Employers, in their role as health care purchasers, are increasingly assuming the role of de facto health policy makers in the United States

(1,

2). Deciding which plans to offer employees and negotiating rates and benefits with managed care companies require substantial knowledge about the costs and quality of medical care

(3). For mental health benefits, stigma and societal misconceptions make it particularly important that empirical evidence be available to guide such decisions.

Among the information most central to decisions regarding choice of health benefits is the cost of the illnesses covered by those benefits. Employers are the most common purchasers of private insurance, providing 89% of all private insurance in the United States in 1996

(4). Employers have an economic stake in understanding not only the direct costs of care—the costs to the purchaser of treating the illness—but also many of the indirect costs, such as lost revenues caused by missed work and decreased productivity

(5,

6).

A number of studies have documented high health care costs associated with treatment of depression, but far less is known about the impact of depression on absenteeism and disability in the workplace. Depression is highly associated with impairment in functioning, and it has been estimated that over 70% of people with major depression are actively employed

(7). Data from national epidemiologic surveys demonstrate that individuals with depression report substantial lost work days due to their illness

(6–

10). In a study published in 1996

(11), major depression was estimated to cost $6,000 in health-related and work-related costs per depressed worker and that $4,200 of this amount was borne by employers. However, most of these studies relied on self-report and on economic assumptions to arrive at these estimates. Greenberg et al.

(12) noted that most available data on costs of depression “are predicated on numerous assumptions concerning the prevalence, duration, treatment, and effects of depression.”

The current study was developed as part of a unique collaboration between university-based researchers and a major U.S. manufacturing corporation. In this article we assess the health and work costs of depressive illness within that corporation and compare them with the costs of four other chronic conditions: diabetes, ischemic heart disease, hypertension, and back problems.

Method

Study Group

The study examined 1995 data from a large manufacturing corporation that employs approximately 23,000 individuals throughout the United States. Data from corporate personnel records were merged with health insurance claims by using encrypted identifiers. Analyses were conducted on data for the 15,153 employees who filed any health claims, received their insurance through the corporation, and were not enrolled in health maintenance organizations. Data on sick days were available for all enrollees covered by the Fair Labor Standards Act (N=9,398), most of whom were blue-collar employees. Analyses of health costs were drawn from the entire study group, and analyses of sick days and the cost of sick days included all employees with available sick day data.

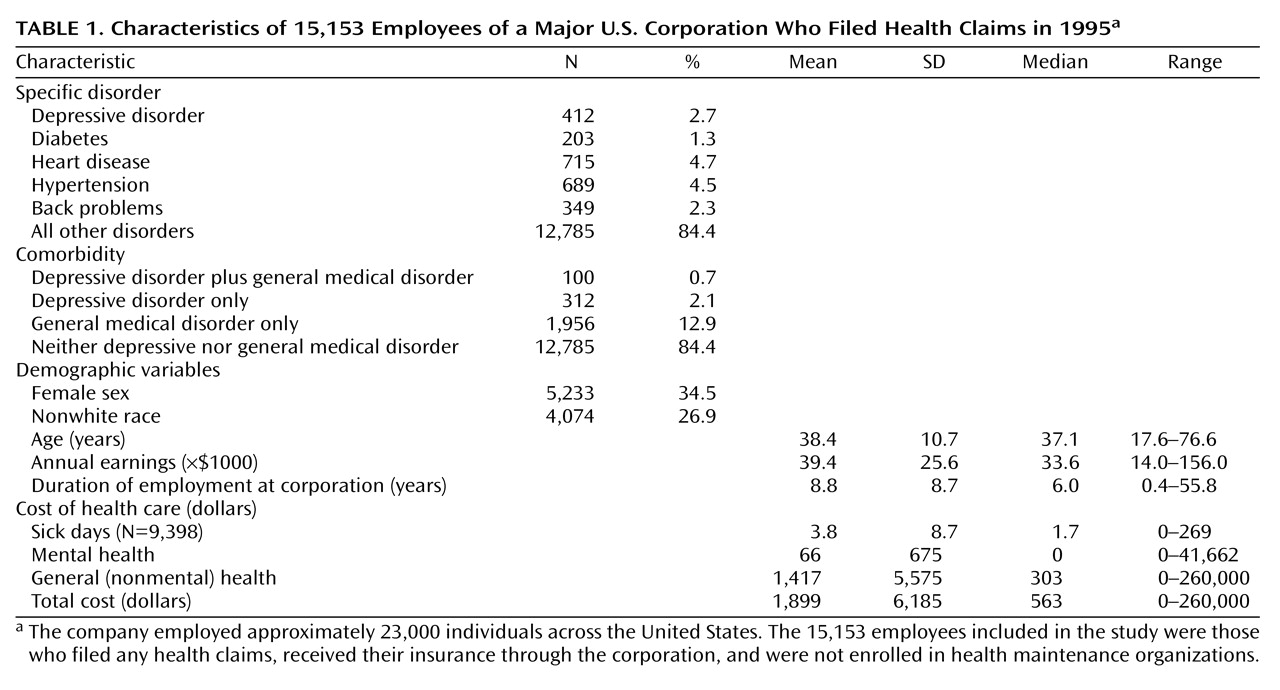

Table 1 describes the characteristics of the study group.

Independent Variables

Diagnosis of major depression, dysthymia, or depressive disorder not otherwise specified during any outpatient or inpatient treatment episode during 1995 was used as a marker for depressive illness. A total of 412 employees had one or more visits for depressive disorders. Within this group, 205 (49.8%) were treated for major depression (ICD-9 codes 296.2–296.3), 124 (30.1%) for dysthymia (ICD-9 code 300.4), and 83 (20.1%) for depressive disorder not otherwise specified (ICD-9 code 296.9).

Four general medical conditions were chosen to provide a benchmark against which to compare the costs of depression: diabetes, heart disease, hypertension, and back problems. One or more claims for diabetes (ICD-9 codes 250.0–250.9) were submitted by 203 employees during 1995. A total of 715 employees submitted a claim for heart disease (ICD-9 codes 410.0–414.9) during that period. Hypertension claims (ICD-9 codes 401.0–401.9) were submitted by 689 employees. A total of 349 employees submitted claims for back problems (ICD codes 720.0–724.9) (

Table 1).

Potential Confounders

Demographic and work-related variables included in multiple regression models as potential confounders were age, race, sex, annual income, tenure of employment, education level, and the state in which they were employed. Univariate statistics for some of these characteristics are presented in

Table 1.

Dependent Variables

Our perspective on costs was that of the purchasers of care and included costs to the employer, the employee, and other, co-covering, insurance plans. Since this corporation pays approximately 80% of general medical costs and 50% of mental health costs, it represents the predominant purchaser of health care in this group of subjects. Because of the potential difficulties in using charge data as a proxy for costs

(13), we estimated health costs from the payers’ perspective by summing the amount of the claim counted toward filling the deductible requirement, copayments, coinsurance, pharmacy costs, and the amount paid by the corporation for each claim

(14).

Separate analyses were conducted for mental health expenditures and general health (i.e., non-mental-health) expenditures. Mental health payments summed all claims submitted to the health plan for any outpatient visit or hospitalization for which mental disorder was the primary diagnosis (i.e., ICD-9 codes 290.00–312.99). General medical payments summed all non-mental-health claims for both outpatient and inpatient treatment. Total health payments summed mental health and general health expenditures.

Total paid sick and disability costs were available for each employee during 1995. The cost of disability days was calculated by dividing annual sick and disability pay expenditures by the employee’s daily salary.

We calculated the total mean costs per employee as the sum of total health care costs plus total disability costs, controlling for the potential confounders. Costs for the entire corporation were estimated by multiplying the costs per enrollee by the number of enrollees with the condition of interest.

Statistical Techniques

After examining univariate analyses, we used a series of ordinary least-squares multiple regression equations to model each outcome (costs or sick days) as a function of a five-level variable (depressive illness, diabetes, coronary artery disease or hypertension, back problems, or all others). All models controlled for the following covariates: sociodemographic characteristics, state in which the enrollee was employed, salary, and tenure with the corporation. The estimate of the total variance explained by the models (R2) ranged from 6.0% to 9.9%.

In a second analysis, we examined the effects of depressive comorbidity on total medical costs by constructing four mutually exclusive groups: depressive disorder alone, any of the four comparison medical disorders alone, both depressive and comparison disorders, or neither type of disorder. R2 values for these models ranged from 6.0% to 8.5%.

For all analyses, least-squares means were used to calculate costs associated with each condition with adjustments for covariates. Significance (p) values were adjusted by using the Tukey test for multiple post hoc comparisons.

Results

Health Care Costs

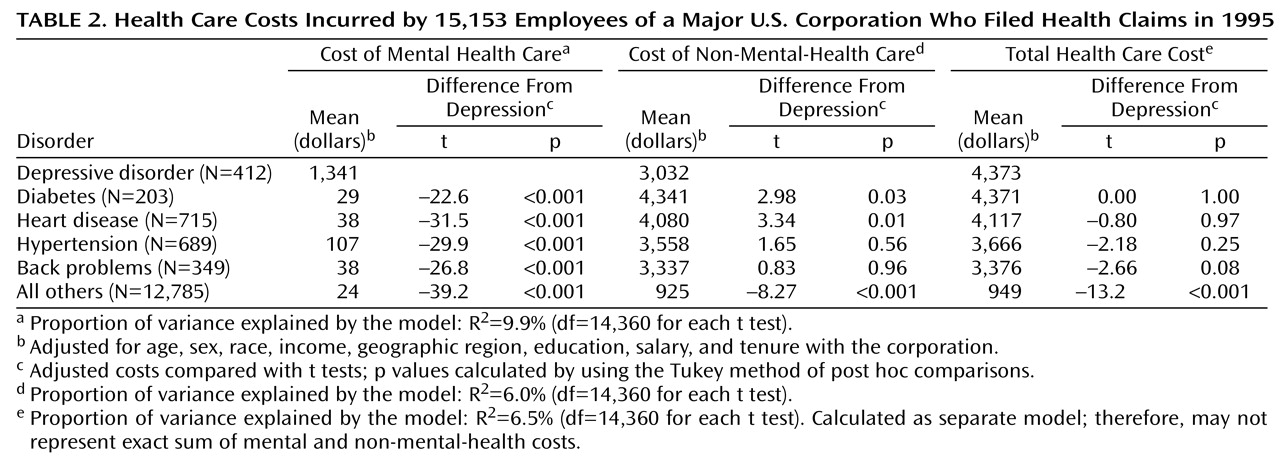

After adjusting for confounders, we found that employees with depressive illness incurred $4,373 in annual health care costs. These costs did not differ statistically from any of the four comparison conditions, but they were significantly higher than the annual costs of $949 for employees without any of the other conditions (

Table 2).

Within the total health care costs, the mean mental health cost per enrollee associated with depression was $1,341, which, as expected, was significantly more than the cost for any of the comparison medical conditions. The cost of non-mental-health care for depressed patients during that time period was $3,032, significantly lower than the cost of diabetes or coronary artery disease but significantly higher than the cost for patients without any of the four index medical conditions (

Table 2).

Sick Days

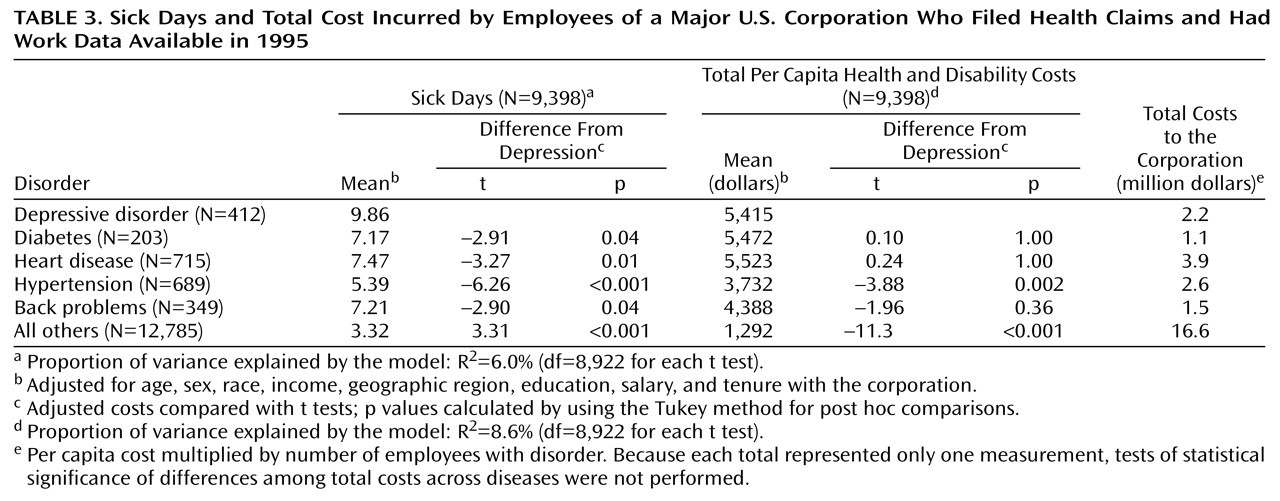

In multivariate models among employees with available work data (N=9,398), individuals who filed at least one claim for depressive illness took a mean of 9.9 annual sick days. This was significantly greater than the number of sick days taken for any of the comparison conditions (

Table 3).

To better understand whether certain subgroups of depressed individuals were driving these high health care costs, we next examined whether there were interactions between any health or demographic variables and depression. One of those variables—age—proved to be highly significant. Depressed individuals younger than age 40 took 3.5 more sick days than those who were 40 years old or older (for the interaction variable, parameter estimate=3.5, t=2.94, p=0.003). A similar age effect was evident for two other diagnoses: diabetes (interaction parameter estimate=7.75, t=4.27, p=0.0001) and hypertension (interaction parameter estimate=2.35, t=2.49, p=0.01).

Total Health-Related Costs

Patients submitting claims for depressive illness incurred a mean annual total of $5,415 in health and disability payments. This amount was significantly higher than the cost of hypertension and similar to the cost for the other three conditions (

Table 3).

We estimated the total costs associated with each illness across the corporation; these estimates take into account both the mean cost per enrollee and the prevalence of the condition. The costs of depression and hypertension fell between $2 million and $3 million per year. Costs of coronary artery disease, because of its high prevalence and mean cost per employee, were approximately $4 million, whereas the costs of diabetes and back problems were both closer to $1 million (

Table 3).

The Impact of Comorbidity on Health and Disability Costs

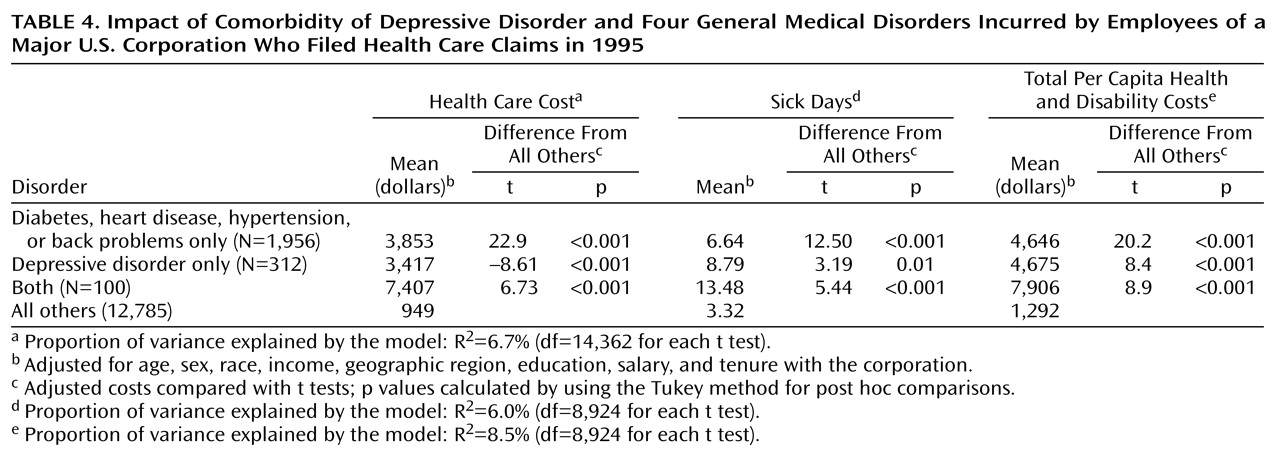

To assess the effect of depressive comorbidity on the total costs of medical illness, we compared the costs incurred by enrollees with depression plus one of the comparison medical conditions, the costs incurred by individuals with either depression or any of the four general medical illness, and the cost for all other employees (

Table 4). Enrollees with either type of condition alone incurred comparable costs. In contrast, employees with comorbid general medical and depressive illness cost $7,906, or 1.7 times more than those with either condition alone.

Discussion

Our findings emphasize the high costs to employers associated with depressive illnesses, particularly in days missed from work. Depressive illness within this corporation was associated with comparable health costs and more sick days than four other chronic illnesses. The combination of depression and any of these other medical conditions was associated with substantially higher total costs than those seen for either type of condition alone.

The data used for this study allow a unique opportunity to study the costs of depression from the perspective of an employer. Nonetheless, the data also pose several limitations that should be identified before discussing the results in greater detail. First, the data were gathered from only one corporation. Although this corporation has a wide geographic and demographic distribution, caution should be applied before generalizing the findings to all workplaces. Second, days missed from work represent only one aspect of the work costs resulting from depression. More than many chronic illnesses, depressive illness might be expected to result in decreased productivity while at work as well as on-the-job errors or accidents

(15). We expect, therefore, that the work costs of depression relative to other illnesses may be higher than those reported in this study. Third, claims data invariably rely on provider visits for both case identification and treatment. This study, therefore, was not able to identify untreated depressive illness, to assess chronicity of illness independently from service use, or to determine appropriateness of care.

The high costs of depression might lead employers to arrive at two, seemingly opposite, conclusions: either too much is being spent on depressive illness or these costs reflect high levels of morbidity that require increased attention and allocation of resources. Two facts suggest that the latter rather than the former explanation may be more appropriate. First, many of the excess costs of depression in this corporation were associated with sick pay rather than with health or mental health care expenditures. Second, we have reported elsewhere

(16) that, within this corporation, reductions in mental health expenditures over a 3-year period were followed by an expansion of medical costs as well as a disproportionate increase in absenteeism among individuals with mental disorders. Since the current study uses data from the final portion of that 3-year period, this reduction in mental health benefits may actually be one of the factors driving up health and disability costs in this study.

Almost one-fifth of the costs of depressive illness in this company were related to disability pay, and the full effect of depression on productivity and sick time is likely substantially larger. Furthermore, these costs appeared to be concentrated in younger workers, a pattern analogous to that seen in the comparison medical illnesses. This generation of workers, with less workplace loyalty and more competing responsibilities at home

(17), may be less willing or able to continue to work when they become sick. As this younger cohort ages, the impact of depression in the workplace can only be expected to grow larger.

Informed involvement on the part of purchasers may ultimately provide an important safeguard for high quality of mental health care under managed care. Employers, even more than health care providers, have a strong incentive to provide care that will maximize not only the health but also the functional capacity of their employees. Depression is an illness whose prevalence and impact on function make such a perspective particularly crucial.