Millions of Americans have watched in dismay as their investments have plummeted in value during the country's economic downturn. Unemployment is growing. Countless people are struggling to pay their mortgage while those who can't have lost their homes. And what has now become a global financial crisis is taking its toll on people's mental health, not just on their pocketbooks.

A study reported in the October 2008 Psychological Medicine, published by Cambridge University Press in England, found a strong link between debt and mental illness. Almost a quarter of all people with mental illness are in debt, compared with only 8 percent of people with no mental illness, the study found.

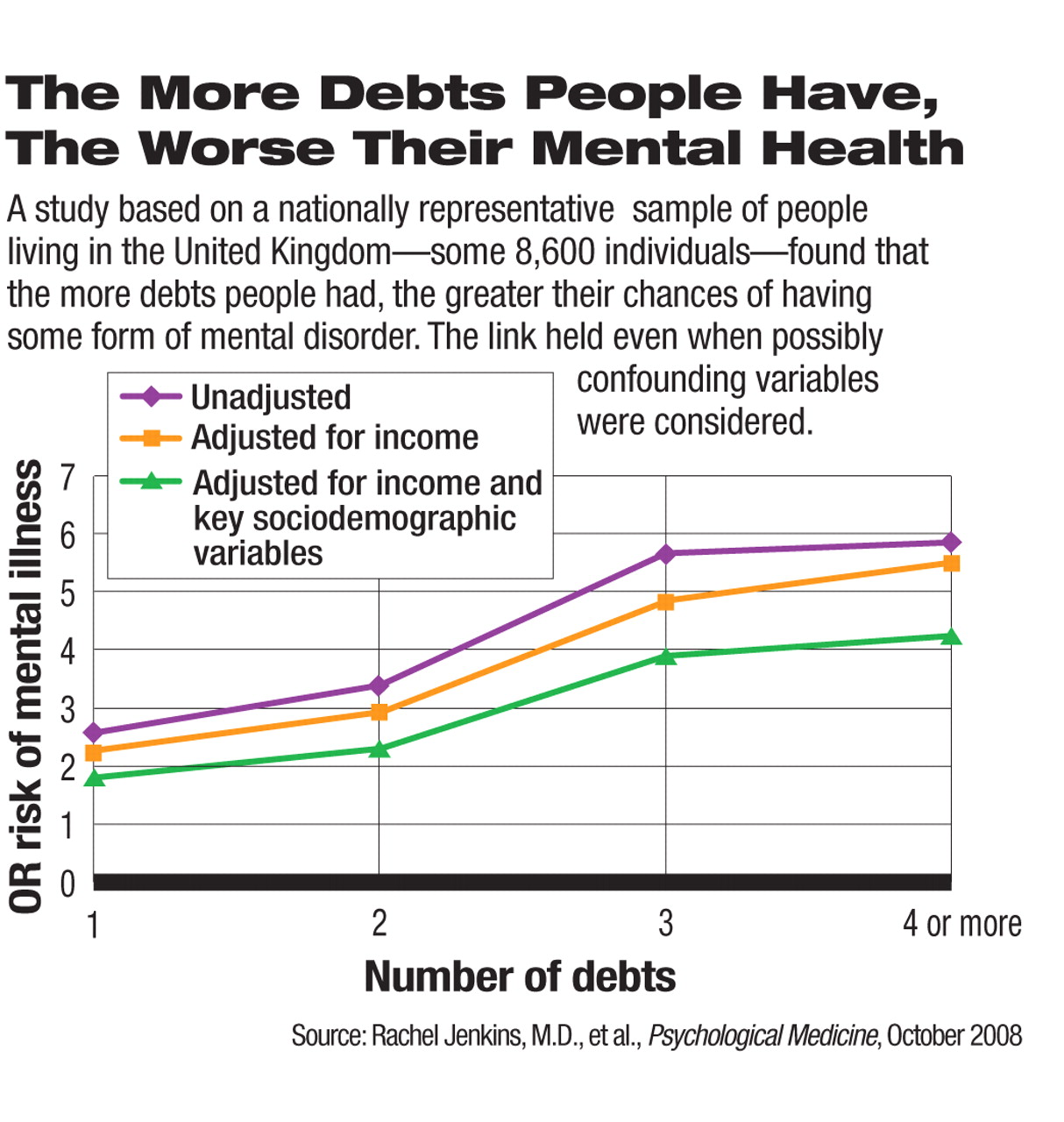

The study, headed by Rachel Jenkins, M.D., a professor at the Institute of Psychiatry in London, was based on a nationally representative sample of people living in the United Kingdom—some 8,600 individuals. All were assessed for anxiety and depressive disorders, psychosis, alcohol abuse, and drug abuse. They were also asked detailed questions about their income and debt. Jenkins and her colleagues then looked to see whether there were any links between mental disorders and income or debt.

The researchers found that those subjects with a low income were twice as likely to have a mental disorder as were those with a higher income. Also, the more debts they had, the more likely they were to have some form of mental disorder.

The researchers then compared the relationship between income and mental disorders with the relationship between debt and mental disorders. The relationship between having a low income and having a mental disorder was weakened when debt was considered. In contrast, the relationship between having debt and having a mental disorder remained robust even when a low income was considered, and it was only slightly weakened when other sociodemographic variables were considered.

In fact, even after adjusting for income and other variables, the more debts people had, the more likely they were to have a mental disorder overall, an anxiety or a depressive disorder, psychosis, alcohol dependence, or drug dependence. Also, people with six or more separate debts had a sixfold increase in mental disorder after adjusting for income.

Thus, there may be a strong association not only between low income and mental illness, but also between debt and mental illness, Jenkins and her team concluded. But of the two associations, the latter seems to be more potent.

The study was not designed to determine whether debt leads to mental illness or whether mental illness leads to debt. However, “Both are probably true,” Jenkins told Psychiatric News.

Truly, some of the study data could be used to argue either case. For instance, that debt was found to be four times as prevalent among people with psychosis as among people in good mental health suggests that serious mental illness keeps people from holding down good jobs and thus puts them at risk of going into debt. In contrast, that debt was found to be three times as prevalent among people with an anxiety or a depressive disorder as among people in good mental health implies that the stress of being in debt can erode people's mental health.

In any event, the implications for psychiatrists are the same in either case, Jenkins advised. They should assess the financial situations of their patients, she said, and if their patients are in considerable debt, they should refer them to a debt-management expert.

The study was funded by England's Department of Health, the Scottish Executive Health Department, and the Welsh Assembly Government.