For those with depressive disorders, the reality of medication therapy alone is all too bleak. Research has shown that only about one-third of patients achieve symptomatic remission with the first antidepressant medication they try.

Even after trying two antidepressants, patients with depression still have only about a 50 percent chance of achieving remission (Psychiatric News, January 20, April 21). Clinical trial and case-study data suggest the overall odds of remission are roughly the same for those with anxiety disorders. However, for those with obsessive/compulsive disorder or panic disorder, success with medication therapy can be especially difficult to achieve.

Clearly, new treatment options are needed for patients with depressive or anxiety disorders. During 2004, the most recent year for which statistics are available, an estimated 21 million people were diagnosed with major depressive disorder in the United States, Western Europe, and Japan (the world's top three pharmaceutical markets), yet only half of all patients receive any treatment.

The prospect of large populations of patients with unmet medication needs is certainly ample reason for the world's research-oriented pharmaceutical companies to search for new drugs to fill the treatment gap. Treating depression and anxiety is big business (see box on facing page). Indeed, a large pool of pharmaceutical companies is working hard to bring new medications to the market.

Through an extensive review of documents from the Food and Drug Administration, pharmaceutical companies, industry analysts, and other sources, as well as interviews with numerous experts, Psychiatric News has identified nearly 60 medications in development to treat depressive and anxiety disorders. Many of those medications are being studied for both depression and anxiety, following the obvious success of the selective serotonin reuptake inhibitors (SSRIs) and serotonin/norepinephrine reuptake inhibitors (SNRIs) in treating both. However, at least 20 drugs in development are being studied only as antidepressants, and about 10 are in development only as anxiolytics.

The drugs under development to treat depression and anxiety, however, are only part of the pharmaceutical industry's overall effort in the psychiatric market. According to a report released last month by the Pharmaceutical Research and Manufacturers of America, a professional association that represents most of the larger, research-oriented pharmaceutical companies, the industry is developing 197 medications to treat mental illness. Not surprisingly, the largest number—57—are targeted at Alzheimer's disease and other dementias. However, coming in a close second and third are medications for depression, at 44, and anxiety, at 39.

Meds Trickle From Crowded Pipeline

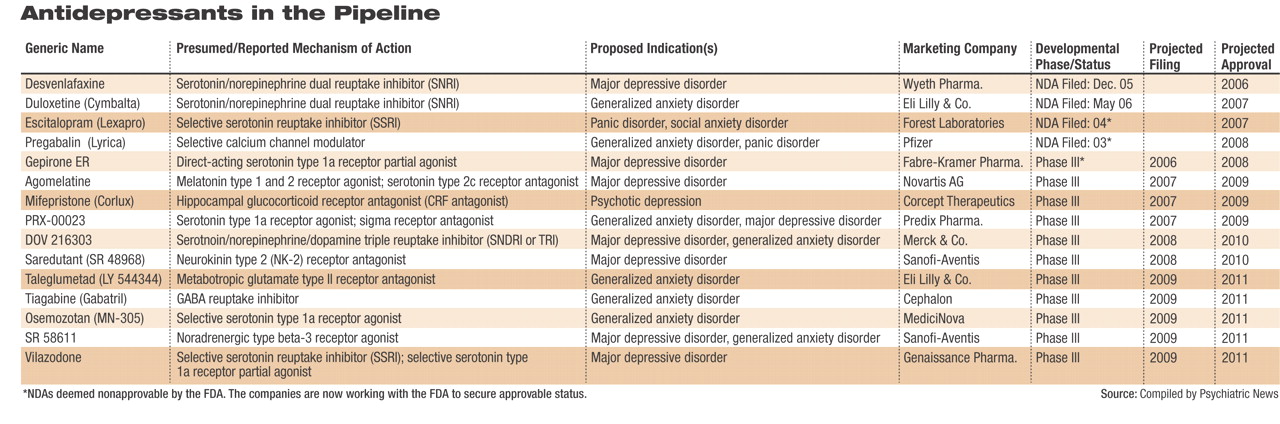

Of the dozens of medications in development to treat anxiety and/or depression, only a few are in the mid- to late stages of development (phase 2 or phase 3 clinical trials). In these stages, medications are being tested in large-scale human clinical trials. Phase 2 involves testing a drug in 100 to 500 patients to evaluate the drug's effectiveness and identify side effects. Phase 3 involves testing a drug in 1,000 to 5,000 patients to confirm the drug's effectiveness and monitor adverse drug reactions over longer periods of time. By the time a drug reaches phase 3, it has already undergone years of scrutiny in the laboratory, animal trials, and smaller human trials and has the best chance of reaching pharmacy shelves within the next 18 months to three years.

Currently, one new medication for depression has completed all clinical testing and has been submitted to the U.S. Food and Drug Administration (FDA), and possibly other regulatory bodies across the globe, for approval. Two medications already marketed for other indications are awaiting FDA approval for the treatment of anxiety disorders. The phase 3 pipeline holds several drugs indicated for depression and/or anxiety disorders (several drugs are under study for both). These drugs could reach pharmacy shelves by 2008. Phase 2 studies are under way for nearly 20 other putative antidepressants/anxiolytics, as well as several drugs targeted only for anxiety disorders.

“The majority of drugs in late-stage development for depression are similar to the drugs that are already on the market, in that they target the monoamines: serotonin, norepinephrine, or dopamine,” Anathea Waitekus, M.P.H., an analyst with Decision Resources, told Psychiatric News.

The drugs in the pipeline attracting the most interest, however, are the“ triple re-uptake inhibitors (TRIs),” Waitekus and several other analysts told Psychiatric News. As many as 15 TRIs have been in the pipeline over the last five to 10 years; however, “the ability of a number of these compounds to reach the market is questionable,” added Emma Travis, a senior CNS sector analyst with Datamonitor.

“The last five years has seen a large number of products in development for depression fall from the pipeline,” Travis continued,“ highlighting the difficulty in moving compounds through late-stage development and the complexity of demonstrating clear advances in efficacy and side effect [profiles] compared to currently marketed products.”

While the depression pipeline “contains some interesting compounds, including [neurokinin] receptor antagonists and the triple reuptake inhibitors,” Travis said, in the anxiety drug market, “growth has traditionally come from the SSRIs' and SNRIs' gaining additional indications for anxiety. Not surprisingly then, the current late-stage pipeline is made up of a number of existing CNS market players seeking approvals for secondary indications in anxiety.” The anxiety pipeline, she said, contains“ only a few novel compounds.”

Immediate Future and Beyond

Based on information compiled by Psychiatric News, the following compounds are deemed by industry analysts to be the most likely to reach drugstores over the next two to three years (see table). Analysts stressed the highly competitive nature of the depression market, noting that “most pharmaceutical companies chasing new antidepressants release as few details as possible.”

•

The drug closest to reaching pharmacy shelves for major depressive disorder (MDD) is GlaxoSmithKline's new SNRI, desvenlafaxine. The drug is the active metabolite of venlafaxine (GSK's Effexor/Effexor XR) and was developed as a replacement for the older drug, which loses patent protection in 2008. GSK submitted an NDA for desvenlafaxine extended release last December, and an initial FDA decision is expected this summer.

Desvenlafaxine is said by those familiar with the clinical trials data to retain the efficacy of its predecessor and may possibly be more efficacious. In addition, the drug appears to boast a more tolerable side-effect profile than its predecessor. Supplemental NDAs for desvenlafaxine for the treatment of anxiety disorders are likely to follow over the next few years, analysts agreed.

•

The fate of gepirone extended release, a direct-acting serotonin partial agonist intended to treat MDD, is now in the hands of the small, privately held Fabre-Kramer Pharmaceuticals. Organon originally submitted an NDA for gepirone to the FDA in 2001. After much back and forth between the agency and Organon over the adequacy of the dataset submitted, the FDA finally deemed the application “not approvable” in June 2004. Organon subsequently announced it would not continue to pursue the drug's approval and in June 2005 sold all rights to the drug to Fabre-Kramer. Fabre-Kramer had been expected to submit a revised NDA to the FDA earlier this spring; however, this submission could not be confirmed.

•

Two medications already on the market are awaiting FDA approval for new indications to treat anxiety disorders. The FDA's initial review of Eli Lilly and Co.'s duloxetine (Cymbalta) for generalized anxiety disorder (GAD) is due by November. Cymbalta, an SNRI that debuted in late 2004, is approved for the treatment of MDD and diabetic peripheral neuropathic pain.

In March 2005 the FDA deemed Forest Laboratories' escitalopram (Lexapro)“ not approvable” for the treatment of panic disorder and social anxiety disorder. At that time, the company said publicly that the agency expressed concerns about subsets of data within the two phase 3 clinical trials submitted in support of the applications. Both applications, filed by Forest in 2004, remain active at the FDA, analysts noted, indicating to them the company's intention to continue to work with regulators to gain final approval. Lexapro is approved for use in GAD and MDD.

In 2003 Pfizer submitted a new drug application (NDA) for pregabalin (Lyrica) for the treatment of GAD; however, in September 2004 the FDA deemed that application “not approvable.” (The drug did gain approval as a treatment for neuropathic pain and as an adjunct treatment for partial seizures.) Pregabalin gained European Union approval for GAD in March; at the same time, an additional phase 3 clinical trial was initiated in the United States aimed at addressing the FDA's questions and concerns. Data from that trial, analysts agreed, could possibly be submitted to the FDA as early as the end of 2007.

While all of these drugs are under regulatory review, Psychiatric News made multiple attempts over the last three months to clarify their status in the pipeline. Due to regulations governing the confidentiality of pharmaceutical manufacturers' proprietary information, the FDA does not comment publicly on the status of drug applications, even to confirm receipt of a submission. Moreover, most of the companies contacted for this article did not respond to requests for comment. However, both Lilly and Pfizer Inc., through their spokespersons, expressly declined to speak with Psychiatric News regarding any aspect of their products in development.

Phase 3 Holds New Promise

The phase 3 pipeline boasts several novel drugs to treat both depressive and anxiety disorders. Clinicians involved in clinical trials for these putative medications, analysts said, seem most excited about the advent of the triple reuptake inhibitors, which target all three of the brain's mono-amines (serotonin, norepinephrine, and dopamine).

•

At least one TRI, Merck and Co.'s DOV 216303, is in phase 3 trials and could reach the market by 2010. GSK's NS 2359 could also launch about the same time. DOV Pharmaceuticals (which licensed DOV 216303 to Merck) and Sepracor also have TRIs in earlier stages of development.

TRIs “will be the next blockbusters in major depression,” noted Natalie Taylor, Ph.D., an analyst at Decision Resources and author of a January report reviewing the major depression drug market. Sales of TRIs could reach $1.5 billion to $2.0 billion per product each year as early as the second or third year after market introduction.

Because of their new mechanism of action, TRIs “are expected to offer a clinically significant difference in efficacy and in tolerability,” Taylor noted in her report. The drugs are believed to offer advantages in efficacy over existing SSRIs and SNRIs, addressing a broader array of symptoms and having a faster onset of action. TRIs are also expected to have fewer side effects, in particular, a lack of drug-associated weight gain and sexual dysfunction, common with many of the currently available medications.

“There are also drug developers looking farther into the future, looking past the monoamine system to see truly novel mechanisms of action,” Decision Resources' Waitekus told Psychiatric News.

•

Novartis is progressing through phase 3 with agomelatine, a drug developed by French pharmaceutical company Servier. Agomelatine acts as an agonist at melatonin type 1 and type 2 receptors while antagonizing serotonin type 2C receptors. In clinical trials the drug has been especially free of such side effects as weight gain, sexual dysfunction, and gastrointestinal problems. In addition, because it interacts with melatonin receptors, the drug has a favorable effect on both sleep and daytime alertness. Novartis, which acquired the drug in March, declined at thattime to say when it plans to file an NDA for agomelatine.

Specific Pathways Being Targeted

While many analysts cautioned that the next few years will largely bring new drugs that are similar to those already on the market, they also expressed optimism that advancing technologies—including new methods of imaging diseased nervous systems and elucidating the biochemical and anatomical pathways underlying psychiatric disorders—will lead to new medications with highly specific targets, including genes and regulating proteins.

Several companies are developing a new class of antidepressant, known as anti-tachykinin or tachykinin-receptor modulator” drugs. There are three tachykinin receptors in humans: the neurokinin-1 (NK-1) receptor, which is found throughout the central and peripheral nervous system and preferentially binds the peptide substance-P; the neurokinin-2 (NK-2) receptor, which is found primarily in the peripheral nervous system and preferentially binds the peptide neurokinin-A; and the neurokinin-3 (NK-3) receptor, which is found in the CNS and binds to the peptide neurokinin-B.

Compounds that bind to and block NK-1 (NK-1 antagonists) may be useful to treat nausea, vomiting, and depression. Compounds that block NK-2 appear to be useful as anxiolytics, while those that block NK-3 have been studied to treat depression, bipolar disorder, and schizophrenia, as well as cognitive deficits associated with Parkinson's disease and the dementias.

Sanofi-Aventis is proceeding with phase 3 clinical trials of saredutant, an NK-2 antagonist, for depression. Phase 2 data are said to be “very promising,” and the drug is the farthest along of any of the anti-tachykinins in the pipeline. Roche Pharmceuticals and GSK also have anti-tachykinin antidepressants/anxiolytics in their pipelines.

Another novel target being pursued for the treatment of depression and anxiety (as well as other indications) is corticotrophin releasing factor (CRF). Numerous CRF antagonists, also known as glucocorticoid receptor antagonists, are in development, with Corcept Therapeutics' mifepristone (Corlux) farthest along in the pipeline. These drugs attempt to reduce the flood of cortisol released by both physical and emotional stress. Researchers theorize that the release of large amounts of cortisol over time leads to neuronal damage and is possibly responsible for some of the structural changes noted in the brains of some patients with severe mental illnesses.

Other companies are moving other novel antidepressants and anxiolytics through the pipeline, including highly specific serotonin modulators, selective noradrenergic antagonists, and compounds that interact with numerous other receptor complexes thought to be involved in psychiatric disorders.

Nonetheless, Kate George, an analyst at IMS Health and editor of the IMS LifeCycle R&D Report, cautioned that “even if future research permits the identification of specific receptor regions and receptor subtypes involved in depression,” the development of drugs with more specific mechanisms of action and fewer side effects may not be appreciably more effective than current medications.

“Depression,” George wrote in a February 2006 LifeCycle R&D Report, “is a genetically complex disorder... and behavior is complex and multifactorial.” That complexity, she added,“ combined with the infancy of these biotech programs, means that a ground-breaking pharmacologic therapy or use of tailored therapy for depression is a long way off—and may never be possible at all.”▪