The 12-month estimates of diagnosable mental disorders among adults in the United States range from 26% to 30%, and lifetime estimates range from 46% to 50% (

1,

2). Although mental disorders account for only 6.2% of the nation's health care expenditures in direct costs, their indirect costs, in terms of reduction in labor, public income support payments, incarceration, and homelessness, are exorbitant (

3).

For example, depression alone causes a loss of $44 billion each year in both presenteeism, defined as loss of productivity that occurs when employees perform poorly due to coming to work sick, and absenteeism (

4). Moreover, among those with serious mental illness—approximately 6% of the population (

1)—each year $100 billion is spent on health care (

5), $193 billion is lost in earnings (

6), and $24 billion is spent for disability benefits (

7). Decreased adherence with medical regimens, increased risk of adverse health behaviors, and increased risk of heart disease and other chronic conditions compound the indirect cost of mental illness (

8) and further jeopardize insurance status through ineligibility and job loss (

9). Notably, increased costs are not limited to those with the most serious illnesses. Without treatment, even mild disorders can become serious (

1) and assume a chronic course (

10).

Persons with mental illness face many challenges with respect to health care insurance coverage. They are disproportionately denied insurance because of preexisting conditions (

11). Moreover, among those who are insured, high cost-sharing, for example, through deductibles, copayments, and coinsurance, and limits on the number of covered visits make it difficult to obtain adequate care (

11–

14).

On March 23, 2010, President Obama signed the Patient Protection and Affordable Care Act (P.L. 111-148). This act was later amended through a reconciliation process, and the resulting Health Care and Education Reconciliation Act (P.L. 111-152) was enacted on March 30, 2010. It is now often referred to as the Affordable Care Act (ACA). The purpose of the ACA is to eliminate the sociodemographic disparities in health care coverage by holding insurance companies more accountable, lowering health care costs, and guaranteeing more health care choices (

www.healthcare.gov/law/about/index.html). The ACA also prohibits insurers from denying coverage or charging more for persons with preexisting conditions (

15), another factor that disproportionately affects insurance coverage among persons with mental illness (

11). Incremental reforms began in 2010, but the most substantial changes, such as individual mandates, employer requirements, expansion of public programs, premium- and cost-sharing to individuals, premium subsidies to employers, tax changes, and health insurance exchanges, take effect in 2014 (

www.commonwealthfund.org/Health-Reform/Health-Reform-Resource.aspx).

This study provided information about uninsurance rates during four retrospective time periods for ongoing trend analysis of changes in insurance coverage before and after phasing in of the ACA. (Four time periods were chosen because two points are not sufficient to establish a trend line.). Experience in Massachusetts, which enacted a similar mandatory insurance act on April 12, 2006, showed that health insurance uptake, in spite of penalties, is slow and steady and is characterized by patterns related to sociodemographic factors, behaviors, and perceived health needs of individuals (

16–

18).

In this study, data from the 1993 through 2009 Behavioral Risk Factor Surveillance System (BRFSS) were used to examine uninsurance rates among nonelderly adults in the United States over four time periods (1993–1996, 1997–2001, 2002–2005, and 2006–2009) grouped by whether they experienced frequent physical or mental distress. Results of the analysis were used to determine the group or groups at highest risk of uninsurance over the four time periods. They were also used to generate adjusted nationwide and state-specific estimates of uninsurance on the basis of sociodemographic factors.

Methods

The BRFSS is a state-based surveillance system, operated by state health departments in collaboration with the Centers for Disease Control and Prevention. The objective of the BRFSS is to collect uniform, state-specific data about preventive health practices and risk behaviors linked to chronic diseases, injuries, and preventable infectious diseases in the adult population (

19,

20). Trained interviewers collect data on a standardized questionnaire monthly from an independent probability sample of households with telephones among the noninstitutionalized U.S. adult population. The BRFSS questionnaire consists of core questions asked in all 50 states and the District of Columbia; supplemental modules containing a series of questions about specific topics, such as adult asthma history, intimate partner violence, and mental health; and state-added questions. All BRFSS questionnaires, data, and reports are available at

www.cdc.gov/brfss.

Beginning in 1993, questions about mentally and physically unhealthy days were included in the BRFSS. These measures are widely used in state health reports and annual reports of state-level health status and mental health indicators (

21). They are useful for identifying unmet health needs and disparities among demographic and socioeconomic subpopulations, characterizing the symptom burden of disabilities and chronic diseases, and tracking population patterns and trends (

21). Unlike physical and mental health screening questionnaires that attempt to assess the likelihood that the respondent meets criteria for a particular mental or physical illness, the physically and mentally unhealthy days questions assess perceived level of physical and mental health.

Two questions involve respondents' self-assessment of their health over the previous 30 days. The question, “How many days was your physical health, which includes physical illness or injury, not good?” assesses physically unhealthy days. The question, “How many days was your mental health, which includes stress, depression, and problems with emotions, not good?” assesses mentally unhealthy days. These questions have demonstrated validity and reliability for population health surveillance (

21–

23). For example, adults with serious psychological distress report five times as many mentally unhealthy days as those without serious psychological distress (

24).

We categorized mentally and physically unhealthy days as indicating either infrequent distress (zero to 13 days) or frequent distress (14 to 30 days). To be included in the analysis, persons must have responded to both questions about physically and mentally unhealthy days. Responses were further categorized into four mutually exclusive groups—those with neither frequent mental nor physical distress, those with frequent mental distress only, those with frequent physical distress only, and those with both frequent mental and physical distress. These categories were later collapsed into two categories, frequent mental distress and no frequent mental distress, on the basis of the uninsurance patterns observed in the data.

We categorized health care coverage using yes or no responses to the question, “Do you have any kind of health care coverage, including health insurance, prepaid plans such as health maintenance organizations, or Medicare or other government plan?” Covariates of interest included sex, age group (18–34 and 35–64), race or ethnicity (non-Hispanic white, non-Hispanic black, Hispanic, and non-Hispanic other), and education (less than high school, high school graduate, and at least some college education). We limited data analyses to those aged 18 to 64 years because those aged 65 years or older were generally covered by Medicare.

Data, including information about insurance status and physically and mentally unhealthy days, were available for 2,815,246 respondents aged 18 to 64 years. Data were available for all states in all years except in 2002, when data were available for only 22 states. Unadjusted prevalence estimates were calculated to examine uninsurance—that is, lack of health care coverage—over time by sociodemographic characteristic and state to provide background about the population being examined. Logistic regression models were created to examine adjusted prevalence estimates (predicted marginals) of uninsurance over time by mutually exclusive category of frequent physical and mental distress status adjusted for sex, age, race or ethnicity, and educational status. Further analyses examined the adjusted prevalence estimates of uninsurance over four time periods by frequent mental distress status, individual sociodemographic characteristic, and individual state. SUDAAN software was used for all analyses to account for BRFSS's complex survey design.

Results

Uninsurance by year and sociodemographic characteristic

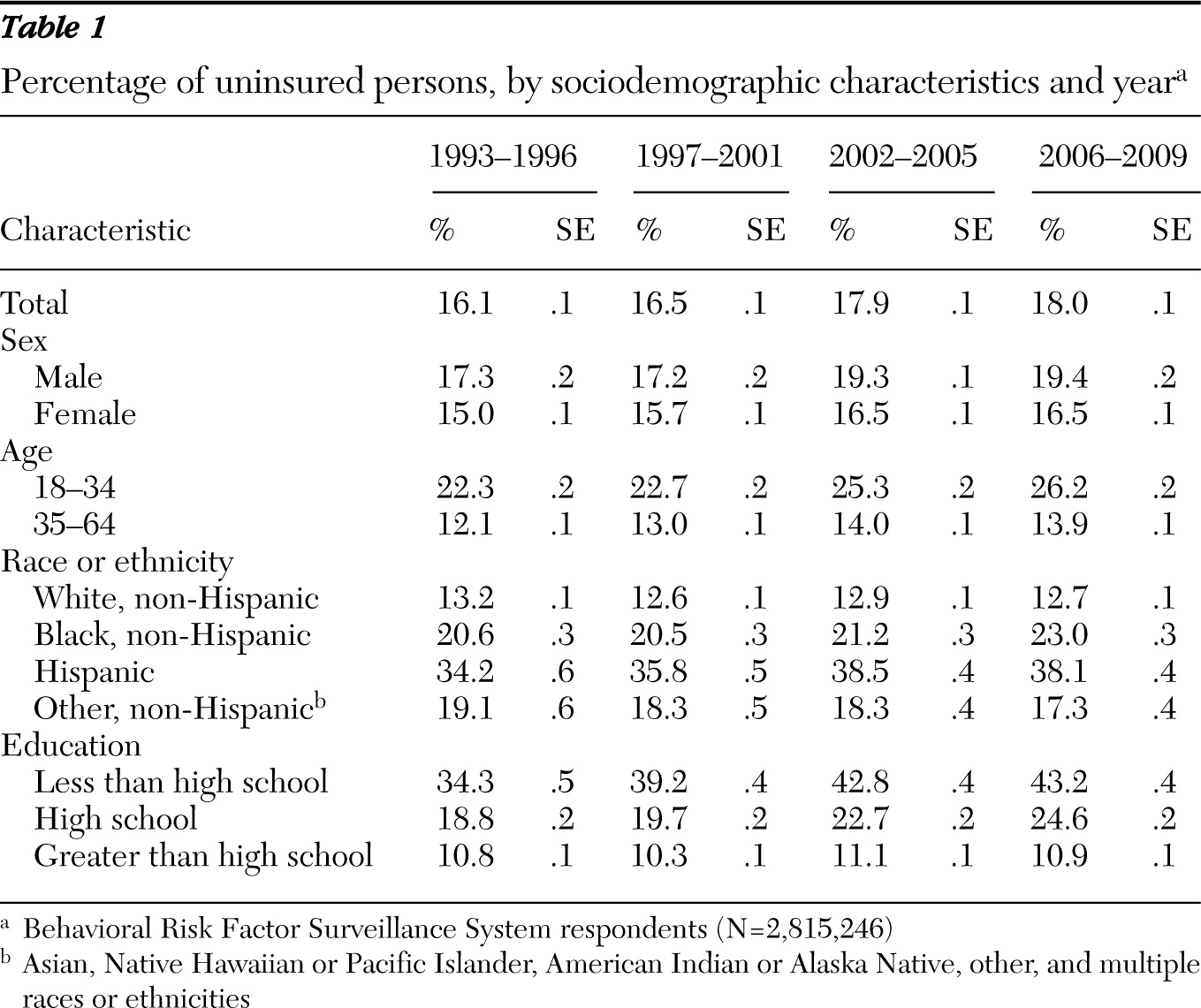

The proportion of nonelderly uninsured adults increased significantly over time, from 16.1% (95% confidence interval [CI]=15.9–16.3) in 1993–1996 to 18.0% (CI=17.8–18.2) in 2006–2009 (

Table 1). Throughout this time, a higher proportion of males (versus females), younger adults (versus older adults), Hispanics (versus all other racial and ethnic groups), and persons with less than a high school education (versus high school graduates and those with at least some college or technical school education) were uninsured.

Uninsurance by state and year

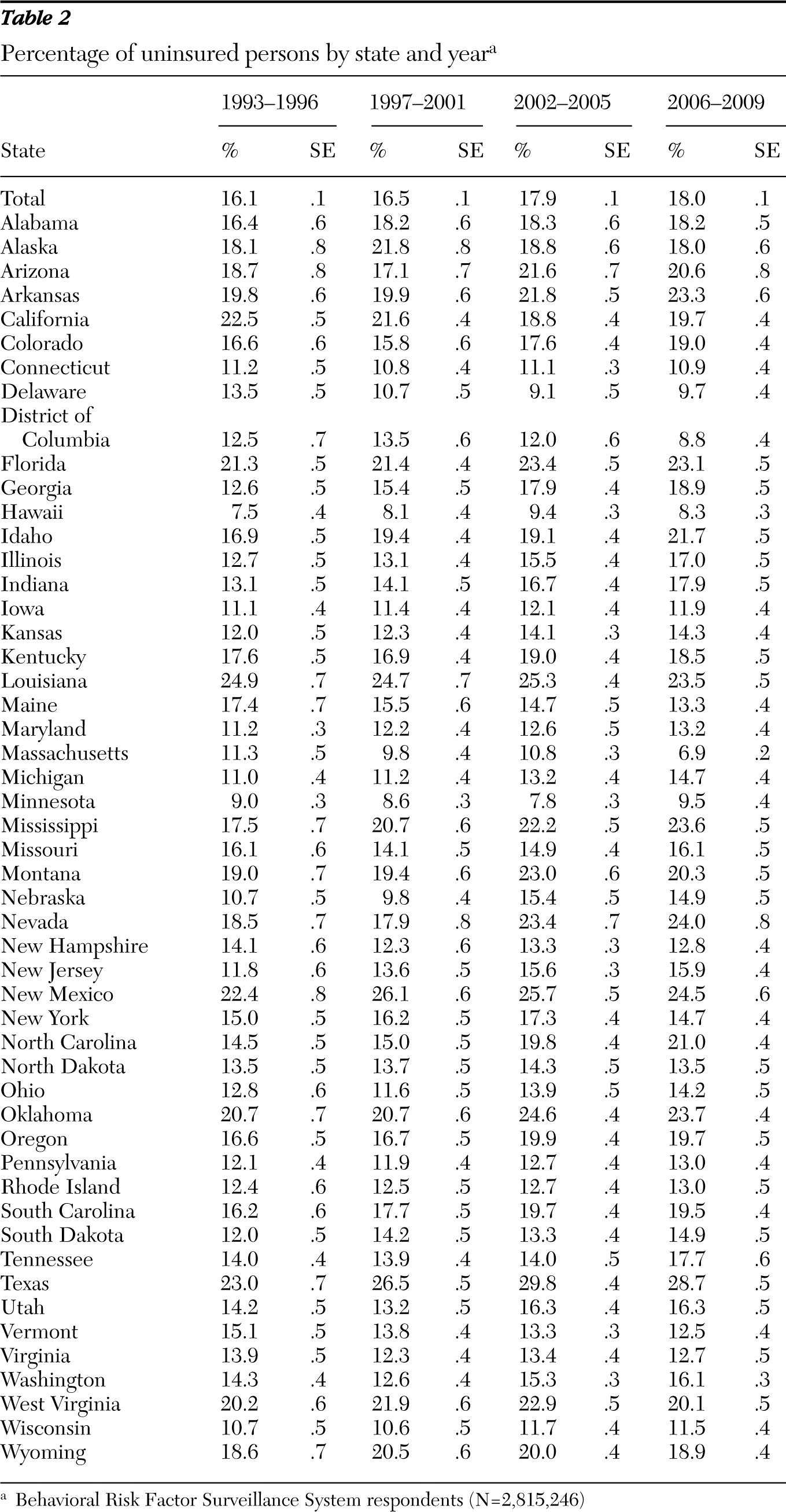

The proportion of nonelderly uninsured adults also varied over time by state (

Table 2). The proportion of uninsured significantly increased between the time periods 1993–1996 and 2006–2009 in Arkansas, Colorado, Georgia, Idaho, Illinois, Indiana, Kansas, Maryland, Michigan, Mississippi, Nebraska, Nevada, New Jersey, North Carolina, Oklahoma, Oregon, South Carolina, South Dakota, Tennessee, Texas, Utah, and Washington. The proportion of uninsured significantly decreased during the same period in California, Delaware, the District of Columbia (Washington, D.C.), Maine, Massachusetts, and Vermont.

Uninsurance by mental and physical distress and year

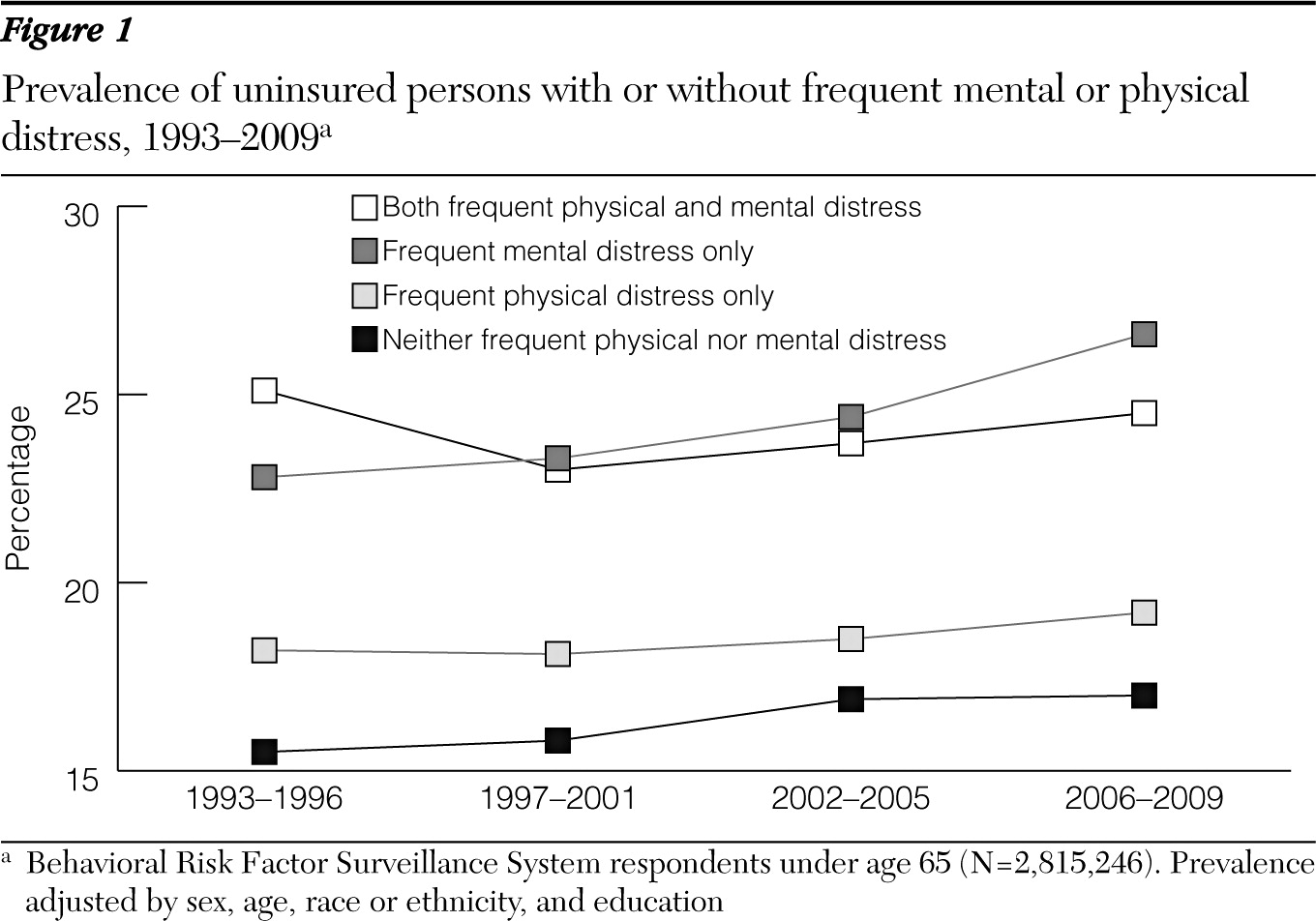

Overall between 1993 and 2009, after adjustment for sex, age, race and ethnicity, and educational attainment, nonelderly adults with neither frequent mental distress nor frequent physical distress were least likely to be uninsured (16.6%; 16.4%–16.8%), followed by those with frequent physical distress only (17.7%; 17.3%–18.1%), those with both frequent mental distress and frequent physical distress (21.8%; 21.2%–22.4%), and those with frequent mental distress only (22.6%; 22.2%–23.0%). The prevalence of uninsurance remained fairly consistent over time among those with frequent physical distress only and those with both frequent mental distress and frequent physical distress. However, it increased significantly between 1993–1996 and 2006–2009, from 15.5% (CI=15.3%–15.8%) to 17.0% (CI=16.8%–17.2%), among those with neither frequent mental distress nor frequent physical distress and from 22.8% (CI=21.8%–23.7%) to 26.6% (CI=25.9%–27.3%) among those with frequent mental distress only (

Figure 1).

Given that the uninsurance estimates for the categories of frequent mental distress and both frequent physical distress and frequent mental distress were very similar and significantly higher than for the categories of frequent physical distress only and neither frequent physical nor mental distress, the four categories were collapsed into two groups—persons with frequent mental distress and persons with no frequent mental distress—for the remaining analysis.

Uninsurance by mental distress, characteristics, and year

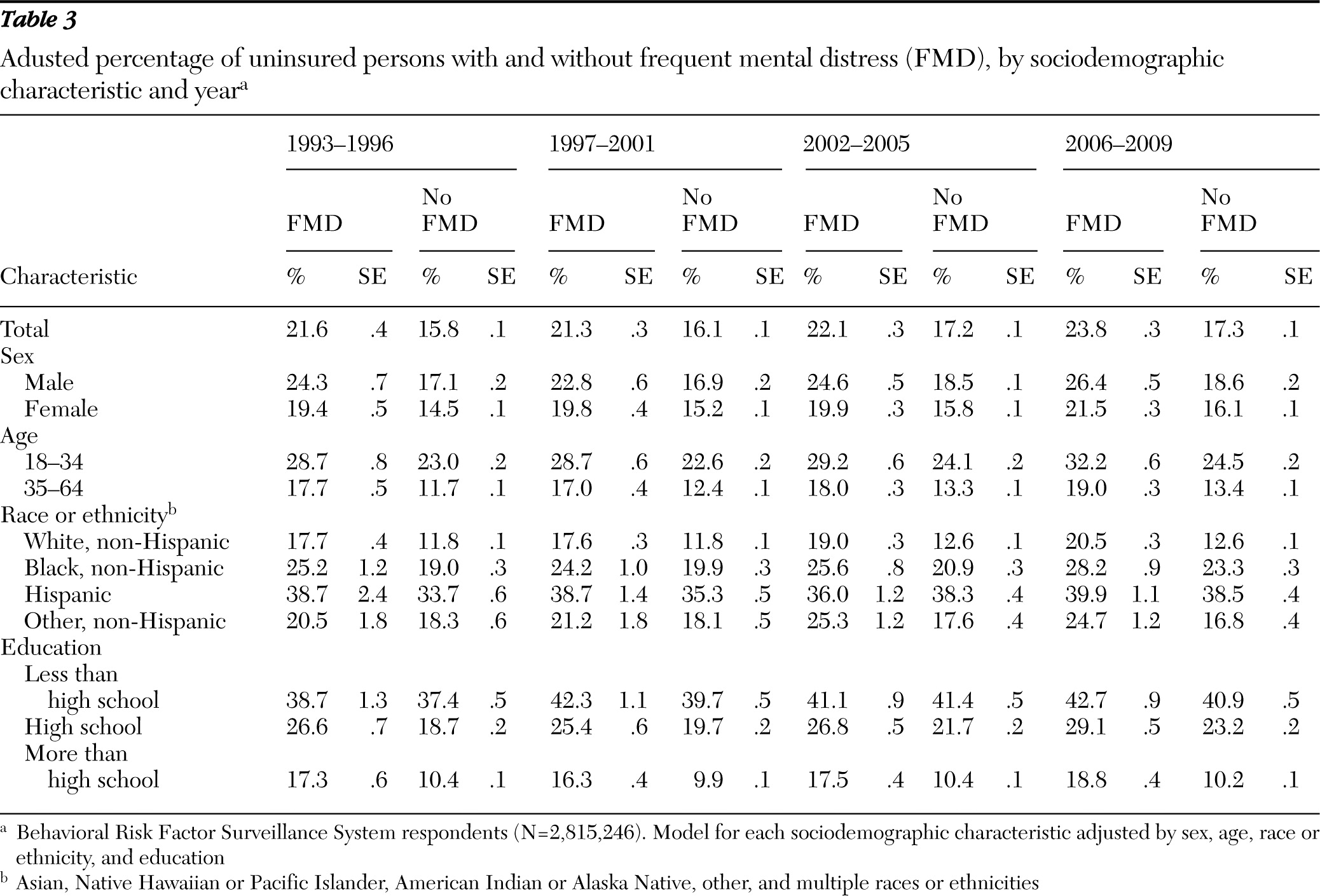

Overall, after adjustment for sex, age, race and ethnicity, and educational attainment, the prevalence of nonelderly uninsured adults increased significantly between the time periods 1993–1996 and 2006–2009 among those with frequent mental distress, from 21.6% (CI=20.8%–22.5%) to 23.8% (CI=23.3%–24.4%). Among persons with frequent mental distress, significant increases in uninsurance between the two time periods were found for females (19.4%, CI=18.4%–20.4%, to 21.5%, CI=20.9%–22.1%), those aged 18 to 34 years (28.7%, CI=27.2%–30.1%, to 32.2%, CI=31.0%–33.5%), white non-Hispanics (17.7%, CI=16.9%–18.5%, to 20.5%, CI=20.0%–21.0%), and persons with a high school education (26.6%, CI=25.2%–27.9%, to 29.1%, CI=28.1%–30.1%) (

Table 3).

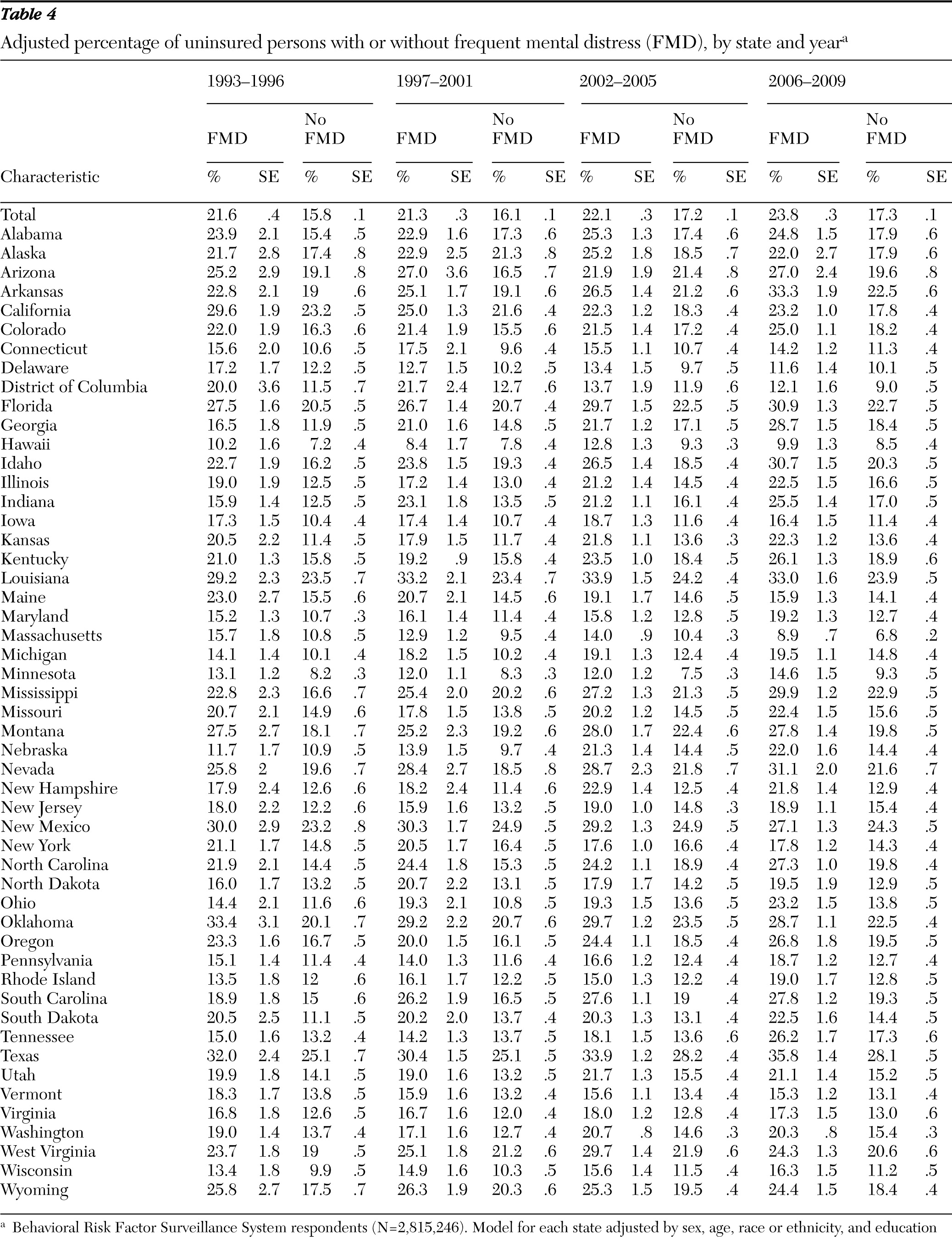

Uninsurance by mental distress, state, and year

After adjustment for sex, age, race and ethnicity, and educational attainment, there was a significant increase in nonelderly uninsured adults with frequent mental distress between the time periods 1993–1996 and 2006–2009 in Arkansas (from 22.8% to 33.3%), Georgia (16.5% to 28.7%), Idaho (22.7% to 30.7%), Indiana (15.9% to 25.5%), Michigan (14.1% to 19.5%), Mississippi (22.8% to 29.9%), Nebraska (11.7% to 22.0%), Ohio (14.4% to 23.2%), South Carolina (18.9% to 27.8%), and Tennessee (15.0% to 26.2%). Notably, there was a significant decrease in uninsurance over the same time period for people with frequent mental distress in California (29.6% to 23.2%) and Massachusetts (15.7% to 8.9%) (

Table 4).

Discussion

This research contained several noteworthy findings. First, even after adjustment for sociodemographic characteristics, uninsurance among adults aged 18 to 64 years was markedly higher among those with frequent mental distress only and those with both frequent mental distress and frequent physical distress than among those with frequent physical distress only. Second, the prevalence of uninsurance did not differ markedly between those with only frequent mental distress and those with both frequent mental distress and frequent physical distress, suggesting that frequent mental distress may be the driving factor in the prevalence of uninsurance in this population. Finally, the prevalence of uninsurance among those with frequent mental distress only and those with neither frequent mental distress nor frequent physical distress increased significantly over time.

Sociodemographic characteristics play a critical role in one's ability to obtain insurance (

25). Uninsured adults have less access to recommended care, receive poorer quality of care, and experience worse health outcomes than insured adults (

9). In this study, among those with frequent mental distress, 40% of adults with less than a high school education and more than 25% of minority populations (more than 25% of non-Hispanic blacks and 35% of Hispanics) were uninsured. According to the National Survey on Drug Use and Health, 79% of uninsured adults with mental illness or substance abuse who reported that they needed treatment indicated that they could not obtain it because of cost (

26). Moreover, many persons with mental illness report incomes 200% below the federal poverty level (FPL) (

27). Among persons 100% to 200% below the FPL who have mental illness or substance use disorders, approximately one-third lack public or private insurance (

26).

Populations with expectations of high health care costs—such as those with chronic physical or mental illnesses—are more likely to attempt to purchase insurance than those with low risk, such as young healthy adults. However, insurance companies are more likely to deny coverage to these high-risk populations (

28). Persons with mental illness are disproportionately denied insurance because of preexisting conditions (

11) and according to our study the gap in coverage between those with and without mental distress is increasing over time. Our research indicated that even after adjustment for sociodemographic characteristics, the prevalence of uninsurance among those with frequent mental distress only and both frequent mental distress and frequent physical distress was significantly higher than among those with frequent physical distress only. Moreover, our results indicated that healthy young adults, persons without frequent mental or physical distress, increasingly have chosen to opt out of buying health insurance.

Our study had several limitations. First, the BRFSS may underestimate the burden of physical and mental distress because it excludes those without land-line telephones and those unable to answer the phone because of impaired physical or mental health. Second, BRFSS is based on self-reported data, and biases in reporting health insurance coverage and number of physically and mentally unhealthy days in the past 30 days may have occurred. Third, because BRFSS data about physical and mental distress for 2002 were available for only 22 states, the results for that year may not be representative of the entire country. Finally, because BRFSS data are cross-sectional, whether the lack of health insurance coverage affected or resulted from physical distress, mental distress, or both is uncertain. In other words, persons with frequent physical or mental distress or both may not seek health insurance coverage or may be denied insurance because of a preexisting condition, or people who cannot afford insurance may be more likely to subsequently develop frequent distress.

Conclusions

Given the disproportionately high rate of uninsurance among nonelderly adults with frequent mental distress, it will be important to monitor potential changes in health care access, utilization, and self-reported health after implementation of the ACA, particularly among those with mental illness.

Acknowledgments and disclosures

The authors report no competing interests.