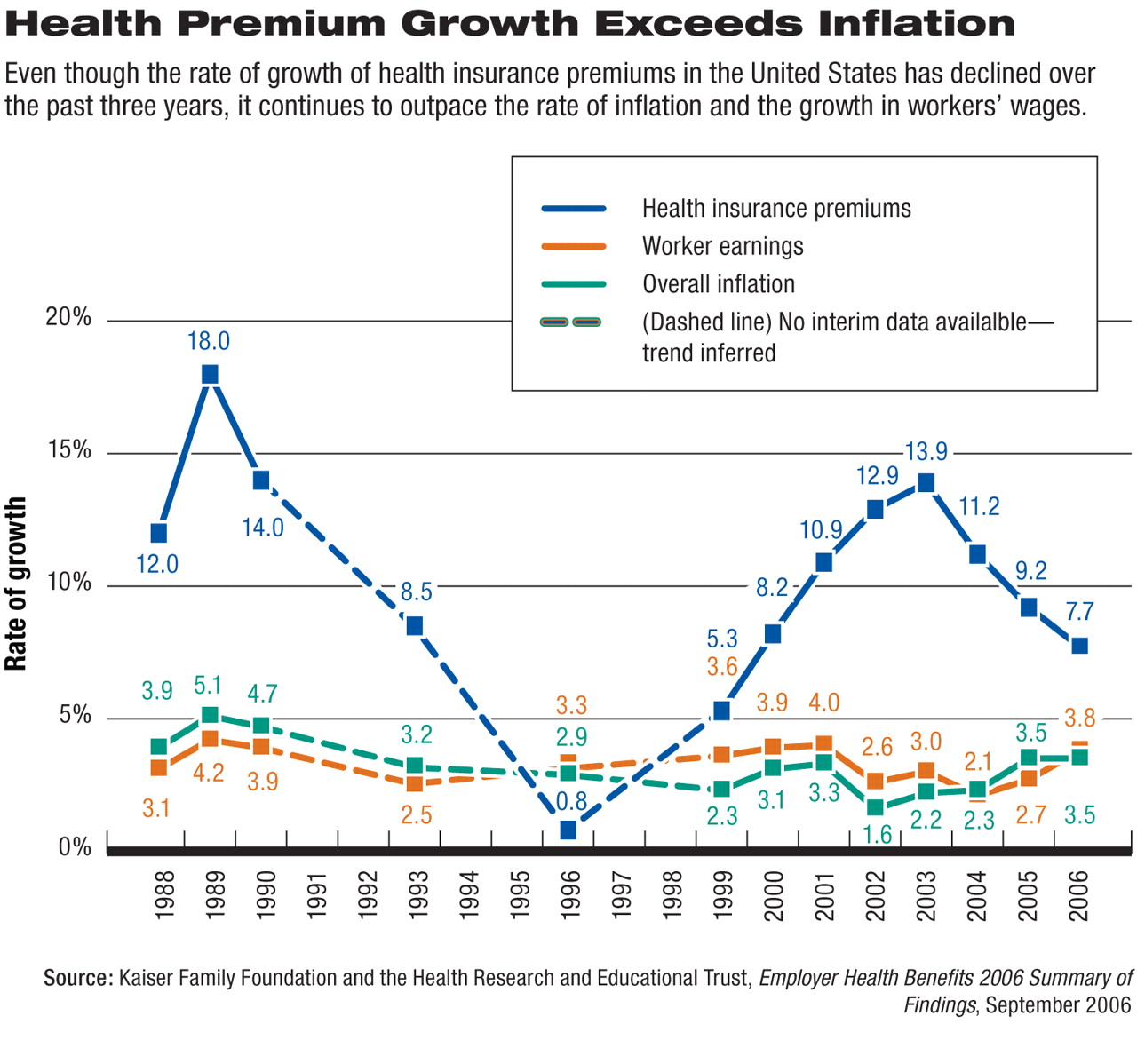

Health insurance premiums for employer-sponsored health coverage rose during the first five months of this year at the slowest rate since 2000, but still increased more than twice as fast as workers' wages did.

According to the Kaiser Family Foundation and the Health Research and Educational Trust (HRET) annual survey of employer health benefits, premiums rose an average of 7.7 percent during the period of January to May this year. That is less than the 9.2 percent increase recorded in 2005.

It was, however, still more than twice the average increase in workers' wages (which was 3.8 percent) and in overall inflation (3.5 percent; see

chart).

Family health coverage now costs an average of $11,480 annually, with workers paying an average of $2,973 toward those costs. That figure is about $259 more than they paid last year and $1,354 more than workers paid toward their premiums in 2000.

On average, workers are paying about 16 percent of their policy's premiums for single coverage and 27 percent for family coverage, with their employers paying the rest.

“While premiums didn't rise as fast as they have in recent years, working people don't feel like they are getting any relief at all because their premiums have been rising so much faster than their paychecks,” said Kaiser Family Foundation President and CEO Drew Altman, Ph.D., in a press release issued with the survey. “To working people and business owners, a reduction in an already very high rate of increase just means you're still paying more.”

The annual Kaiser/HRET survey was conducted between January and May of this year and included 3,159 randomly selected, nonfederal, public and private firms with three or more employees.

Of those firms, 2,122 responded to the full survey; 1,037 that did not respond were contacted by telephone and asked, “Does your company offer or contribute to a health insurance program as a benefit to your employees?” Responses to the phone question were included in overall estimates of firms offering health benefits.

About 61 percent of U.S. firms offer health benefits to at least some of their workers, statistically unchanged from last year's rate (60 percent). While nearly all large businesses (defined as those with at least 200 workers) offer health benefits to their workers, fewer than half of the smallest firms (with three to nine workers) do.

The survey also revealed that employers do not express great confidence in current strategies to contain rising health care costs. Just 17 percent of small employers and 28 percent of large employers said they consider disease-management programs “very effective” at controlling health care costs.

They were even less likely to rate other strategies as very effective, including consumer-directed health plans (16 percent of small and 13 percent of large employers), higher employee cost sharing (15 percent of small and 13 percent of large firms), and tighter managed-care networks (9 percent of small and 4 percent of large firms).

Also notable is the increase in cost-sharing required by most health plans. The average in-network deductible in preferred provider organizations reached $473 for single coverage. Average copayments for drugs across plan types were $11 for generic drugs, $24 for preferred drugs, and $38 for nonpreferred drugs, according to the survey.

“We are still losing the race between premiums and workers' earnings, and if that trend persists, employer-based coverage will continue to decline as fewer employers and workers can afford the cost of coverage,” said Jon Gabel, a study co-author and vice president of the Center for Studying Health System Change.