proved true.

In the 2001 Employer Health Benefits Survey, 44 percent of large firms (200 or more workers) said that they were “very” or “somewhat” likely to increase employee premiums in the next year ( Psychiatric News, October 19, 2001).

Results of the 2002 survey show that 56 percent of large firms actually did increase those costs. And the future appears even more bleak. Seventy-eight percent of large firms said that they are very or somewhat likely to increase employee premium costs next year.

In the past, explained Jon R. Gabel, HRET’s vice president, employers had absorbed much of the cost of premium increases because of the tight labor market and good economic conditions. Now, they no longer feel the need to compete for employees and are passing increased health care costs along to their employees.

Premiums Increased Substantially

For single coverage, employees now pay an average of $454 a year, amounting to a 27 percent, or $95, increase over last year’s cost. Employees’ share of premiums for family coverage averaged $2,084 a year, amounting to a 16 percent, or $238, increase over last year’s cost.

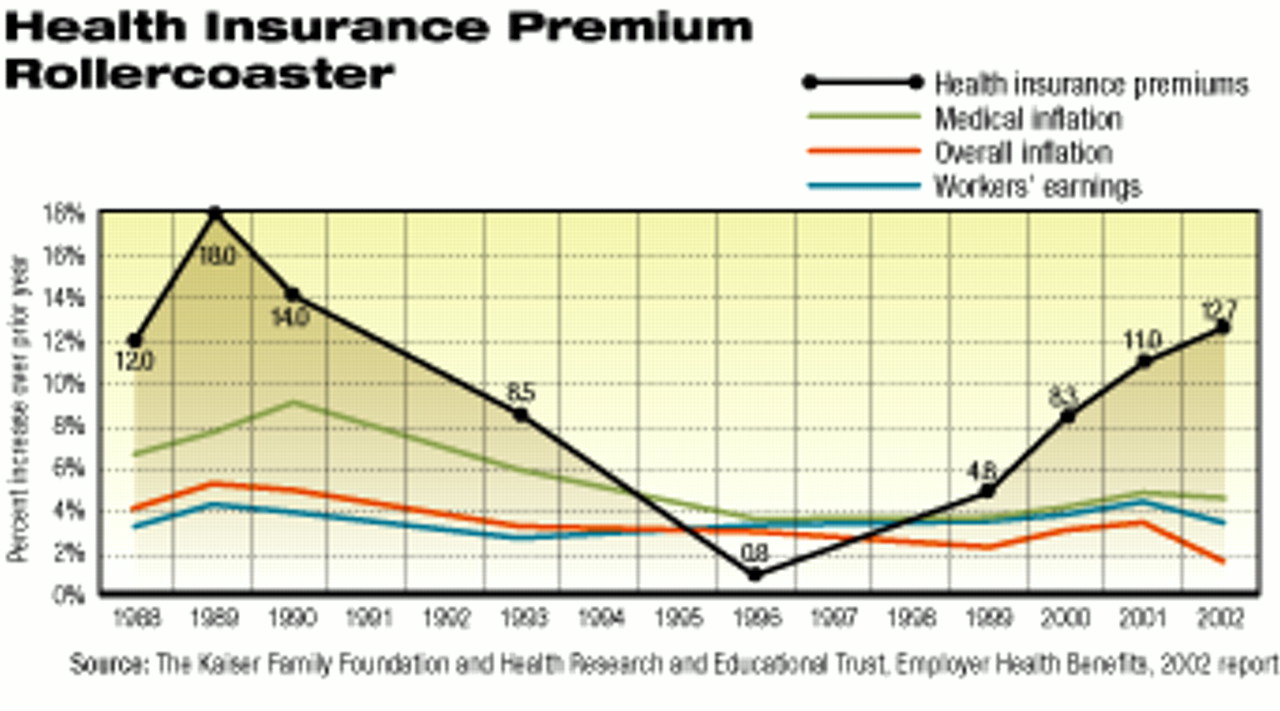

The total average premium cost, which is shared by employers and employees, rose 12.7 percent, the highest increase since 1990. Premiums are now, on average, $3,060 for single coverage and $7,954 for family coverage.

Gabel said, “One of the most alarming findings is the continued growth of underlying health care expenses, which indicates that we can expect double-digit inflation for the foreseeable future. Three more years of this type of inflation could bring family coverage to nearly $11,000.”

The survey report contains data showing trend lines for health insurance premiums, medical inflation, overall inflation, and workers’ earnings from 1998 to 2002 (see chart above).

Since 1996, when health insurance premiums increased by only .8 percent, premiums have shown the most dramatic rise of the trend lines identified.

Mental Health Benefits Stagnate

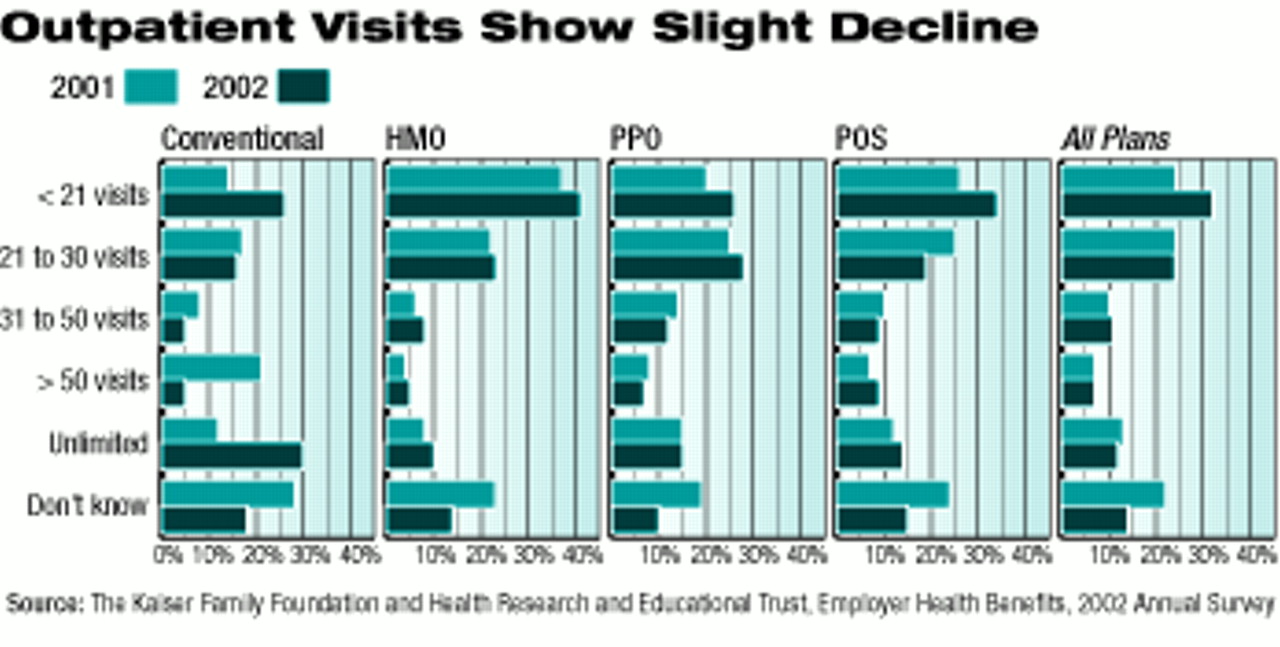

Coverage for mental health benefits showed a slight decline. In the 2001 survey, 24 percent of employers reported that employees given mental health benefits had coverage for 20 visits or fewer. In the 2002 survey, that percentage had grown to 32 percent.

Other categories of coverage, for example, 21 to 30 visits, did not change or changed only by 1 percent or 2 percent. “Don’t know” declined from 22 percent in 2001 to 14 percent in 2002 (see chart).

Coverage for inpatient days did not change consistently or dramatically. The percentage of covered workers with 10 days or fewer of coverage for inpatient mental health care increased from 4 percent to 7 percent. However, the percentage of covered workers with unlimited coverage for inpatient care also increased from 16 percent to 18 percent.

Gabel told the audience that employers and health plans had responded to consumer pressures by retreating from many of the restrictive elements of managed care and that those changes were reflected most dramatically in HMOs, which are most tightly managed.

The profile of mental health coverage by type of plan suggests support for that view. HMOs showed a slight trend upward in terms of number of visits and days covered.

Gabel told Psychiatric News that with the support of funds from the MacArthur Foundation, Richard G. Frank, a professor of health economics at the Harvard Medical School, will analyze trends in mental health benefits from 1997 using data from the KFF-HRET surveys. He anticipates the results will be published in Health Affairs in 2003.

Altman told the audience that the “most powerful and surprising finding” of the survey was the breadth of the impact of the combination of “rising health care costs and a sputtering economy.” Deductibles, as well as premiums, rose.

For PPOs (preferred provider organizations, the most common type of health care plan, covering about half of all workers), the average deductible increased 37 percent, to $276.

Copayments for prescription drugs continued to climb, averaging $9 for generics, $17 for preferred drugs (brand name drugs with no generic substitutes), and $26 for nonpreferred drugs (brand name drugs with generic substitutes).

Seventeen percent of the firms with covered workers reported benefit decreases, and 10 percent of the firms reported benefit increases.

Retiree benefits are also being affected. In 2002, 40 percent of firms with 200 or more workers reported that they had increased the retiree share of health care premiums in the past two years. Nine percent reported that they had eliminated retiree health benefits for new employees.

In yet another omen, 65 percent of firms with 200 or more workers said that health insurance caused the greatest “cost concern” for their company. By contrast, only 20 percent, the next highest figure, expressed concern about salaries.

Norman A. Clemens, M.D., chair of APA’s Committee on APA/Business Relations, told Psychiatric News, “This bleak picture of declining coverage makes our efforts to reach the business community more important. We must work even more vigorously to make our case that insurance coverage promoting access to quality mental health services will benefit employers as well as employees.”

Lawrence B. Lurie, M.D., chair of APA’s Committee on Managed Care, emphasized the importance of looking at the functioning of the total health care system. He told Psychiatric News, “We have to start identifying specific sources of inefficiencies and waste, as well as considering methods of restructuring how we pay for and deliver health care. Excessive administrative costs at managed care companies and unnecessarily high marketing costs for prescription drugs are two items that come to mind.”

The survey reported findings from telephone interviews with 3,262 randomly selected public and private employers. Firms range in size from enterprises with as few as three workers t corporations with more than 300,000 employees.

The 2002 Employer Health Benefits Survey is posted on the Web at www.kff.org/content/2002/20020905a/. ▪