Little is known about limits on coverage for mental health care in private employer-sponsored health plans, which in 2001 covered 73 percent of all insured individuals in the United States (

1). Such plans offer substantially lower levels of coverage for mental health services than for general medical services (

2,

3,

4,

5). Moreover, larger employers offer more generous coverage than smaller ones (

2). Other information about coverage for mental health care in private employer-provided plans is lacking.

We used data on mental health benefits in high-coverage health plans offered by 1999's Fortune 100 companies—the top 100 companies in the United States in terms of annual revenue—to describe some of the most generous coverage options for mental health care made available by employers in the United States. Together, these companies had approximately nine million employees, representing about one out of every ten private non-farm employees (

6). The high-coverage options for mental health care that these companies offer are of interest, because these options can minimize out-of-pocket expenses for employees—and their dependents—who have chronic mental health problems.

Fortune 100 companies, because of their size and their leadership positions in their industries, exert substantial influence on employer-sponsored mental health benefits (

7). When these companies change their benefit options, other companies in their industries, which are competing for employees and market share, have an incentive to follow suit (

8). Competition may thus produce industry-specific trends in employee medical benefits, resulting in substantially different plan options for mental health care in different industries and similar options within an industry. The presence of differences in coverage options by industrial sector implies that workers' risk of incurring high out-of-pocket expenses for mental health services depends on which industry they work in, even if the workers have similar skills and experience and they all work for large companies.

Methods

Information on mental health benefits was abstracted from summary descriptions of health care plans, which were requested from all companies on the Fortune 100 list for 1999. Benefits managers sent the descriptions of all plans available to full-time employees working at corporate headquarters in the spring of 2000. Several employers offered multiple plans. In these cases, the plan that was expected to require the lowest out-of-pocket expenses for persons with chronic conditions was selected for abstraction, without regard to the premium. This selection reflected the aim of the researchers who requested the plan data (

9)—that is, to describe health plan options most favorable to persons with chronic conditions. Thus the plans selected for this study offered relatively generous health insurance coverage and were among the highest-coverage options available to employees of large companies.

The abstracted data were sent to the director of human resources or equivalent in each company for review, and all data were reviewed and verified during follow-up telephone interviews. Complete and verified data were obtained from 76 companies. The other 24 companies did not differ significantly (p<.05) from the 76 responding companies in annual revenue, number of employees, industrial sector, or census region.

Our analysis focused on mental health outpatient and inpatient coinsurance rates, outpatient copayment amounts, and annual limits for outpatient mental health visits and inpatient days. Although health plan deductibles, lifetime maximums, separate mental health inpatient copayments, and coverage denials can also cause out-of-pocket costs to vary, most of the plan summaries did not separately identify these items specifically for mental health services, so they were omitted from the analysis. Differences in coinsurance rates and copayment amounts by industry were estimated with the Tobit model (

10), which is an appropriate method for outcomes with upper or lower limits, such as coinsurance rates.

Results

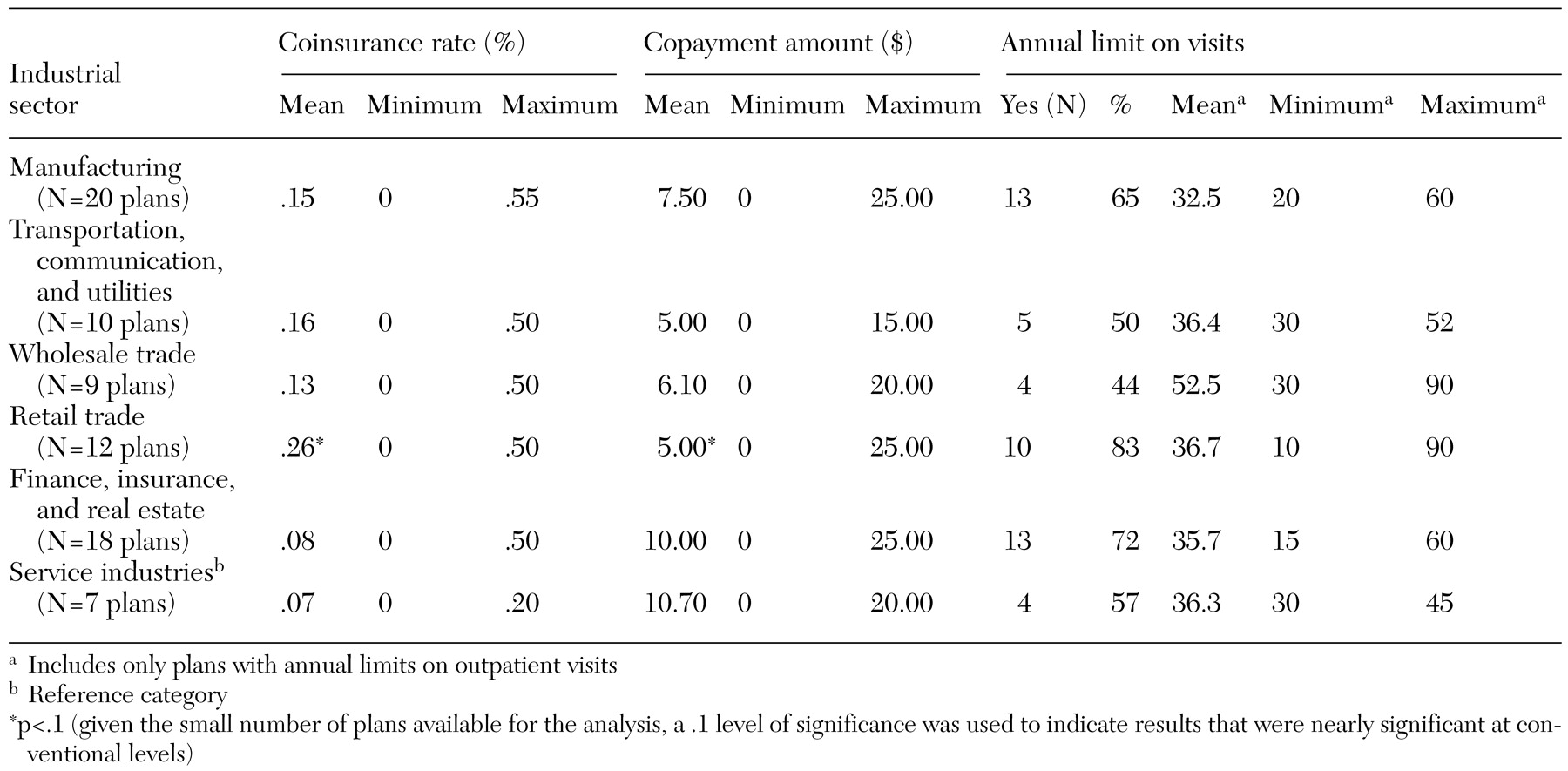

As can be seen in

Table 1, among the 76 plans, outpatient mental health coverage limits varied both within and across industrial sectors. Of the six industrial sectors, high-coverage plans offered in the service industries had the lowest average coinsurance rate (7 percent), and plans in the retail trade industry had the highest average rate (26 percent). At least one plan in every sector except the nonfinancial service industries had a coinsurance rate of at least 50 percent for outpatient mental health services, but at least one company in every industry offered a plan with a zero coinsurance rate. Differences in the mean copayment across sectors were not statistically significant. However, within every industrial sector, outpatient copayments ranged from a minimum of zero to as much as $25 at some companies. Moreover, copayments were negatively correlated with coinsurance rates (Pearson's correlation=−.585, p<.001).

Averages of annual limits for outpatient visits did not vary significantly by industrial sector, but substantial variation occurred across companies within a sector. Almost two-thirds of all plans did not include any annual limit on visits; among those that did, limits varied from ten to 90 visits per year (both occurred in plans in the retail trade sector).

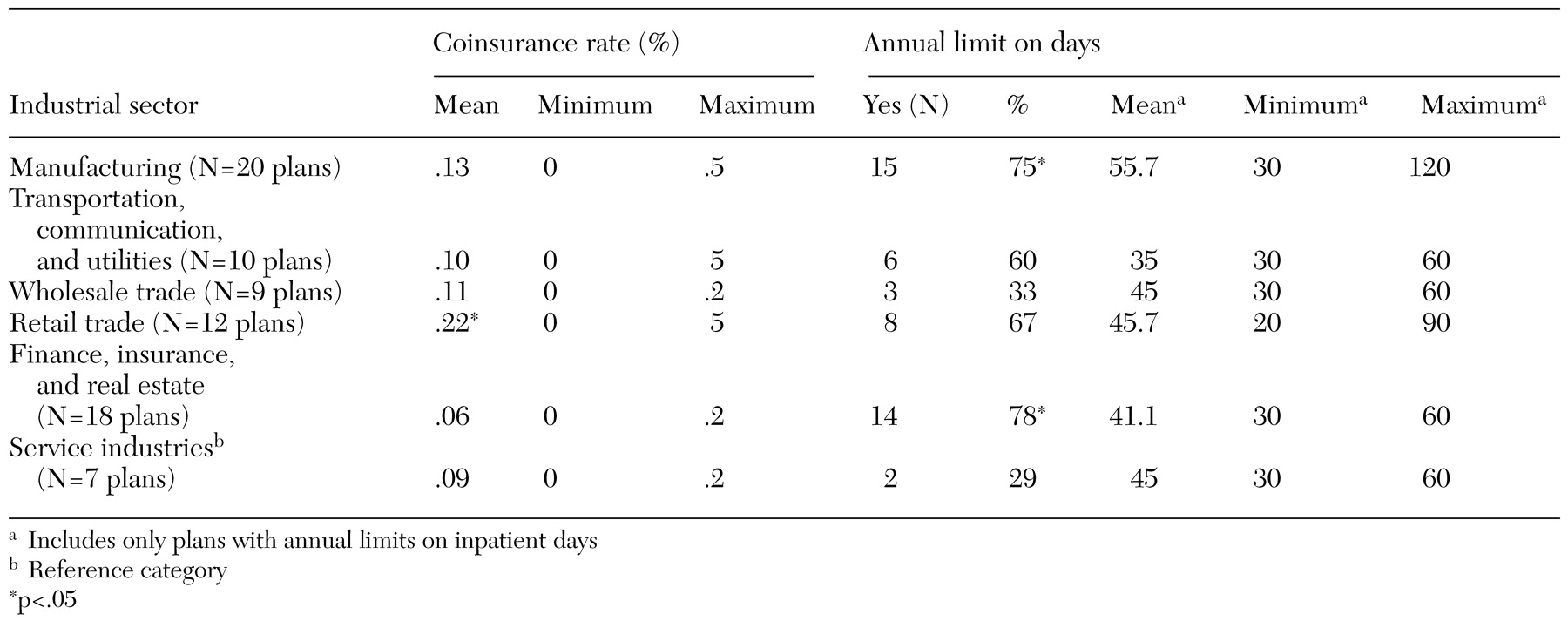

Options for minimizing out-of-pocket expenses from inpatient service use also varied considerably across and within sectors (

Table 2). The relatively high mean coinsurance rate for plans in the retail trade sector, for example, suggests that relatively few retail companies offered plans with minimal coinsurance. Also, in three sectors—manufacturing, retail trade, and transportation, communication, and utilities—coinsurance rates were as high as 50 percent in some plans and were zero in others. In other industrial sectors, coinsurance rates ranged from zero to 20 percent.

Industries varied in the proportion of plans that imposed annual limits on inpatient days. Only 29 percent of service industry plans imposed limits, whereas significantly greater proportions of plans in the manufacturing sector (75 percent) and in the finance, insurance, and real estate sector (78 percent) imposed limits. Among plans that had limits, some plans limited coverage to 30 inpatient days or fewer, and others allowed up to 120 days. However, most plans in each sector imposed limits of 30 to 60 days.

In this sample of plans, differences in cost sharing and utilization limits may have been related to plan type, because managed care plans use other mechanisms, such as utilization review, to limit mental health service use (

10). Overall, fee-for-service (FFS) or preferred provider organization (PPO) plans made up 53 of 76 (70 percent) of all plans. Only three of seven health plans (43 percent) in the service sector, which had relatively low average coinsurance rates and relatively high copayment requirements, were FFS or PPO plans. In contrast, ten of 12 health plans (83 percent) in the retail trade sector, which had relatively high coinsurance rates, were FFS or PPO plans. Other industrial sectors fell between these two extremes in terms of both cost sharing and the proportion of plans of each type. Thus the composition of plan types varied across industrial sectors, and this variation partly explains differences in cost-sharing requirements for mental health care among high-coverage plans.

Nevertheless, plan type had only a modest relationship with cost-sharing requirements and utilization limits. HMO and point-of-service (POS) plans were less likely than FFS and PPO plans to require outpatient or inpatient coinsurance (48 percent compared with 79 percent, p<.01), and they were less likely to place a limit on outpatient visits (48 percent compared with 74 percent, p<.05). However, almost half of HMO and POS plans imposed coinsurance. Moreover, HMO and POS plans were more likely to require copayments for outpatient services (70 percent compared with 43 percent, p<.05) and almost as likely to impose a limit on inpatient days (60 percent compared with 66 percent, not significant).

Discussion and conclusions

For employees of the largest companies in the United States, options for minimizing out-of-pocket expenses for mental health services varied substantially across employers. We found that even among employees in the same industry, some employers offered plans that included relatively little cost sharing and relatively generous utilization limits, whereas other employers' most generous plans required at least 50 percent cost sharing for inpatient and outpatient services and had relatively strict utilization limits. This finding is consistent with results reported in one of the largest studies of individuals' mental health insurance coverage (

2). Although employer group size has been shown to be one of the strongest predictors of generosity of coverage for mental health care, employer group size and other characteristics of employers and employees explained relatively little of the variation in the generosity of mental health coverage in that study (

2). Our results suggest that many employees of large corporations simply do not have the option of selecting a plan that offers generous coverage for mental health care.

In interpreting our findings, two limitations require special emphasis. First, large companies often make multiple health plans available to employees, yet our results were based on a single plan selected from each company. The selected plans were not representative of plans offered by Fortune 100 companies in that they included relatively generous coverage for mental health care compared with average cost-sharing requirements reported for a more representative sample (

11). Nonetheless, the plans we studied may be representative of high-coverage options available to employees at Fortune 100 companies in 2000. Had information about other Fortune 100 health plans been available, the relevance of this particular sample could have been better defined. Second, information on several key features of these plans was not available, which limited the validity of conclusions about the generosity of coverage. Plans that do not use coinsurance, for example, may use administrative mechanisms or lifetime limits to control utilization of services or may set high premiums. Clearly, future research needs to be concerned with the features of health plans that are not easily observed and that are infrequently documented.