The 2010 Patient Protection and Affordable Care Act (widely known as the Affordable Care Act [ACA]) has the potential to transform the delivery and financing of care for individuals with mental illness. One key provision—the establishment of state-based health insurance exchanges to regulate the purchase of insurance by individuals and small businesses beginning in 2014—is expected to extend coverage to an estimated 15 million individuals, including many with mental illness (

1). However, there is some concern that state exchanges may not function well for this population (

2).

The primary concern related to the function of state exchanges for individuals with mental illness involves the potential for adverse selection. Adverse selection can occur in health insurance markets structured like the exchanges, where enrollees have a choice among competing health plans. When individuals choose among plans, those plans offering more generous benefits often attract individuals who are more likely to have high health care costs. If individuals suspect they will use a large quantity of health care services in the subsequent year, they will choose a plan with low cost sharing and more expansive provider networks. Because the new law prohibits plans in the state exchanges from adjusting premiums to reflect individuals' expected health care costs, each plan has an incentive to cherry-pick the healthiest enrollees and to dissuade others, including those with mental illness, from joining the plan. Also, the ACA requires that exchanges offer health plans in four benefit tiers (bronze, silver, gold, and platinum), which creates additional concerns about adverse selection given the incentives for sicker enrollees to choose a plan offering more expansive benefits (i.e., gold or platinum plans).

Previous research suggests that adverse selection is particularly problematic for individuals with mental illness in part because they have higher than average total health care costs, which often include high non-mental-health-related medical costs (

3). McGuire and Sinaiko (

2) found, for example, that individuals with fair or poor self-reported mental health status had average 1-year total health care costs of $5,370, compared with $2,077 for those with good, very good, or excellent mental health. In addition, because mental illnesses are often chronic, individuals are able to predict that they will have higher than average costs, increasing the likelihood that they will purchase a generous health plan (

4,

5). Higher health care costs associated with mental illness have been shown to pose budgetary risks and market instability in multiple health care contexts in the United States (

6) and elsewhere (

7).

The ACA includes several provisions to minimize the problem of adverse selection (

8,

9). To minimize cherry-picking by excluding patients with high costs, plans in state health care exchanges are prohibited from using preexisting condition exclusions and are required to offer guaranteed issue and renewal of insurance policies, cover “essential health benefits” including mental health and addiction treatment, and meet standards for provider network adequacy. Risk adjustment between plans is then mandated to ensure that plan compensation accurately reflects the expected health care needs of the population covered, including those that attract sicker enrollees. The basic idea behind risk adjustment is that individuals with different expected health care costs are charged similar premiums. Health plans with enrollees with low expected health care costs pay into a central pool, and those funds are distributed to plans with enrollees with high expected costs. The ACA charged the U.S. Department of Health and Human Services (DHHS) in conjunction with states with establishing the criteria and methods to be used for risk adjusting on the basis of the demographic characteristics and medical diagnoses of plan enrollees.

The ACA also includes temporary provisions to supplement risk adjustment to increase market stability in the 3 years after exchanges are implemented (2014–2016)—reinsurance and risk corridors (

10,

11). First, in a state-run reinsurance program, all health plans in the state would be required to pay a fee to compensate individual market plans that enroll high-cost individuals. This would be done by calculating the percentage of an enrollee's costs incurred above a state-specific threshold up to a reinsurance cap, with the expectation that health plans would purchase additional reinsurance from the commercial reinsurance market to kick in above the cap. Such commercial reinsurance is already commonly used by health plans. These thresholds have not yet been determined. DHHS might, for example, propose a $50,000 threshold with 80% of costs above that amount reinsured to a cap of $150,000 (

12). Commercial reinsurance would be expected to kick in above the cap. Second, temporary risk corridors will be similar to those used in Medicare Part D, with federal distribution of payments to plans with higher than expected costs, and payments by plans with lower than expected costs. Risk corridor thresholds would apply in state exchanges when costs reach plus or minus 3% of a specified target level. It is important to note that the ACA requires that plans use community ratings when setting premiums. Premiums paid by individuals (independent of subsidies) may vary only by whether an individual or family policy is purchased, by geographic area, by age, and by tobacco use. While community ratings can increase fairness, in the absence of risk adjustment mechanisms, plans would not be fully compensated for the expected costs of their members, thereby creating additional incentives to cherry-pick enrollees.

Two other provisions of the ACA are relevant to reducing incentives to avoid enrolling individuals with mental illness in state exchanges. First, the ACA extends the major provisions of the 2008 Mental Health Parity and Addiction Equity Act (MHPAEA) to individual insurance policies under state exchanges. The original law did not apply to individual policies or to firms with fewer than 50 employees. Before passage of the MHPAEA, coverage for behavioral health care under private insurance often required higher cost sharing (e.g., coinsurance of 50%, compared with 20% for outpatient medical services) and special service limits (e.g., 20 outpatient visits and 30 inpatient days per year) (

13). The MHPAEA eliminated these differences by requiring that coverage for mental health and substance abuse benefits be offered on par with medical/surgical benefits. The ACA also requires that essential health benefits, including mental health treatment, be provided by health plans participating in the state exchanges, although states will be given flexibility in determining the scope of these services. Individuals with more serious mental illness often require services that are not covered under typical private insurance coverage, such as residential or intensive outpatient treatment (

14). Restrictive provider networks might also discourage plan enrollment by individuals with mental illness. Depending on states' scope of the essential benefits package, health plan exclusion of certain treatments for mental illness could effectively discourage enrollment. Thus, despite federal parity and essential health benefits requirements, adverse selection remains a concern in state exchanges.

Given this context, it is critical to examine the extent to which risk adjustment will adequately compensate health plans that enroll a larger share of individuals with chronic mental health and medical conditions. In this study, we first conducted a simulation-based analysis using health care claims data to compare expected group health care costs using a widely used diagnosis-based risk adjuster (the Adjusted Clinical Groups System) with actual group costs, under different assumptions about the sorting of enrollees with chronic mental health and medical conditions into health plans. We next examined expected total health care costs under risk adjustment with and without a reinsurance threshold of $100,000 per individual to assess whether reinsurance served as a useful supplement to risk adjustment. Since states have flexibility in designing reinsurance programs under their exchanges, our choice of a simple $100,000 reinsurance stop-loss will not precisely mimic final state reinsurance designs implemented in 2014 but has the advantage of being a relatively straightforward approach to demonstrating the possible effects of reinsurance in conjunction with risk adjustment. We note that this is a simulation exercise, and key implementation details yet to be determined may also influence plan compensation under risk adjustment in the exchanges.

Method

Data Source

Our sample included 5 million individuals under age 65 insured through an employer, Medicaid, or the Children's Health Insurance Program. It is expected that exchange enrollees will have been previously insured through individual or small group plans, or uninsured. Data included individuals' inpatient, outpatient, and pharmacy claims from 2006–2007, obtained from PharMetrics, a division of IMS Health Corporation. We used these data to approximate the health profile of likely state exchange enrollees, since no claims data are available for the currently uninsured who are expected to enroll in exchanges, and we weighted the study population by age, gender, and region of residence to match the currently uninsured U.S. population using Current Population Survey data (see Table S1 in the data supplement that accompanies the online edition of this article).

Model Cohorts

We calculated each individual's expected health care expenditures using diagnosis-based risk adjustment (

15,

16) with the Adjusted Clinical Groups System, version 9.0 (December 2009 release). Like other prospective diagnosis-based risk adjusters, this model used diagnosis codes contained in outpatient and inpatient insurance claims in our base year to predict health care spending the following year. Thus, plans are compensated in year 2 only on the basis of year 1 diagnoses.

We used ICD-9 codes in the base year to categorize individuals as having a chronic mental health condition if their condition was likely to last for more than 12 months with or without medical treatment according to an expert panel. The following diagnoses were considered chronic mental health conditions: anxiety, attention deficit hyperactivity disorder, schizophrenia and affective psychosis, personality disorders, depression, and other psychosocial disorders (ICD codes 295–299, 300–302, 306, 308, 309–314). We used the same process to categorize individuals as having a chronic medical condition. To calculate costs, we summed all allowed inpatient, outpatient, and prescription drug charges for each individual. This represents the full costs of care including patient cost sharing but not plan non-claims expenses (e.g., administrative overhead). All costs are presented in 2007 dollars.

We modeled the performance of risk adjustment under different assumptions about the level of sorting of individuals into plans by presence of chronic mental health or medical conditions using predictive ratios. Predictive ratios identify the predicted cost for a health plan population using a specific risk adjustment model divided by the actual cost for this population. A ratio of 1.0 indicates that the risk adjustment process perfectly estimated plan costs, with predicted costs equal to actual costs; ratios higher than 1.0 indicate health plan overpayment, and ratios lower than 1.0 indicate plan underpayment. It is important to note that these are calculated at a plan level. If equal numbers of individuals' health care expenditures are overestimated and underestimated (and by the same amount), the predictive ratio will be 1.0, even if the model does not perform well at predicting individual expenditures.

First, we modeled the most extreme assumption—that individuals perfectly sort into plans by presence of a mental health condition. We calculated predictive ratios for a hypothetical health plan that enrolled only individuals with a mental health condition and for a hypothetical plan that enrolled only individuals with no mental health condition.

Second, we modeled health plan cohorts of enrollees to determine whether under- and overpayment are worse when plans have different shares of individuals with chronic mental health conditions and chronic medical conditions. We simulated enrollment for 100 health plans, each with 50,000 random members from our total sample (without replacement). We created four health plan risk groups with 25 plans in each by share with a chronic mental illness—low morbidity, moderately low morbidity, moderately high morbidity, and high morbidity. We did this by reassigning a predetermined number of individuals to plans based on the presence of a chronic mental health condition. We randomly chose 3,000 individuals (6% of all enrollees) with a chronic mental health condition and removed them from the 25 plans designated as “low morbidity” and switched them with 3,000 individuals with no chronic mental health conditions randomly chosen from the 25 plans designated as “high morbidity.” We next randomly chose 1,000 individuals (2% of enrollees) with a chronic mental health condition and removed them from the 25 plans designated as “moderately low morbidity” and, in the same manner, switched them with 1,000 individuals with no chronic mental health conditions randomly chosen from the 25 plans designated as “moderately high morbidity.” We used the same process to create four additional health plan risk groups—low, moderately low, moderately high, and high morbidity—by share with a chronic medical illness. Our interest was in determining whether risk adjustment does a poorer job (as prior research would suggest) or a better job at compensating health plans that have a larger share of enrollees with chronic mental health as opposed to chronic medical conditions, or if there is no difference in the performance of risk adjusters across the two types of conditions. We calculated the average predictive ratio and range across all plans in each risk level.

Finally, to assess the added benefit of reinsurance in combination with risk adjustment, we recalculated predictive ratios using the four mental health risk groups and a reinsurance threshold of $100,000 per individual. Thus, if an enrollee's actual health care costs were $105,000, only $100,000 was included in our total health care cost calculation. The plan would not be at risk for the additional $5,000—it would come from a central pool of funds. In our data, less than 1% (0.17% of the weighted sample) of individuals reached this level of spending in year 2.

Results

First, we compared the performance of diagnosis-based risk adjustment for two hypothetical health plans: plan 1 included only individuals with a mental health condition, and plan 2 included no individuals with a mental health condition. For plan 1, the predictive ratio comparing predicted with actual costs was 0.916, indicating that the health plan with all enrollees with mental health conditions would be underpaid by 8.4% in year 2. For plan 2, the predictive ratio was 1.023, indicating that the plan with no enrollees with mental health conditions would be overpaid by 2.3% in year 2.

Table 1 lists average group health care costs in year 2 for four health plan cohorts with 25 plans in each designated as low, moderately low, moderately high, and high morbidity by share of enrollees with chronic mental health condition-related claims during year 1. The proportion with any chronic mental health condition ranged from 1.6% in the low morbidity group to 13.6% in the high-morbidity group. The underlying risk of these four risk classes is reflected in their differing average group total health care costs in year 2. For example, average total health care costs were $141 million for the low-morbidity plan cohorts, but $168 million for the high-morbidity plan cohorts.

Table 1 also shows group costs for four separate health plan cohorts by share of enrollees with chronic medical conditions. The proportion with any chronic medical condition ranged from 22.6% in the low-morbidity group to 34.6% in the high-morbidity group.

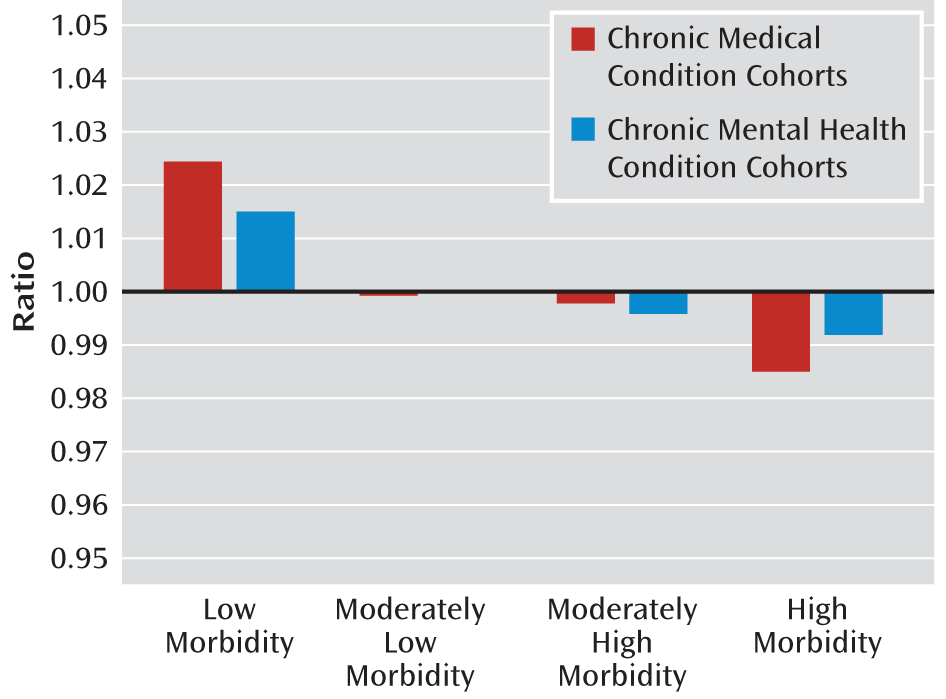

Figure 1 presents predictive ratios in risk adjustment models for health plan cohorts by share of enrollees with chronic mental health and medical conditions (see Table S2 in the online data supplement for full results). For health plans in the high-morbidity cohort with the largest share of enrollees with chronic mental health conditions, risk adjustment would result in average underpayment of less than 1% (predictive ratio, 0.992; range, 0.965–1.021). However, as the range indicates, the worst reimbursed plan in the high-morbidity group would be underpaid by 3.5%. In comparison, for health plans in the high-morbidity cohort with the largest share of enrollees with chronic medical conditions, risk adjustment would result in slightly greater average plan underpayment but still less than 1% (predictive ratio, 0.985; range, 0.960–1.012), with the worst reimbursed plan underpaid by 4%.

For health plans in the low-morbidity cohort with the smallest share of enrollees with chronic mental health conditions, risk adjustment would result in average overpayment of 1.5% (predictive ratio, 1.015; range, 0.994–1.053), with the best reimbursed plan in the low-morbidity group overpaid by 5.3%. For health plans in the low-morbidity cohort by share of enrollees with chronic medical conditions, risk adjustment would result in slightly greater average plan overpayment of 2.4% (predictive ratio, 1.024; range, 0.992–1.070), with the best reimbursed plan overpaid by 7%.

Table 2 compares predictive ratios and ranges for the four health plan cohorts by share with a chronic mental health condition with and without reinsurance. (See Table S2 in the online data supplement for reinsurance results for the four health plan cohorts by share with chronic medical conditions.) Reinsurance using a $100,000 stop-loss per individual does not materially alter the conclusions described above related to average payments after risk adjustment for health plan cohorts. However, the health plans at the extreme end of the predictive ratio distribution fared a bit better. For example, in the high-morbidity cohort by share of enrollees with chronic mental health conditions, for the worst reimbursed plan (i.e., the lower bound on the range), the amount of underpayment was reduced from 3.5% (without reinsurance) to 2.6% (with reinsurance). Thus, reinsurance appears to provide additional benefit in addressing the problem of underpayment for those plans with the worst financial outcomes.

Discussion

Our findings indicate that risk adjustment reduces health plan underpayment and overpayment associated with the share of enrollees with mental health problems. This finding is noteworthy given earlier research indicating that risk adjustment performed poorly in compensating health plans enrolling a large share of individuals with mental health conditions (

17,

18). This difference may be due to refinements in methods of risk adjustment over time, differences in treatment modalities, or differences in the population diagnosed with chronic mental health conditions. In this study, risk adjustment performed similarly for health plan cohorts with a disproportionate share of enrollees with chronic mental health conditions and chronic medical conditions. Our results also indicate that reinsurance, in this case modeled as a $100,000 stop-loss, could be helpful in further compensating plans with a large share of enrollees with mental health conditions. The transitional reinsurance provision applies only to plans operating in the individual market, but these are precisely the plans that would be expected to have the largest share of individuals with chronic mental illness.

The finding that reinsurance mattered for certain plans is relevant given that states are granted substantial flexibility in the design of reinsurance and that this provision of the ACA is slated to be phased out by 2016. Proposed regulations suggest that regulators did not design the state-based transitional reinsurance program under exchanges as a replacement for the commercial health plan reinsurance contracts that most insurance plans today purchase. This study provides evidence in support of the view that the ACA's transitional reinsurance program should function as a supplement to rather than a replacement for the commercial reinsurance already in use.

State and federal policy makers should consider supplementing current policies with other regulatory approaches to mitigate adverse selection given evidence that some plans may still be underpaid at a level that would raise concern and potentially foster practices aimed at avoiding higher-cost enrollees. Plans have multiple tools to systematically select healthy enrollees, including marketing strategies (e.g., offering gym memberships), policies constraining provider networks to undersupply specialty mental health providers, and restrictive plan management practices (e.g., prior authorization). While there is no specific language in the ACA about contracting with managed behavioral carve-outs firms, presumably health plans would have the option of doing so. Note, however, that these contractual arrangements at the plan level would not be helpful in reducing selection incentives. One option advocated by McGuire and Sinaiko (

2) would be to handle selection in state exchanges in the same manner as most private employers do—by selective contracting with a limited number of health plans and actively managing the contracts to monitor quality.

It is important to note that the challenges posed by adverse selection are not unique to the exchanges. Rather, they affect most aspects of mental health care financing and delivery and are at issue in many provisions of the ACA beyond the exchanges. For example, adverse selection poses concerns for creating accountable care organizations of health care systems that will include services for individuals with mental illness, and careful attention to the design and implementation of risk adjustment will also be critical in this context.

This study has some important limitations. Our simulations were based on expected populations; we do not yet know what the state exchange populations will look like (

19). Since no claims data are available for the currently uninsured who are expected to enroll as individuals in state exchanges, we used claims data from publicly and privately insured populations. A recent analysis using the Medical Expenditures Panel Survey estimated that 7% of future exchange enrollees report fair or poor mental health, compared with 8% of current Medicaid enrollees and 3% of those with employer-based coverage (

20). This suggests that using a weighted simulation of claims of individuals with both public and private insurance, as we did, was preferable to using private insurance claims only. An additional challenge in anticipating the characteristics of the future exchange population is that not all exchange enrollees will have been uninsured; because of the subsidies offered, it is anticipated that many in the nongroup and small-group insurance market will shift to state exchanges. Also, we did not model the effects of insurance product tiers (e.g., bronze, silver) or the transitional risk corridors program. In addition, we constructed 100 health plans with 50,000 enrollees for our analyses; it is conceivable that results would differ with smaller plans. Also, at this time, we do not know many of the critical details about how states and the federal government will implement exchanges, and substantial flexibility will be allocated to states. Therefore, we are limited in our ability to account for the relevant features of exchanges in this study. For example, to the extent that states adopt reinsurance programs that differ from the $100,000 stop-loss modeled in this study (as we expect they will), the effects of this provision may differ. Furthermore, we would expect that the transitional risk corridors program could temporarily provide some additional compensation to plans with a larger share of enrollees with mental health conditions.

In addition, the emphasis on care integration under the ACA through accountable care organizations and patient-centered medical home models is likely to lead to changes in the delivery of mental health care occurring alongside implementation of state exchanges (

21). It is not possible to anticipate in our study design how such changes will affect exchange enrollees with mental health conditions. Finally, our analysis did not take into account a range of critical data issues, including the concern that states are unlikely to have comprehensive claims data to determine prior-year diagnoses for all enrollees to calculate risk adjustment payments.

Context is critical in anticipating how these new insurance marketplaces will function. Over the next few years, critical decisions regarding the design of risk adjustment methods and health plan contracting will be made on a state-by-state basis in conjunction with federal regulators. The findings of this study suggest that these design choices will have important implications for how well health plans that draw a larger share of enrollees with mental illness will fare.

Acknowledgments

The authors gratefully acknowledge expert research assistance by Erin Trish.