A significant shift in health care funding from the private to the public sector is projected over the next 10 years, in part because of the new Medicare prescription drug benefit.

By 2014, the public sector will fund more than 49 percent of all U.S. health care, said Stephen Heffler, director of the National Health Statistics Group at the Centers for Medicare and Medicaid Services, and colleagues in a Health Affairs Web exclusive posted February 28.

“The implementation of the Part D [prescription drug] benefit, as well as the expected continuation of the longer-term trends toward more public funding of health care, leads us to anticipate the public sector will pay for nearly half of all spending in the U.S. by 2014,” said Heffler during a Webcast briefing on the projections.

Heffler said the shift would happen as the leading edge of baby boomers become eligible for Medicare in 2011. He emphasized, however, that the shift in public spending is not related to demographic trends.

“The larger demographic impact of that cohort [becoming eligible for Medicare] is during the years following this set of projections,” Heffler said.

Rather, the increased public funding of U.S. health care is related to a variety of trends that are shifting spending away from the private sector, including the new Medicare drug benefit.

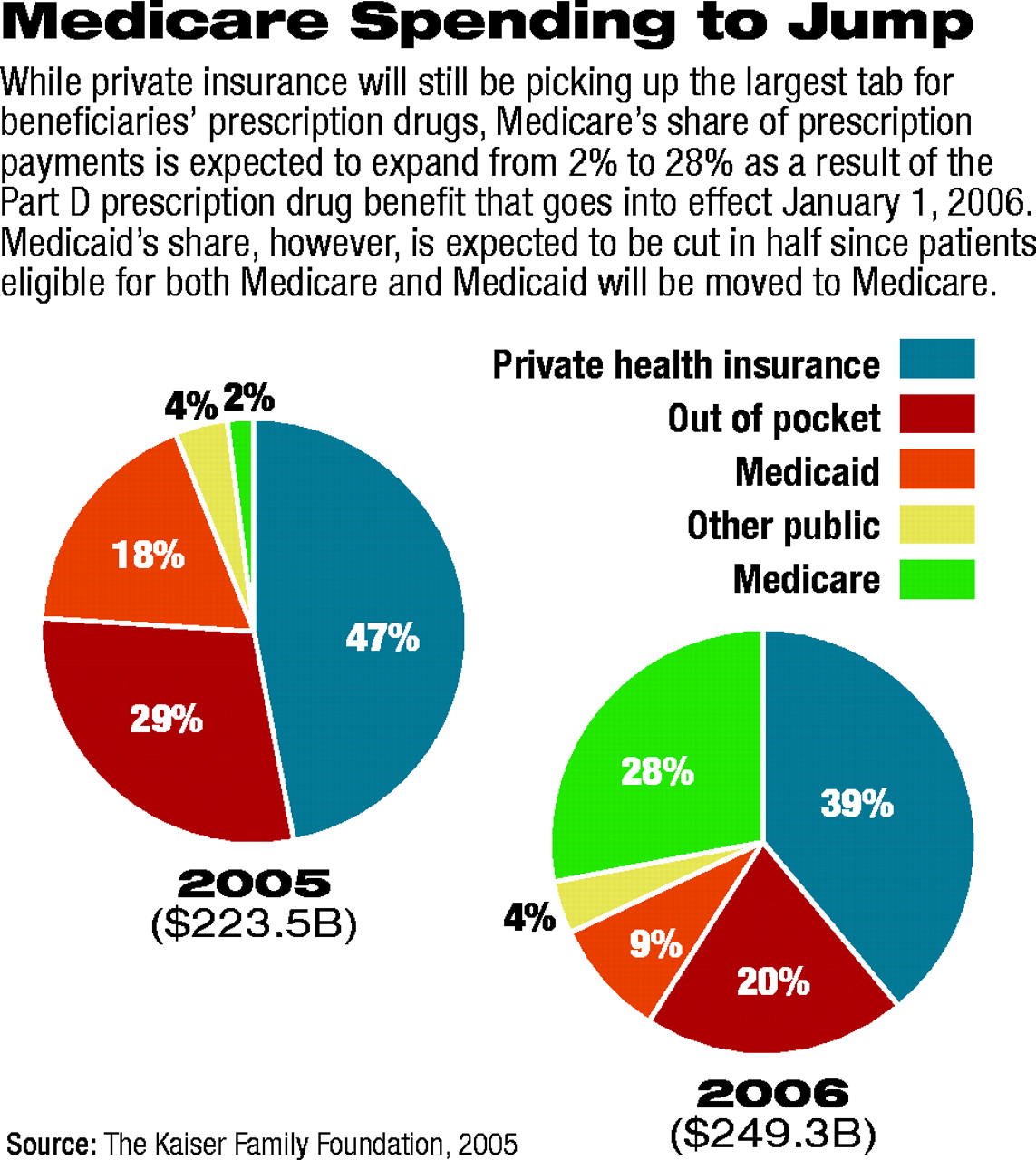

As an illustration of the drug benefit's contribution to increased public spending, total Medicare drug spending is expected to be $69.9 billion in 2006 when the benefit begins. But without the drug benefit and other drug-related provisions, Medicare prescription drug spending would have been projected to be just $2.9 billion in 2006.

“This shift of approximately $67 billion in funding on behalf of the projected 38.9 million enrollees in the Medicare Part D benefit comes from the two primary payers of prescription drugs in 2005—Medicaid and private payers,” the authors wrote.

While the drug benefit is helping to shift the source of financing toward the public sector and away from the private sector, it is not expected to contribute to increases in overall spending. In part, this is because increased utilization resulting from the benefit is expected to be offset by price discounts also associated with the benefit.

In fact, the authors said that the growth in overall U.S. health care spending over the next 10 years is actually expected to decelerate, due to reductions in medical consumption. These reductions are expected to be achieved as a result of what the authors call the “quiet reimposition of selected tools of utilization management, such as preauthorization requirements and utilization review and the increased use of cost sharing to dampen demand for discretionary services under private health insurance.”

Yet despite this deceleration in growth, overall health care spending will continue growing faster than gross domestic product (GDP). “The consequence is a projected increase in health's share of GDP from 15.3 percent in 2003 to 18.7 percent by 2014,” the authors projected.