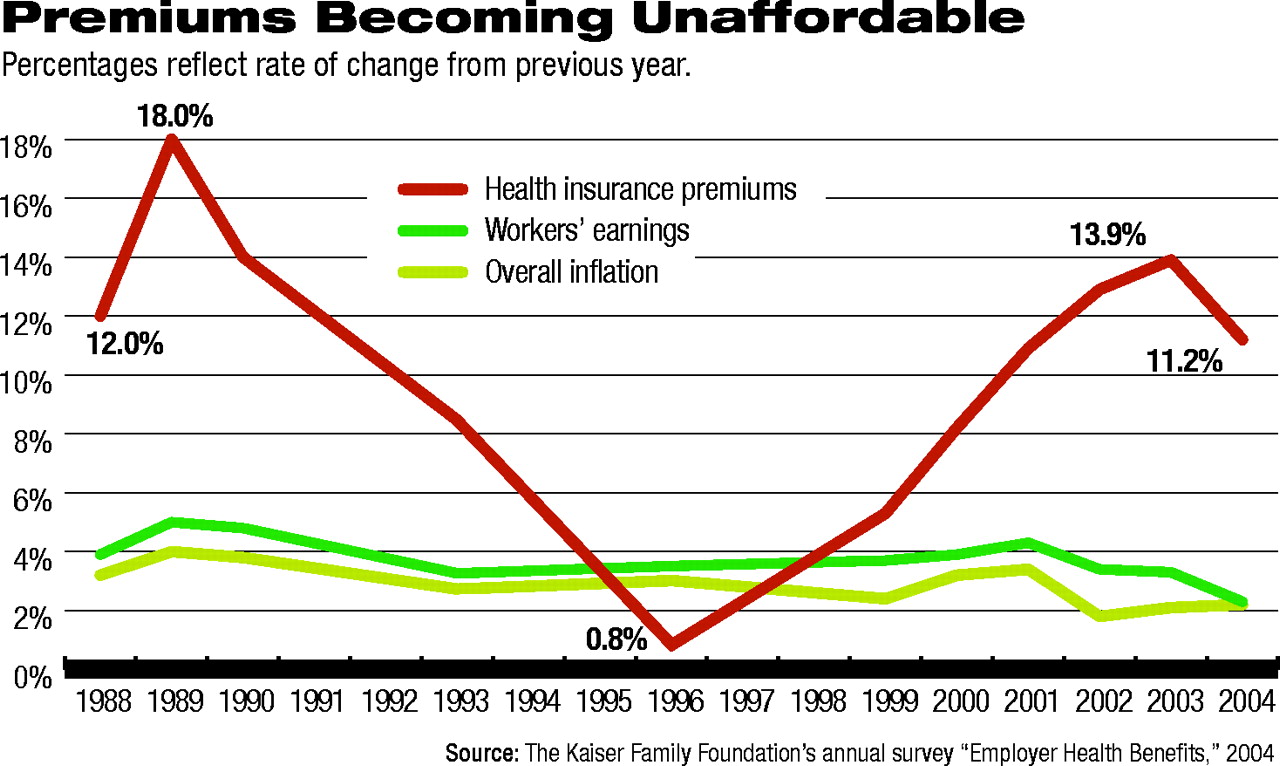

Employer-sponsored health insurance premiums increased an average of 11.2 percent between spring 2003 and spring 2004.

That's less than last year's 13.9 percent increase, but still the fourth consecutive year of double-digit growth, according to the 2004 Annual Employer Health Benefits Survey conducted by the Kaiser Family Foundation and Health Research and Educational Trust (HRET).

The 11.2 percent increase in premiums for employer-sponsored health insurance this year is five times the rate of inflation (2.3 percent) and five times the rate of increase of workers' earnings (2.2 percent).

The survey was conducted between January and May 2004 and included 3,017 randomly selected public and private firms with three or more employees. Findings appear in the September/October Health Affairs.

In 2004 premiums reached an average of $9,950 annually for family coverage and $3,695 for single coverage. Family premiums for preferred-provider organizations (PPOs), which cover most workers, rose to $10,217 annually in 2004, up from $9,317 annually in 2003.

Since 2000, premiums for family coverage have risen 59 percent, compared with inflation growth of 9.7 percent and wage growth of 12.3 percent

The survey also found that the percentage of workers receiving health coverage from their employers in 2004 is 61 percent, down from the recent peak of 65 percent in 2001. As a consequence, there are an estimated 5 million fewer jobs providing health insurance in 2004 than 2001, according to HRET.

A likely contributing factor is a decline in the percentage of small employers (defined as those employing three to 199 workers) offering health insurance over this period. At the time of the survey, 63 percent of small firms offered health benefits to their workers, down from 68 percent in 2001.

“The cost of family health insurance is rapidly approaching the gross earnings of a full-time minimum wage worker,” said Drew Altman, president and CEO of the Kaiser Family Foundation. “If these trends continue, workers and employers will find it increasingly difficult to pay for family health coverage, and every year the share of Americans who have employer-sponsored health coverage will fall.”

These are among the highlights of the survey's findings:

•

Worker contributions: This year workers on average are contributing $558 of the $3,695 annual premium cost of single coverage and $2,661 of the $9,950 cost of premiums for family coverage.

•

Cost sharing: Cost sharing rose modestly in 2004 compared with the larger increases observed in recent years. Most covered workers are in health plans that require a deductible be met before most plan benefits are provided. In PPO plans, which cover more than half of all workers with health benefits, the average deductible for single coverage is $287 for services from preferred providers and $558 for services from nonpreferred providers, about the same as in 2003.

•

Consumer-driven plans: While about 10 percent of all firms offer a high-deductible plan (defined as a plan with a deductible of at least $1,000 for single coverage) to covered workers this year, only about 3.5 percent of those firms offer a personal or savings account option along with a high-deductible plan. But the idea is attracting interest: about 6 percent of all firms said that they are “very likely” to offer such a plan within two years, and another 21 percent of all firms said that they are“ somewhat likely” to do so.

•

Type of insurance: In 2004 PPOs continue to be the most common form of health coverage, with more than half (55 percent) of all employees with health coverage enrolling in a PPO. Health maintenance organizations (HMOs), which cost significantly less to belong to than PPOs, cover about 25 percent of covered workers. Conventional, or indemnity, benefit plans have all but disappeared, covering just 5 percent of insured workers.

“You have to look over the past several years to really understand why Americans are so worried about health care costs,” Altman said.“ Just for premium contributions alone, families are paying $1,000 more this year for their health coverage than they paid in 2000. More than any other factor, these out-of-pocket cost increases are what's driving voter concern about health.”

The survey report, “2004 Annual Employer Health Benefits Survey,” and additional information are posted online at<www.kff.org/insurance/7148/index.cfm>.▪