Some small businesses are offering incentives to employees not to enroll in group health insurance, according to a survey by an Internet research firm specializing in providing data on compensation and benefits.

In a survey of 304 small businesses, 14 percent indicated that they were providing incentives to employees not to participate in company medical plans or were actively encouraging employees to enroll in a spouse's medical plan. Incentives typically included lump-sum salary increases, cash rebates, and contributions to other employee-benefit accounts, according to a report on the survey conducted by Salary.com.

“Salary.com estimates that many companies could offer employees a 10 percent salary increase in lieu of plan participation and still lower total payroll expenses in a given year,” said Richard Cellini, head of research at Salary.com.

Though relatively rare, the practice is probably the most radical among a number of strategies small businesses are using to counter the rise in health care costs.

In its Small Business Basic Medical Coverage Survey, Salary.com found that nearly 90 percent of small businesses are paying more to provide basic medical insurance to their employees in 2005 than in 2004. Half of the 304 surveyed companies reported year-over-year increases of 10 percent to 20 percent, while almost one-tenth of small businesses surveyed reported increases of 30 percent or more.

“Health care costs continue to grow for the majority of small businesses, but many companies have found ways to at least slow the rate of increase,” said Kevin Cuddeback, director of Salary.com's Small Business unit. “Often they are using tactics that directly impact their compensation practices.”

Salary.com's Small Business Basic Medical Coverage Survey was conducted in July 2005. Salary.com invited a cross-section of small businesses across the country to participate. Prospective participants received an e-mail containing the survey questionnaire. They completed as many sections of the questionnaire as they desired and submitted the results to Salary.com electronically. The survey was completed by 304 small businesses (each employing from one to 200 individuals in the United States).

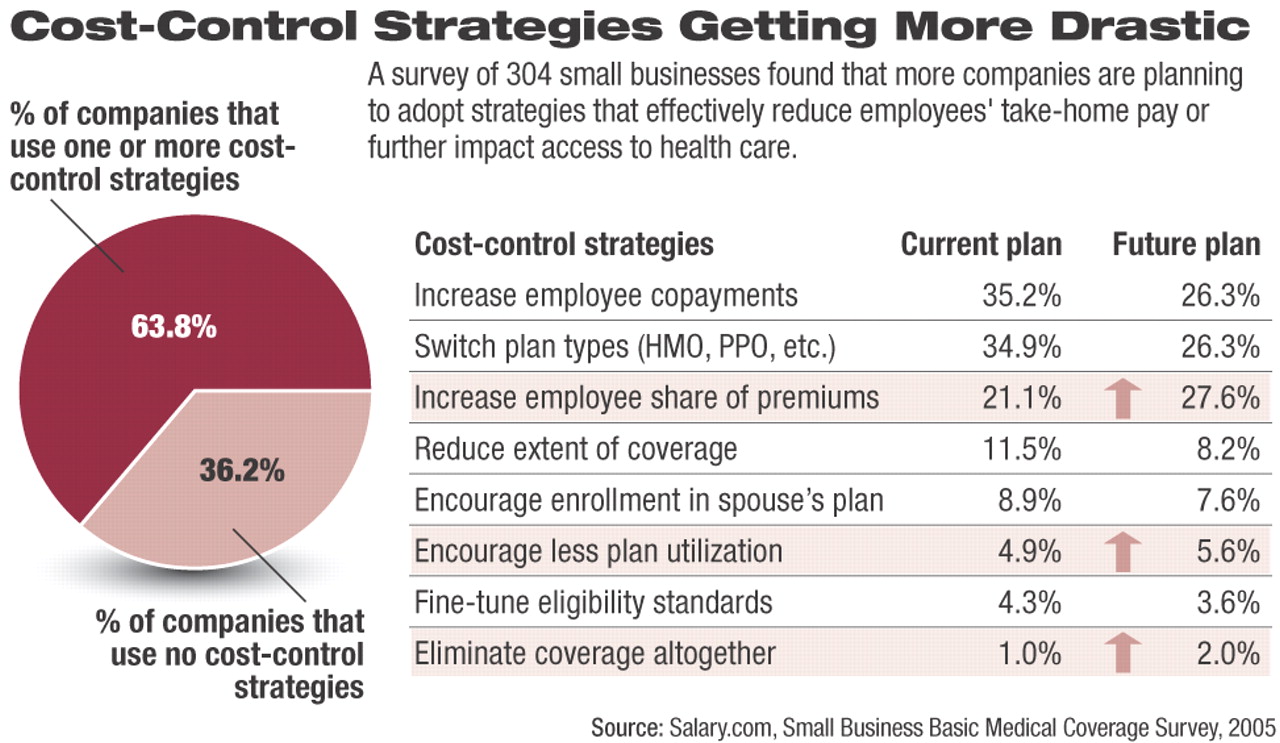

Sixty-four percent of small businesses reported trying one or more strategies to contain basic health care costs. The most common cost-containment strategy (35.2 percent of respondents) is to increase employee copayments. A significant percentage (21.1 percent) of employers have chosen to contain overall medical costs by increasing the employee share of monthly premiums—a tactic that has a direct impact on employee take-home pay.

An even larger percentage (27.6 percent) of employers reported that they intend to adopt this tactic in the near future, making it the fastest-growing trend in medical cost containment among small businesses today (see chart).

These were among other survey results:

•

Few companies band together to purchase group insurance. Only 1.7 percent of the companies reported joining forces with other companies through a buyer's cooperative to purchase basic medical insurance.

•

Micro-employers (one to 20 employees) offer either the most generous plans or the least generous. Among this group of employers, 32.2 percent offer fully funded medical coverage requiring employees to pay nothing toward the cost of medical care premiums. But 31.7 percent of this group—more than any other small business segment—offer completely unfunded medical coverage, requiring employees to pay 100 percent of the premium cost.

•

“Straddle” companies (100 to 150 employees) occupy the awkward midrange of the small business category—too large to be lean, too small to enjoy economies of scale. Straddle companies reported the highest peremployee health care costs (17.7 percent of gross annual payroll, versus the average 14.6 percent for all small businesses). Additionally, straddlers reported a higher rate of increase in the cost of medical coverage (11.4 percent for 2004-2005) than almost any other group of small businesses. Straddlers offer employees the smallest contribution toward the cost of medical coverage (45.2 percent on average) and are also more likely than any other small business segment except microemployers to offer employees completely unfunded plans. Twenty-eight percent of firms with 100 to 150 employees offer unfunded health plans.