Evidence from the United States and other countries has accumulated showing that people can have significantly improved outcomes when they receive timely and comprehensive care during the first episode of psychosis, which typically occurs before age 30 (

1,

2). Yet, new treatment approaches can be valuable only if people have access to comprehensive services, and insurance status may determine access to optimally effective care for those with first-episode psychosis (FEP) (

1). Uninsurance has been associated with a lower likelihood of receiving mental health care prior to a first hospital admission for psychosis (

3) and with significantly longer durations of untreated psychosis (

4).

Type of insurance coverage and insurance continuity may also matter. Patterns of outpatient treatment prior to a first hospital admission for psychosis differ between those with private and public insurance (

3). Features of insurance plans, such as levels of cost-sharing and restrictiveness of drug formulary design, can impair access to effective treatment for psychosis (

5–

7). Additionally, certain elements of evidence-based care for early psychosis (e.g., supported employment) are infrequently covered by private insurance (

8). Different mental health providers accept different types of insurance (

9), so changes in insurance coverage can also affect the likelihood of experiencing unmet needs for schizophrenia care (

10). In general, greater continuity in health insurance coverage is correlated with better access to care (

11), and insurance disruptions are associated with reductions in office-based services (

12).

Several factors influence insurance status during young adulthood, when psychosis typically emerges. The Affordable Care Act (ACA) allows people to stay on their parents’ private insurance plan until age 26, at which point young adults face a transition point for losing private insurance (

13). Medicaid is another important source of insurance for teenagers, but child eligibility ends at age 18 or 21, depending on the state, and adult eligibility varies broadly. Emerging psychosis could complicate insurance status for young adults. Symptoms may interfere with the ability to hold a job or maintain student status, which could jeopardize one’s employment-related insurance. Young adults with psychosis could also access public insurance by applying for Supplemental Security Income (SSI) or Social Security Disability Insurance (SSDI). SSI generally enables Medicaid eligibility and in most states is linked with automatic Medicaid eligibility. However, emerging psychosis may not meet the disability severity or chronicity criteria for SSI eligibility. SSDI grants Medicare eligibility only after a 12- to 24-month waiting period.

Little is known about patterns of insurance status and insurance transitions among young adults with emerging psychosis who are beginning treatment, partly because it is difficult to definitively identify emerging psychosis in available administrative or claims data sources. One study examined insurance transitions for 48 participants in a trial of early psychosis treatment in Connecticut, finding that insurance disruptions were common during the first 12 months of the study (

14). In this article, we use data from the landmark RAISE-ETP (Recovery After an Initial Schizophrenia Episode–Early Treatment Program) trial to describe insurance coverage and insurance transitions for young adults newly diagnosed as having FEP. The RAISE-ETP trial is unique in that data are from multiple sites and the inclusion requirements for the study ensure that the participants were newly diagnosed during a first episode of psychosis and are receiving initial or early treatment. With the exception of supported employment and education, the trial did not fund any treatments; thus, pressure to obtain or maintain insurance coverage was important in much the same way as in usual care.

Our objective in this secondary analysis was to describe the distribution of insurance status (i.e., private, public, or no insurance) at program entry in the RAISE-ETP sample, to compare this distribution with nationally representative data of young adults of similar ages, and to identify clinical and sociodemographic correlates of insurance status and transitions.

Methods

Data

The main data for our analyses were from the RAISE-ETP study, a cluster-randomized clinical trial, which found that comprehensive coordinated care (specifically, the NAVIGATE model) led to significant improvements in quality of life, psychosis symptoms, treatment engagement, and participation in education or work activities compared with typical community care (

15–

17). The RAISE-ETP study included 404 patients who received care from 34 nonacademic community mental health centers located in 21 states across the United States. The study included people ages 15–51 who met criteria for a psychotic illness in no more than one discrete psychotic episode (

18). Participants had less than 6 months of cumulative exposure to antipsychotics, indicating proximity to first treatment. The average age of participants at the start of the study was 23 years old. Study enrollment occurred between July 2010 and July 2012, and data collection continued through July 2014 (

18). Written informed consent was obtained from adult participants and from legal guardians of participants under age 18. The institutional review boards (IRBs) of the coordinating center and of each site approved the study. The National Institute of Mental Health data and safety monitoring board provided oversight, and the U.S. Department of Veterans Affairs (VA) Connecticut Healthcare System provided additional IRB approval for secondary analyses. The RAISE-ETP study largely occurred before most major ACA provisions (i.e., Medicaid expansions and insurance exchanges) went into effect in 2014. An advantage of using these data was that participants were interviewed at baseline and then regularly over the 2-year study period. Self-reported health insurance status was documented at baseline and then quarterly throughout the 2-year study period. Participants were asked about their health insurance status and whether they were currently uninsured or were covered by private health insurance, Medicaid, Medicare, the State Children’s Health Insurance Program (SCHIP), or the VA.

We used the baseline RAISE-ETP information along with the quarterly assessment information for only the first 12 months of the study to minimize the occurrence of missing assessment data, which became more of a problem after the first 12 months of the study. We limited the analysis to the 288 participants with nonmissing information on baseline insurance status and with nonmissing information on insurance status at the 12-month, 15-month, or 18-month assessment. We used the 12-month assessment data for the 253 participants for whom the data were available. For those with missing 12-month insurance data, we used the 15-month data (N=15), and if the 15-month data were missing, we used the 18-month data (N=18). The RAISE-ETP participants who were excluded from our analytic sample were similar to the participants we selected in terms of demographic characteristics but had somewhat longer average duration of untreated psychosis (DUP), had worse symptoms and quality of life, and were more likely to be in the RAISE-ETP community care comparison group (see Appendix Table 1 in the online supplement to this article).

To simplify the description of insurance transitions, we created three mutually exclusive insurance status categories for both the baseline measurement and the 12-month measurement: private insurance, public insurance, or uninsured. Participants with private insurance were coded as having private insurance, regardless of whether they had another type of insurance at the same time. Only five RAISE-ETP participants reported both private and public insurance at baseline. Participants who reported having Medicaid, SCHIP, or Medicare (but no private insurance) were coded as having public insurance. Participants who did not report any type of private or public insurance were coded as uninsured.

We also sought to assess the degree to which insurance status and stability was similar between the RAISE-ETP sample and the general population of young adults in the United States. To make this comparison, we used 2011 Medical Expenditures Panel Study (MEPS) data. The MEPS is a nationally representative survey of the U.S. civilian noninstitutionalized population conducted by the Agency for Healthcare Research and Quality. Data are collected through an overlapping panel design. Each year a new panel of households is selected, and data for each panel are collected in five rounds of interviews that occur over 2.5 years (

19). Respondents are asked about insurance status on a monthly basis over those five interviews, although we only considered whether there was a change between January and December of 2011. To match the age and sex characteristics of the RAISE-ETP sample, we reweighted the MEPS data. Each unique group defined by age and sex was weighted by the number of times the age-sex cell appeared in the RAISE-ETP sample. To calculate the within-group mean of insurance variables, we used the MEPS sampling weights so that estimates would be nationally representative.

Analyses

First, we described the patterns of insurance status at baseline. Because we hoped to pool data from the RAISE-ETP study arms in subsequent analyses, we first evaluated the association between the treatment condition and the proportion of participants who obtained or changed insurance status between initial treatment and the following 12 months. We used a Cochran-Mantel-Haenszel test to evaluate the significance of differences between treatment groups in insurance status at 12 months, net of baseline status.

Second, we described the patterns of insurance status at baseline and the 12-month measurements in both the RAISE and the MEPS data. We then described insurance changes over the 12-month period. We also examined changes in disability program (SSI and SSDI) status over the 12-month period because of disability programs’ importance for public insurance eligibility.

Third, we assessed the independent correlates of baseline insurance status and predictors of transitions. We estimated a multivariate multinomial logistic regression model to assess correlates of baseline insurance status. Furthermore, we estimated multivariate logistic regression models of the likelihood of losing insurance (conditional on having it at the time of study entry) and of having any gap in coverage over 12 months. These models included the following sociodemographic variables, which were measured at baseline: age (15–17, 18–23, 24–25, 26–28, 29–32, ≥33), sex, race-ethnicity (non-Hispanic White, non-Hispanic Black, Hispanic or Latino, other), mother’s completed education (some or completed grade school, some high school, completed high school, some college or higher), whether currently employed or in school, and whether currently receiving disability benefits. These models also included three clinical predictor variables: DUP (above or below the median of 74 days), the Positive and Negative Symptoms Scale (higher scores indicate worse symptoms), and the Quality of Life Scale (QLS) (higher scores indicate better quality of life). Analyses were conducted with Stata, version 15.

Results

Impact of Coordinated Specialty Care

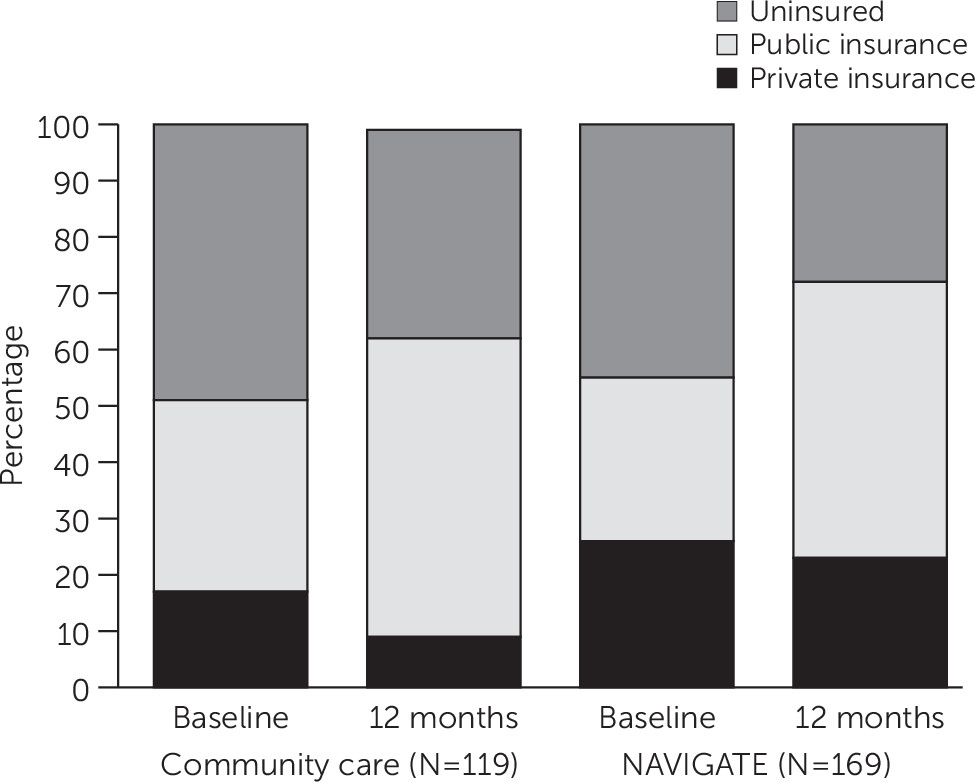

Comparison of insurance status by treatment group from baseline to 12-month assessment showed no significant difference in the changes in insurance status by treatment group (

Figure 1) (by Cochran-Mantel-Haenszel statistic). The NAVIGATE and community care control groups in the RAISE-ETP data were thus pooled in subsequent analyses.

Among participants in the RAISE-ETP sample at baseline (

Table 1), 64 people (22%) had private insurance, 90 people (31%) had public insurance, and 134 people (47%) were uninsured. In comparison, the MEPS sample of 18- to 28-year-olds had much higher levels of private insurance (N=2,332, 57%) and lower levels of both public insurance (N=1,158, 13%) and uninsurance (N=2,039, 29%) at baseline (

Figure 2).

Among those in the RAISE-ETP sample, 9% received disability benefits at baseline, and this proportion was higher for people with public insurance at baseline (

Table 1). Those with private insurance at baseline were more likely to have a shorter DUP at baseline than people with public insurance or no insurance. Non-Hispanic White people and people whose mother had higher educational attainment were more likely to have private insurance at baseline than were other racial-ethnic groups and people whose mother had lower educational attainment. Being a student or currently employed was also associated with a higher likelihood of having private insurance at baseline. Schizophrenia symptoms and quality-of-life measures at baseline were better for people with private insurance and worse for people who were uninsured.

Insurance Stability

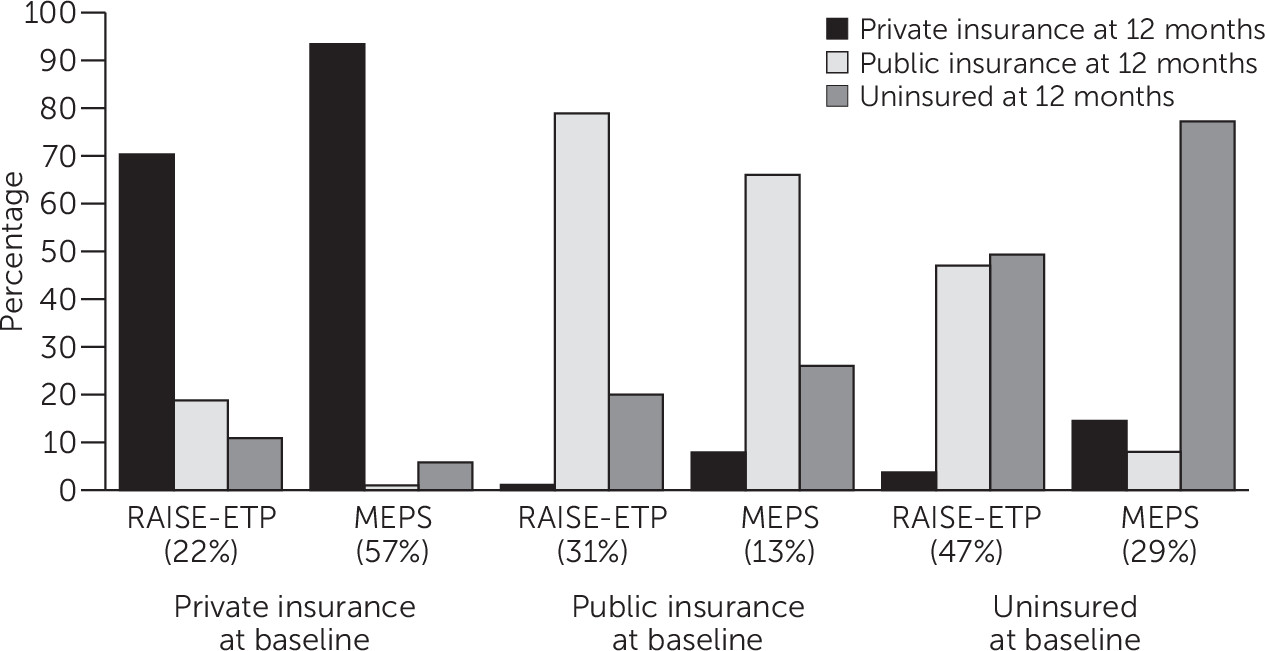

Among those in the RAISE study who had private insurance at baseline, 70% still had private insurance 12 months later, while 19% had public coverage 12 months later and 11% were uninsured 12 months later (

Figure 2). There was more insurance stability among those who had public insurance at baseline, with 79% still having public insurance 12 months later. Among those who started without insurance, nearly half gained public coverage and nearly half remained uninsured 12 months later.

In comparison, in the similarly aged MEPS sample, 93% of those who started the year with private insurance still had private insurance at the end of the year, while transitions to both public insurance and uninsurance were both infrequent and less common than in the RAISE-ETP sample (

Figure 2). Among those in the MEPS sample with public insurance at baseline, 66% also had public insurance 12 months later. However, insurance stability was very different among those who started the year without insurance in the MEPS sample compared with those in the RAISE-ETP sample. Individuals who started the year without insurance represented a smaller proportion of the MEPS sample than the RAISE-ETP sample; however, whereas about 50% of these participants remained insured at the end of the year in the RAISE-ETP sample, 77% remained uninsured in the MEPS sample.

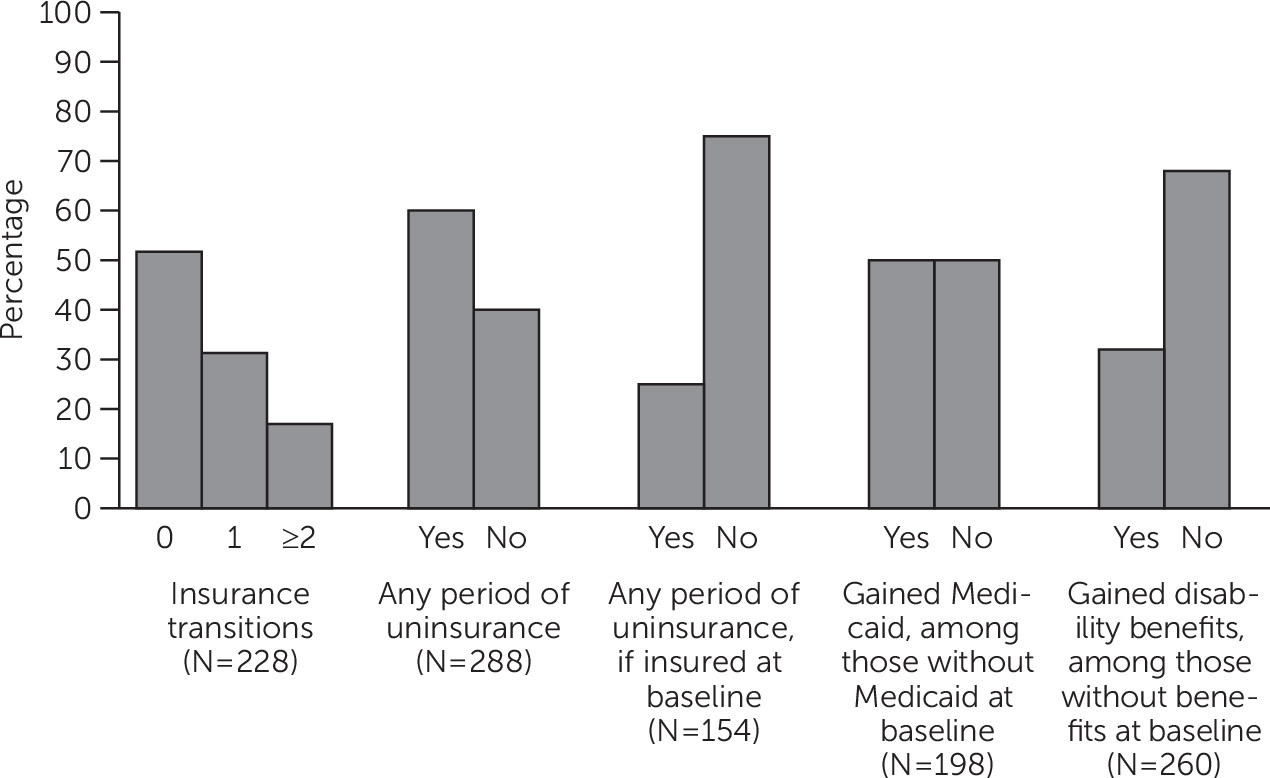

In

Figure 3, we describe insurance transitions in the RAISE-ETP sample in greater detail. Overall, 52% of the sample experienced no changes in their insurance status over 12 months, while 31% experienced one insurance change and 17% experienced two or more insurance changes. Sixty percent of the entire sample experienced uninsurance at some point over the 12-month study period. Among those who were insured at baseline, 25% had some period of uninsurance over the next 12 months.

Among those who did not have Medicaid at baseline, 43% gained Medicaid over the next 12 months and kept it once they obtained it, 8% gained Medicaid but did not keep it, and 50% remained without Medicaid. Some people gained disability benefits during the 12-month period. Among those comprising the 91% of the sample who did not have disability benefits at baseline, only 32% gained disability benefits over the 12-month period.

Predictors of Insurance Status and Insurance Changes

Few individual characteristics predicted baseline insurance status or changes in insurance status. Multivariate analysis of being uninsured at baseline (

Table 2) showed that people ages 24–28 were more likely to be uninsured at baseline, and people ages 26–32 were less likely to have private insurance at baseline, compared with people ages 18–23. Hispanics/Latinos were less likely to have private or public insurance at baseline, compared with non-Hispanic Whites. Higher mother’s educational attainment and currently being in school or working (i.e., higher functioning) were both correlated with a higher likelihood of private insurance and a lower likelihood of public insurance at baseline. A longer DUP was correlated with higher likelihood of having public insurance. Higher QLS scores and receiving disability benefits were both correlated with a higher likelihood of public insurance and a lower likelihood of uninsurance at baseline.

Age was the only characteristic that significantly predicted the likelihood of having any period of uninsurance over the next 12 months, among those with any insurance at baseline. Those ages 24–25 at baseline were more likely to have any period of uninsurance than those ages 18–23, and those ages ≥29 at baseline were less likely to have any period of uninsurance than those ages 18–23 (see Appendix Table 2 in the online supplement). Longer DUP was marginally and significantly associated with a higher likelihood of having any period of uninsurance. Being ages 24–28, being Hispanic/Latino, having a lower baseline QLS score, and not receiving disability benefits were associated with a higher likelihood of having any period of uninsurance over the study period among the full sample (see Appendix Table 3 in the online supplement).

Discussion and Conclusions

Receiving coordinated comprehensive care in the RAISE-ETP trial did not lead to statistically significant changes in insurance status over a 12-month period. Similar to prior research (

14), this study showed that many people experienced changes in their insurance status in the 12 months after using services for FEP. People with FEP had higher levels of uninsurance and public insurance than the general population and higher rates of transitioning to public insurance during a year after starting either with private insurance or no insurance. Additionally, we found much higher levels of uninsurance in the RAISE-ETP sample compared with a sample of 325 participants in the OnTrack study (

20). This finding may reflect the RAISE-ETP study’s sampling from public mental health clinics, where patients are disproportionately from lower socioeconomic backgrounds.

Prior research has found that type of insurance coverage may affect the type and amount of mental health services received (

3–

8). Private insurance status was relatively stable among RAISE-ETP participants, but private insurance may not cover the comprehensive set of services that represent the standard of care for early intervention. Public insurance, and Medicaid in particular, may offer better coverage of early intervention services than private insurance (

21). We found that once people in the RAISE-ETP study gained Medicaid, they were very likely to stay on Medicaid for the remainder of the year. This continuity may reflect the important role that disability programs like SSI play in providing Medicaid eligibility.

We found that people ages 24–25 at the study baseline were more likely to lose insurance coverage over the 12-month period. This finding could reflect the role of the ACA’s dependent coverage mandate, which went into effect in September 2010, only 3 months after the start of the RAISE-ETP study, allowing young adults to stay on their parents’ private insurance plan until they turn 26. Hispanics/Latinos were more likely to be uninsured at baseline than were members of other racial-ethnic groups, reflecting high rates of uninsurance nationally for Hispanics/Latinos (

22). We also found that people with FEP who have more highly educated mothers are more likely to have private insurance and less likely to have public insurance at baseline. More educated parents may be more likely to have private insurance or may have more resources to help obtain private insurance through other means. The relatively few predictors of insurance status and changes suggests that the mechanisms through which people with FEP obtain and maintain insurance coverage may not be sensitive to those who have the greatest needs. Disability benefit status is an important mechanism for obtaining public insurance in this population. SSI, in particular, is linked to Medicaid enrollment in most states, whereas SSDI confers Medicare eligibility only after a waiting period. Rosenheck and colleagues (

17) found that only 10% of the RAISE-ETP participants received disability benefits (either SSI or SSDI) at baseline, but by month 24 of the study, more than 50% had received disability benefits. Prior research on the RAISE-ETP sample shows that longer DUP, greater positive symptoms, greater education, and currently being in school or working are all associated with a lower likelihood of starting federal disability benefits.

This study had several strengths. It is difficult to identify people experiencing a first episode of psychosis and their insurance status from administrative claims data or from survey data. The RAISE-ETP study included a relatively large sample of people experiencing FEP from 34 research sites across 21 states and collected longitudinal information on the sample.

The study also had several important limitations. First, self-reported insurance status may contain inaccuracies. Second, the RAISE-ETP data were not nationally representative of the population with FEP. RAISE-ETP included people who received care at nonacademic community mental health centers but excluded other settings where psychosis services are delivered. The data also did not capture people with FEP who had not initiated services. Third, although our longitudinal data offer insight into insurance changes over time, they are point-in-time estimates at several points and do not capture all potential insurance transitions. Fourth, we considered 15- or 18-month responses for RAISE-ETP study participants for whom 12-month data were not available. That method allowed for a few additional months for insurance transitions, which is substantially longer in relative terms. Results were similar after limiting the sample to RAISE-ETP participants with 12-month data (see Appendix Figures 1–3 in the online supplement). Additionally, results were robust even after dropping data of five participants who had both private and public insurance at baseline. Fifth, although insurance status may be an important determinant of clinical engagement and outcomes for people with FEP, we did not examine this association.

Our results have several implications. Expanding insurance coverage for young adults may significantly benefit people experiencing FEP, because that population has substantially higher levels of uninsurance compared with the general population in the same age group. Insurance expansions may reduce insurance discontinuities for people experiencing FEP; a majority of people with insurance at the start of the RAISE-ETP study still had insurance 12 months later. Nearly half of people with FEP who were uninsured at baseline remained uninsured 12 months later, and nearly half of people with FEP who were uninsured at baseline gained public insurance over the next 12 months, which was largely because they had qualified for disability benefits. Some observers have advocated for policies that delink access to public insurance for people with FEP from the disability application and approval process (

23,

24). For example, some states have used Medicaid Section 1115 waivers to expand coverage to people with mental or substance use disorders without mandating that they first qualify for disability benefits (

25). States could use this mechanism to target coverage expansions to people with psychosis diagnoses, which may improve access to services with demonstrated effectiveness. Other approaches at the federal level to expand coverage for people with FEP could include allowing Medicaid programs to expand eligibility to people with FEP without requiring a waiver, similar to the Breast and Cervical Cancer Prevention and Treatment Act. Finally, more and better data that follow people experiencing FEP are needed to understand how public policy affects trajectories of insurance, service use, and symptoms.