The MHPAEA represents a new era for coverage of behavioral health conditions. It is substantially more comprehensive than the previous federal parity law and considerably stronger than most state parity laws. The MHPAEA requires plans that cover mental health and substance abuse services to offer benefits for those services at the same level as benefits for medical-surgical services. In other words, the law forbids health plans from employing “quantitative” treatment limitations (such as visit and spending limitations for behavioral health services) that are more restrictive than those offered for physical health services. Furthermore, the MHPAEA disallows the use of “nonquantitative” treatment limitations that affect the scope or duration of benefits for treatment and that apply to behavioral health but not physical health services.

Previous studies have consistently demonstrated that parity, coupled with differential management of the behavioral health benefits, can be implemented without large increases in the cost of behavioral health services (

6–

11). In fact, when parity was introduced in the Federal Employees Health Benefits Program in 2001, the Office of Personnel Management encouraged its health plans to implement mental health carve-outs (separate management of the behavioral health benefit by a specialty organization) and to increase utilization management in anticipation of cost increases (

8). Implementation of the MHPAEA is most clearly differentiated from previous parity implementations because the regulations restrict the use of the very nonquantitative treatment limits that many believe are responsible for containing behavioral health costs (

12). It is unclear whether behavioral health parity will lead to higher costs if behavioral health services are not allowed to be managed differently than medical-surgical services.

In this study, we examined the effects of Oregon's 2007 comprehensive state parity law. Oregon's law is one of the most comprehensive state parity laws, broadly defining mental health, including alcohol and substance abuse, and including no small business exemptions (

Table 1). The Oregon law is particularly noteworthy—and parallels the MHPAEA—in its restrictions that disallow the differential use of nonquantitative treatment limitations in benefit management. Thus, the Oregon law is of particular relevance in considering the effects the MHPAEA might have. Presumably, if Oregon's parity implementation has led to substantial increases in behavioral health service expenditures, we could argue in favor of differential management of the behavioral health benefits. However, if comprehensive parity, coupled with the same management applied to medical-surgical benefits, has had a negligible effect on expenditures in Oregon, then differential management may not be necessary. In this case, there may not be a strong economic argument against the restrictions on nonquantitative treatment limitations found in the regulations implementing the MHPAEA.

Method

The Oregon parity law went into effect on January 1, 2007. The statute contained a broad definition of mental health and addiction, including almost all disorders in DSM-IV-TR. This moved Oregon from a group of seven states with minimal parity mandates into a select group of two states with the most comprehensive parity law in the country (the other being Vermont). Parity applied to in- and out-of-network providers. The Oregon Insurance Division interpreted the statute to mean that managed care tools such as “selectively contracted panels of providers, health policy benefit differential designs, preadmission screening, prior authorization, case management, utilization review, or other mechanisms designed to limit eligible expenses to treatment that is medically necessary” could not be used in behavioral health management unless there was an analogue in the management of medical-surgical benefits (

13).

The Oregon parity law applied to about 70% of individuals in commercially insured group health plans in Oregon. The other 30% of individuals in group plans were in self-insured plans, in which the employer contracts with a health plan to administer the benefits but the employer assumes financial risk for the payment of all claims. These self-insured plans are exempt from state insurance laws as part of the Employee and Retirement Income Security Act of 1974.

We studied the expenditures and utilization of enrollees between the ages of 4 and 64 who were continuously enrolled in one of four preferred provider organization (PPO) health plans affected by the 2007 Oregon parity law. We examined changes in access, out-of-pocket spending, and total spending on mental health and substance abuse services. To account for changes over time that were unrelated to the parity law, we used a comparison group of individuals who were continuously enrolled in self-insured commercial PPO plans in Oregon.

Data Collection

Using an adaptation of the semistructured interview schedule developed for the evaluation of parity in the Federal Employees Health Benefits Program (

8), we collected information on benefit design and management from structured on-site interviews with key informants at each of the four PPO plans. In addition, we collected data on a variety of nonquantitative treatment limitations that are common to both the Oregon regulations and the MHPAEA, including prior authorization, the use of treatment plans as a utilization management tool, and the use of carve-outs.

From each of the four PPOs, we obtained 4 years of data on enrollment and medical and pharmacy claims, including 2 years before and 2 years after the implementation of parity. We also obtained claims data from the Thomson Reuters' MarketScan database on a comparison cohort of individuals who were continuously enrolled in self-insured plans in Oregon.

We classified inpatient and outpatient services associated with specified mental health and substance use diagnoses and psychotropic medications as mental health and substance abuse services based on previous work (

8). Briefly, mental health and substance use diagnoses were defined as those with the ICD-9-CM diagnostic codes 291, 292, 295 through 309 (except 305.1 and 305.8) and codes 311 through 314. An inpatient visit was classified as behavioral health if it had a mental health or substance use primary diagnosis. An outpatient visit was classified as behavioral health if it had a mental health or substance use primary diagnosis or a procedure code specific to mental health and substance abuse care. To identify the use of psychotropic medications, we updated Goldman and colleagues' methodology (

8) to include psychotropic drugs released since 2001. The full list of psychotropic medications is available in the data supplement that accompanies the online edition of this article (Appendix A).

Statistical Analysis

We estimated the effect of the implementation of parity on spending and access using the difference-in-differences method. The difference-in-differences is the average difference in outcomes of interest among individuals in PPOs affected by parity minus the average difference (after the parity implementation) among those in the comparison group (individuals in self-insured plans who were not affected by the parity legislation). The first difference reflects changes in the outcome of interest (use or expenditures) that occur after the parity implementation. By subtracting the second difference—the changes that occur in the comparison group—we net out the secular changes that may have occurred for reasons not related to the parity law. Any remaining significant differences in outcome—the difference-in-differences—are attributed to the parity legislation.

To estimate the difference-in-differences model, we used a two-part model that accommodated two important characteristics of health care spending (

14). First, in any given year, many individuals will not have any behavioral health visits or expenditures. Thus, our dependent variable will have a large cluster of observations at zero. Second, among individuals who do use behavioral health care, the distribution tends to be skewed, with a small proportion of individuals having high levels of spending. After testing competing models, we settled on a two-part generalized linear model using a log link and gamma variance distribution to estimate the relation between spending on mental health and substance abuse treatment and parity (

15). We estimate the probability of any use of mental health and substance abuse services (part one of the two-part model) and total spending for mental health and substance abuse services (which combines part one and part two of the two-part model). We used bootstrapping clustered at the individual level to generate 95% confidence intervals (CIs) that account for correlation among repeated annual observations.

Our unit of observation was the person-year. There were four observations for each individual: 2 years before and 2 years after the implementation of parity. In our regressions, we adjusted for age, gender, the person's relationship to the policyholder (self, child, or spouse), and a marker for rural or urban residence (

16). The key variables of interest were an indicator variable assigned a value of 1 for the postparity period and zero for the preparity period, an indicator variable assigned a value of 1 for individuals in plans affected by parity (i.e., not in a self-insured plan) and zero for the self-insured comparison group, and the interaction of the two indicator variables. We conducted analyses on each of the four plans separately as well as an analysis that pooled all four plans, and we used the self-insured individuals as a comparison group in all analyses.

In addition to the analyses of the population as a whole, we also conducted a subanalysis of the effect of parity on children (ages ≤18).

Results

Detailed information on benefit limits and management for the four PPOs are summarized in

Table 2. Whereas previous studies of parity have shown an increase in the use of management techniques such as prior authorization and treatment plans (

8,

9), in Oregon the use of these methods either stayed constant or declined. Among the four plans we studied, none required preauthorization for outpatient mental health or substance abuse services after the implementation of parity. Only two of the four PPOs required treatment plans (a written plan describing goals, methods, and anticipated time for treatment) for outpatient mental health services, and only one PPO required treatment plans for outpatient substance abuse services. Nonetheless, there was considerable variation in the extent to which plans attempted to manage the behavioral health benefits, and compliance and interpretation of the parity law were inconsistent across plans.

Table 3 summarizes descriptive data on individuals in the four PPOs and in the self-insured comparison group. While there are some statistically significant differences in the population (e.g., individuals in the self-insured group were more likely to be female and less likely to be the policyholder; individuals in plan C were less likely to be located in rural areas), the intervention and comparison subjects were fairly comparable overall and exhibited a similar prevalence of behavioral health diagnoses.

Table 4 reports rates of use of mental health and substance abuse services and spending for service users. For all plans, the rates of use and spending increased during the study period.

Table 4 also reports difference-in-differences estimates for the probability of use of mental health and substance abuse services and for spending on such services. After accounting for secular trends, the overall estimate of the effect of parity on total behavioral health spending was moderate, ranging from $12 to $26, and did not differ significantly from zero. Furthermore, the increases in spending were not necessarily smaller for plans that required treatment plans or carved out behavioral health care. The largest point estimate increase was for plan D ($25.49), which used a carve-out and required treatment plans after eight visits. The final row in

Table 4 displays results from the analysis that pooled plans A, B, C, and D. The point estimate of the effect of parity in the pooled analysis (using 100,328 individuals subject to parity and 19,634 individuals in self-insured plans for comparison) was $15.15 and was not significantly different from zero (95% CI=–$1.58 to $31.25).

Table 5 reports rates of use of mental health and substance abuse services and difference-in-differences estimates of the effect of parity on children. Compared with the population as a whole, children are much less likely to use mental health services (their probability of accessing care is almost half that of the general population). Their expenditures are higher once they have accessed care, however, so average spending per child beneficiary is relatively close to the average spending per adult. In the difference-in-differences analyses, point estimates for total change in spending after parity are higher for children than for the general population (change in spending estimates for children range from +$15.25 to +$36.62, and from +$12.15 to +$25.49 in the general population). In the analyses of children, however, no plan demonstrates a statistically significant increase in spending. Separate analyses for adults (provided in the online data supplement) demonstrate similar findings, with the effect of parity change in spending estimates for adults ranging from +$12.02 to +$26.29, with none statistically significant.

Oregon's parity law also required that coinsurance, copayments, and deductibles be identical for behavioral health and medical-surgical care, although this policy had been the de facto practice for most health plans.

Table 6 summarizes the effects of parity on out-of-pocket spending by users of mental health and substance abuse services. In two of the four plans, parity was associated with a small but statistically significant decrease in out-of-pocket spending (plans A and B). One plan (plan D) demonstrated a small but statistically significant increase in out-of-pocket spending. This increase reflected an overall trend in higher deductibles and cost sharing that was introduced throughout plan D's insurance offerings.

Sensitivity Analyses

We also estimated our difference-in-differences models using propensity score weighting on patients' demographic characteristics and behavioral health risk adjusters (

17). The results from this approach were qualitatively similar to those results from the difference-in-differences models without the propensity score model. Thus, the small differences in population characteristics displayed in

Table 3 do not appear to be confounding the estimates of the effect of parity on behavioral health spending. The details of these analyses, along with other analyses that investigate the adequacy of the comparison group and provide additional information on the context of the Oregon parity law, are included in the online data supplement.

Discussion

This study is the first to examine a parity implementation that restricted nonquantitative treatment limitations, which is the approach that has been favored in the MHPAEA. The Oregon Insurance Division actively interpreted the statute to mean that behavioral health benefits could not be managed in a way that was different from medical-surgical benefits. Our results suggest that this form of parity did not result in substantially larger increases in expenditures for mental health and substance abuse services than those observed in a comparison group of privately insured individuals not subject to the parity law.

The point estimate for the change in spending in our four PPO plans was positive and ranged between $12 and $26, and none differed significantly from zero. One possible explanation for this negative finding is that our evaluation lacked the necessary power to show a statistically significant effect; however, the pooled analysis (using 100,328 individuals covered by parity) was not significantly different from zero.

Parity primarily affects a relatively small group of individuals who need additional outpatient treatment. The added expense of outpatient treatment may thus be relatively small when compared with the overall year-to-year spending for inpatient care and prescription drugs for mental health and substance abuse services. The lack of a significant increase in expenditures may also be related to plans' preparity approach to the quantitative limits. During our structured interviews with representatives of health plans, several informants indicated that quantitative limitations were not 100% binding and exceptions could be made. These exceptions could occur with providers who were in the plan's behavioral health network and would be managed and observed closely. According to these health plans, before parity, there was never any exception for providers who were out of network.

Table 7 provides some indication of the exceptions that some plans made to their visit limitations before parity implementation. (Our estimate is likely biased upward because health plans may have differentiated between different types of outpatient behavioral health visits.) In general, approximately 5% of patients with any behavioral health visit exceeded the specified limits of that plan. The apparent flexibility in these limits prior to the parity law may be one reason that the implementation of parity did not lead to large increases in spending.

Our negative findings suggest that the impact of federal parity on total health care spending could be relatively small. Overall, behavioral health expenditures are a small portion of total health care spending. In our study, expenditures for mental health and substance abuse services accounted for approximately 6.0% to 7.4% of total expenditures, depending on the health plan. An increase in behavioral health spending of $25 (the largest point estimate in our study) would be equivalent to a 1.0% increase in total spending. Thus, even if parity did result in statistically significant expenditures that our study was not powered to detect, the impact on the total premium would still be relatively modest.

While many observers believe that managing behavioral health services is beneficial for patients, some have described the partnering of parity and managed care as “a Faustian bargain”: undesirable but necessary to keep costs in check (

18). The Oregon experience suggests that the Faustian bargain may not be necessary; that is, it may be possible to remove visit limitations without imposing onerous managed care utilization methods on behavioral health services. However, this does not mean that

no managed care would be optimal. Oregon's commercial health plans continued to use traditional managed care tools to control costs and utilization. The distinction enforced by the Oregon Insurance Division was that health plans were not allowed to differentially manage behavioral health services.

Our study has several limitations that should be noted. In our quasi-experimental design, our comparison group consisted of individuals in Oregon who had commercial insurance and whose employers were self-insured and thus not affected by Oregon's parity law. There is a risk that this was not the appropriate comparison group or that this choice did not adequately control for secular trends. However, it is reassuring that individuals from the self-insured plans generally had similar demographic and spending characteristics and were located in the same geographical and service areas. Our negative findings could also be attributed to statewide changes in the ways that providers cared for all of their patients after parity was implemented. For example, providers may have been confused or unable to discern which patients were covered by the parity statute and which were not and may have recommended additional visits for their entire patient population. If this were the case, it might mask the increases in spending attributable to parity because the comparison group was also receiving more intensive treatment.

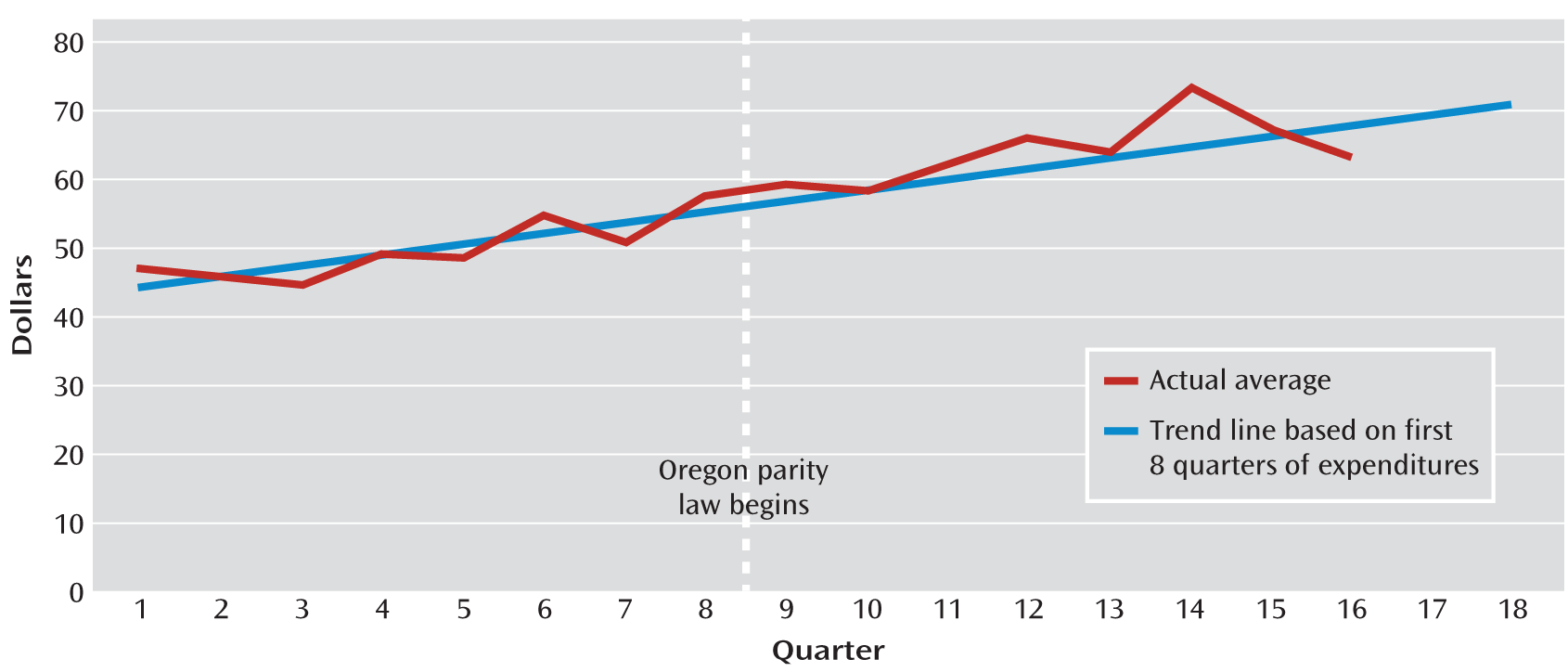

However, close inspection of the self-insured data did not reveal discrete changes in spending after implementation of the Oregon parity law. Rather, spending in the comparison group followed a relatively smooth linear time trend over the 4-year study period.

Figure 1 displays the average quarterly spending for our self-insured group compared with a linear trend forecast based on the first eight quarters (before parity) of spending. These data do not suggest any large changes in spending that coincided with the implementation of the Oregon parity law. Additional evidence to support our comparison group is provided in the online data supplement.

This study is also limited in its analysis of only four PPO plans in Oregon. While these plans represented the majority of the non-self-insured commercial market, they may not be representative of other commercial plans in Oregon or commercial plans throughout the United States. Although we conducted extensive interviews with key informants in each of those plans and documented their management practices, there may be unobserved factors in our four study plans that allowed them to keep costs in check (e.g., cooperative relationships with providers).

It is also possible that other nonquantitative treatment limitations were responsible for controlling costs. We focused our attention on the same set of utilization management techniques that were studied in the Federal Employees Health Benefits Program (

19) and in a recent survey of 368 commercial health plans (

20); however, there may have been other relevant indicators that we did not study. Furthermore, we examined whether health plans had certain utilization management policies but not how strict plans were in applying them. These data are difficult to obtain and beyond the scope of this study.

This study covered 2 years of preparity and 2 years of postparity observations. While we would expect that this time frame would be adequate to capture changes in patient behavior, it may not be long enough to capture changes in provider behavior. In particular, if providers see parity laws as an opportunity to expand business and services, they may invest in infrastructure and facilities that could have longer-term consequences for the costs of treating behavioral health disorders.

Certain aspects of Oregon's insurance market and health care delivery system may not be generalizable to other parts of the country. Oregon is generally considered to have a competitive insurance market. At least seven Oregon-based health plans participate in the non-self-insured group market, with the largest plan capturing only 31% of that market (

21). The state has the authority to review proposed rate increases and to regulate health plans for financial solvency, policy form approval, and consumer protection (

21). There are undoubtedly differences in the health care markets across states that might affect the generalizability of our findings. In particular, psychiatric inpatient beds are generally considered highly constrained in Oregon, which may have limited increases in inpatient use after implementation of parity.

Our findings may presage the results that health plans around the country will obtain after federal parity is implemented. The Oregon experience suggests that management of behavioral health benefits does not necessarily need to be different from management of medical-surgical benefits in order to control costs after the federal parity law goes into place. This does not mean that no management is optimal; however, given the widespread and broad-based nature of the federal law, we need a greater understanding of the types of benefit management that are best at controlling costs and improving quality in order to reap the greatest advantages from the opportunity offered by a national parity law.