The sparse literature on the practices of psychiatrists is limited by reliance on physician self-reported information, which is subject to both response and selection biases. Although these studies provide some information about psychiatrists’ practice behavior, there are few details about insurance participation with respect to the types of patients served or the number of patients with insurance their psychiatrist accepts, which, if available, could inform policy solutions. In this article, we use state physician licensing data and an all-payer claims database to examine the characteristics of Massachusetts psychiatrists practicing in 2013. To better understand access to specialty mental health care, we assessed how many psychiatrists treated patients with different types of insurance, the number of insured patients they treated, and differences in the traits of psychiatrists with more versus less insurance participation.

Discussion

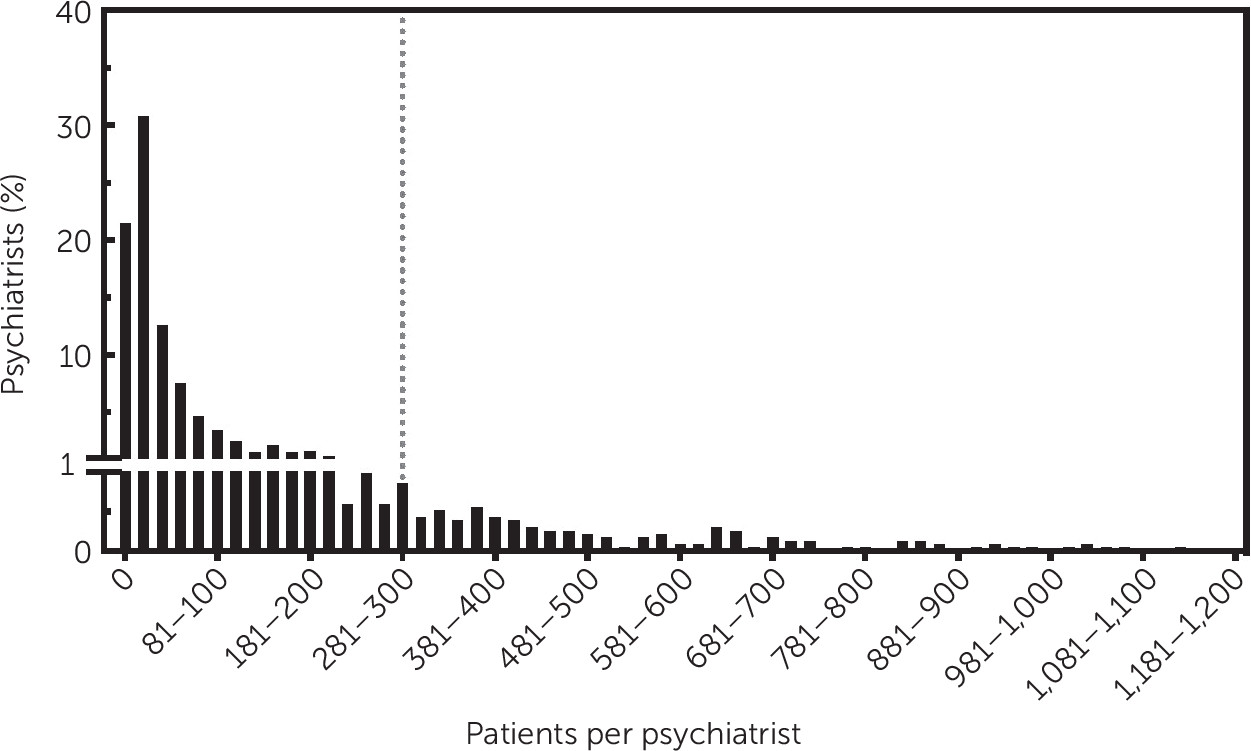

Access to psychiatrists through private insurance appears to be difficult (

8), and our findings suggest that the supply could be considerably lower than previously described for U.S. residents who rely on health insurance to pay for their care. Even in areas with relatively large numbers of psychiatrists, such as Massachusetts, most psychiatrists accept private health insurance for only a few patients per year, and few psychiatrists meet even conservative definitions of a full outpatient caseload of patients billed through private health insurance. We found that many psychiatrists who participate in the insurance market see very few patients with insurance reimbursement, which suggests that counting psychiatrists alone could grossly overestimate the supply available to patients who cannot afford to pay out of pocket. Furthermore, more psychiatrists participate in commercial insurance than public insurance, as previously described (

13), and this disparity increases when looking at psychiatrists who carry full caseloads. Finally, we found that a high proportion of psychiatrists have been in practice for several decades and that more of these psychiatrists are active participants in the insurance market compared with those with few years of practice, which raises concerns about the potential for even greater workforce challenges in the future, as older psychiatrists retire. Without substantial increases in the inflow of new psychiatrists, and particularly those who participate in insurance markets and to a greater degree than current trends demonstrate, difficulties with access could soon worsen.

In Massachusetts, as elsewhere across the country, the small number of psychiatrists who accept insurance and are taking new patients is troubling, particularly for patients with insurance plans with lower than average reimbursement levels (

13,

22). We found that three-quarters of psychiatrists with an active license and a registered address in Massachusetts had an insurance claim during 2013, suggesting that some licensed psychiatrists might practice without participating in any insurance market or might not practice at all. Although Massachusetts appears to have a higher proportion of psychiatrists with some insurance participation compared with estimates of the national average (78.5% versus 55.3%) (

13), even among the population of physicians who had an insurance claim, the average number of unique patients who had a claim through private insurance was small, with 50% (N=1,181) of psychiatrists billing for 18 patients or fewer in the year. Furthermore, the subset of psychiatrists billing for a full caseload of patients came to less than 10% (N=151) of all providers, suggesting that access to outpatient psychiatry may be far more limited than previously realized. Many psychiatrists are likely compensated in some capacity outside of billing insurance for outpatient care, possibly by treating patients who self-pay or by pursuing nonclinical work (

23,

24). These providers may not be accepting new patients or may not be seeing many patients through the insurance market.

Several factors could influence a psychiatrist’s decision about accepting insurance and could explain resulting practice differences between those who do and do not participate, including concerns about administrative burdens required for insurance reimbursement, higher payments outside of the insurance market than within, and the ability to customize treatment plans that may not be adequately reimbursed (e.g., psychotherapy) (

24,

25). The amount of reimbursement, the required administrative steps, and the complexity of the patient population may vary by insurance type (e.g., commercial group insurance plans typically pay higher reimbursement compared with other private insurance, such as Medicaid managed care) (

26). Although the option to pay privately for mental health services might work well for psychiatrists and for some patients with financial resources, this system would not work well for patients with less disposable income, who also could be at elevated risk for mental illness (

27).

Massachusetts contains some of the highest concentrations of academic medical centers and psychiatrists in the country (

1). Massachusetts may represent a positive outlier in the country with respect to the overall supply of psychiatrists, given that there are more than 27 psychiatrists per 100,000 residents—many more than in most states and particularly states with lower population density—and more than double the national average of 12.9 psychiatrists per 100,000 residents (

1,

2). It should be noted that, in 2006, Massachusetts implemented health care reform requiring all residents to have a minimum level of insurance coverage. However, Massachusetts physicians in other specialties have also been found to have low levels of insurance acceptance (

28). Thus, despite the ample physician supply, disparities in access to care resulting from low participation of psychiatrists in insurance markets has led to lack of parity in access to mental health care for patients with private insurance.

Massachusetts and other states are working to set state network adequacy requirements such that there are enough providers across medical specialties to serve the population enrolled. Understanding the psychiatric workforce and how to incentivize provider participation is essential to meet these requirements (

29). Network adequacy rules already vary across states and insurance types; however, it may be worth taking into account the practice patterns of psychiatrists and whether psychiatrists participating in insurance networks are accepting new patients. When considering network adequacy rules, the mere presence of psychiatrists in the state or in a network does not guarantee that patients will have adequate access to specialty mental health care, particularly if these psychiatrists are not seeing significant numbers of patients through insurance.

A further barrier to care may be limitations imposed by insurance networks where the supply of psychiatrists may be further constrained for patients enrolled in a particular plan. For psychiatrists who had insurance claims in 2013, a majority had claims through group commercial insurance, an insurance with more generous reimbursement (

30–

33). In geographic regions outside Boston, the likelihood of a claim through noncommercial insurance was higher than in Boston. This may be the case because the availability of self-pay patients is lower in these regions or because providers have chosen to work in underserved areas where patients are covered by noncommercial plans.

Our study confirms prior findings that the population of psychiatrists in Massachusetts is approaching retirement age (

24,

34–

37). In this state, the number of younger psychiatrists could be insufficient to replace older psychiatrists as they retire. It is striking to note that almost half of psychiatrists have been out of medical school for at least 30 years, even though some psychiatrists have retired during this period and the following decades (

23). Furthermore, we found that this cohort of psychiatrists was most likely to see patients and to bill for a high number of patients through insurance, highlighting concern for the future, as these physicians leave the workforce.

There were several limitations to our study. First, the study focused on a single state and used claims data, which, as we suggested earlier, could represent a positive outlier. Second, we could collect information only about insurance claims for each psychiatrist but did not have data about clinical encounters outside of the insurance market involving these physicians (e.g., self-pay visits). As a result, we could not determine the entire caseload for a given psychiatrist but only the caseload billed through insurance for the coverage types included in our study. The population of Massachusetts has, on average, a high level of income compared with that of other states; thus, it is possible that a greater proportion of residents in Massachusetts, compared with elsewhere, are able and willing to pay out of pocket for psychiatric services. Third, this study may overestimate care provided by preceptors working with trainees, because trainees may be billing under their preceptor’s NPI, rather than their own, when they are the service provider. We also excluded public health insurance (e.g., Medicare and Medicaid FFS) from our study because of concerns about the availability of Medicare data and the completeness of Medicaid data in the version of the APCD we used. However, we did include publicly financed insurance administered by private insurance companies (e.g., Medicaid managed care plans). Although we excluded these groups from our main analyses, we were able to examine patterns in traditional Medicare by using the CMS public use file and in Medicaid FFS from the last quarter of 2013 and found patterns similar to those of included groups (e.g., traditional Medicare appeared similar to Medicare Advantage, and Medicare FFS appeared similar to Medicaid managed care). Furthermore, the racial-ethnic composition of licensed psychiatrists was not available through our data sources. Last, our study comprised data from 2013, but policies and state mandates change over time. However, Massachusetts was an early adopter of mental health parity policies and insurance coverage expansion, so the results in 2013 could more closely approximate the current landscape compared with other states. Nevertheless, they may not be fully representative of the current landscape. Despite these limitations, our data give a snapshot of what is likely a representative description of psychiatrist participation in insurance markets across the country.